views

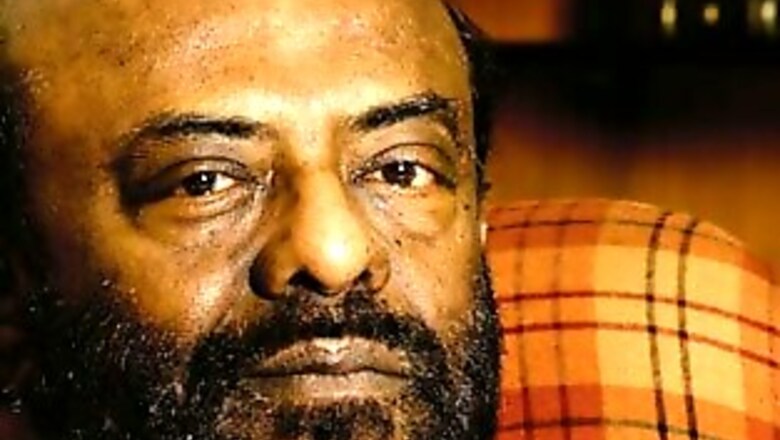

Those who’ve tracked Indian IT for a few years now, usually have no qualms in describing Shiv Nadar as the original pit bull terrier in the business. Fierce, hard charging, unforgiving, and deeply, deeply involved with HCL Technologies--a software services company he spun out of his original creation, a hugely successful hardware firm, HCL Infosystems. His persona was in stark contrast to the other titans in the business. Narayana Murthy assiduously cultivated a statesman-like image while Azim Premji came across as a recluse.

It isn’t as if they weren’t as deeply into their businesses as Nadar was. It’s just that among the three of them, Nadar seemed the last man who would step away from the business. But then, nothing is what it seems. And so on October 2, 2008, when HCL Technologies paid £441 million to outbid Infosys for control of Axon, a UK-based company, it struck most people as odd that its mercurial founder wasn’t there to look into the cameras and say “cheese”.

For HCL Technologies, Axon meant a lot. Lehman Brothers had crashed a month ago, and with it Wall Street. In the panic that followed, there was little money chasing good assets and HCL Tech had gotten itself a pretty damn good deal. What made it sweeter still was that arch rival Infosys, widely tipped to be the front-runner in spite of putting in a lower bid at £407 million, had to concede ground. To insiders at HCL Tech though, Nadar’s absence at the press conference to announce the acquisition didn’t raise any brows. His protégé Vineet Nayar did the needful, thank you very much.

“I have seen Shiv attempting to detach himself. In fact, at times he avoids meetings because when he is present, people at the company defer to him,” says Amal Ganguli, an independent director on HCL’s board. Strange, you would imagine, in a company where Nadar still holds a controlling stake of about 60 percent.

Stranger still, you would imagine, in a company where until recently key executives, petrified of Nadar’s volatile temperament and enormous capabilities to push the boundaries they worked in, took cues from what he wears to work. Legend at HCL Tech has it that when Nadar walks in for a business review wearing a suit with a tie, it’s a good day. An open neck T-shirt on the other hand translates into “get out of the way”. Sleeves rolled up, jacket off, inevitably means all hell’s going to break loose. Fresh cookies in the room are a good omen, etc., etc., etc.

And life went on. A company, which once upon a time was spoken of in the same breath as Infosys and Wipro, lost its way. In 2000, all of them had revenues of roughly $200 million. By 2005, Infy breached $1.5 billion while Wipro was nudging the number at $1.35 billion. HCL Tech on the other hand was just about half way there. Not surprisingly, few people were willing to give the company a snowball’s chance in hell.

Exit Nadar, enter Nayar

This is our time,” says an ebullient Vineet Nayar, the 47-year-old CEO at HCL Technologies. And what a time indeed! Over the last two years, it has managed to snap some of the largest deals that have come Indian IT’s way. To be precise, $2.6 billion in an environment where even mighty Infy struggles to gather momentum. Last year, revenues grew 17 percent and its stock has outperformed both its peers as well as the benchmark index (CNX IT) by a wide margin (see chart on page 44). Better still, HR consulting firm Hewitt Associates ranks HCL Technologies among the best employers in Asia. “In three years, HCL has gone from zero to hero,” says Frances Karamouzis of Gartner, an IT research firm.

What, you wonder, changed? Shiv Nadar, actually.

After fighting pitched battles to dominate the Indian hardware space, Nadar got there by 1987 after he founded HCL Infosystems in 1976. By 1996 though, he figured while he was spilling blood over domestic spoils, the real war was waging elsewhere: Outsourcing.

He quickly reorganised the company and created HCL Technologies to take advantage of the software services opportunity. But Nadar made some strategic mistakes there. He believed the Y2K business was not worth chasing because it was low value. Everybody else though went after it because it helped them build strategic relationships with large American companies. “In hindsight we shouldn’t have missed it,” says Nadar today. “We were the most qualified for it.”

PAGE_BREAK

But he’s quick to add: “We are an engineering company, how many companies in the world have the capability to design an entire aircraft? HCL has that depth of technology.” Boeing is one of HCL Tech’s largest accounts today.

To be fair to Nadar, when the writing on the wall was obvious by 2005, he did the best thing a founder can do. He stepped aside and asked Vineet Nayar to step into the saddle--on the face of it, his polar opposite. Nadar is imperious and usually wears an Armani. Nayar can most often be found with his sleeves rolled up, is an extrovert and likes to hit the dance floor with as much gusto as he would a sales presentation. There’s one thread that binds them though--an undying love for single malt whiskey.

“He was a star,” says Nadar who spotted him in the 80s. Nayar was asked to move into Nadar’s office as the executive assistant, a job meant for those on the fast track. For three years, Nayar was the top sales person for HCL Tech, exceeding his sales targets two to three times over. But he had a problem – he got bored soon.

In 1991 for instance, he got bored with selling. “Shiv was taken aback,” recalls D.K. Srivastava, senior VP at HCL Tech. “His top sales guy didn’t want to sell anymore.” So Nadar asked Nayar to come up with a business plan, which he promptly did with everything from ready-to-eat omelettes, aircraft manufacturing, and satellite-based communication systems. Nadar liked the last idea and HCL Comnet was in business with Nayar at the helm. He didn’t realise it then, but Nadar had “venture capitalised” the future of HCL Technologies.

Which is perhaps why when Nadar eventually asked Nayar to take over HCL Technologies, the protégé demanded only one thing — a free hand. He got it. Over the next four years, Nayar overturned the business strategy and undid pretty much everything his “mentor” had put in place.

Legacy issues

Now, HCL Technologies didn’t exactly have a great reputation with employees. Their employee stock option plan (ESOP) for instance, wasn’t exactly transparent. Who was awarded, how much, and why was largely unknown. To the world outside as well, HCL Tech’s fierce ways had earned it a not-so-endearing reputation. To that extent, Nayar had a tough job on hand. His single most important task was to build trust, both inside and outside.

Within two months of taking over, he established his leadership by addressing every single employee through town hall meetings and other forums; he egged them to ask questions in a world that didn’t know it was possible.

Buzzwords were used to dramatic effect. Whoever heard of a company that said “Employee first, Customer second”? In a company with one of the highest attrition levels in the IT business, the line went down well. “Destroying the CEO’s office” was another line Nayar used to draw applause internally. The message was clear: One doesn’t need to go to the boss for every little thing. These were dramatic departures from the past.

Trust gained, he reorganised the business around verticals and not delivery centres. This also translated into centralising key functions like human resources, bringing the organisation under one intranet, and automating processes to improve the employee experience. Major issues an employee face are now addressed within 72 hours on the outside. It didn’t take Nayar long to gain their trust.

He then turned to the outside. The mainstay of most Indian software companies is writing and maintaining code. Nayar needed to find something in areas where others were not too well-entrenched. That is how he latched on to engineering services, remote infrastructure management (RIM), enterprise applications and platform-based BPO.

Of these, RIM was where HCL Tech was the strongest, thanks to Nayar’s experience at HCL Comnet. It’s a $100 billion opportunity of which Indian companies had captured only $1 billion by 2005 says Nayar. He went after it aggressively and between 2005 and 2009, HCL Tech’s revenues from infrastructure outsourcing increased from $70 million to $355 million.

RIM, however, is only a part of the total IT budget for any company. The big money lies in going after total outsourcing deals. So he formed a big deal group comprising at least 30-40 people to go after these businesses aggressively.

PAGE_BREAK

But every large Indian company too was looking at these opportunities. To lend edge to his system, he made some changes to his organisational structure. In most Indian companies, client relationships are owned by vertical heads, who then get the service lines to put together a solution. Nayar empowered the services heads as well to lead the discussions on total IT outsourcing.

That it was paying off was obvious when in the last quarter of 2008, Nayar announced HCL Tech had signed 20 deals worth $1 billion, the highest ever in a quarter for this company. Of these, three deals were in excess of $100 million each and five were worth $50 million each.

Since then, the question on everybody’s mind was, how did Vineet Nayar manage all of this? We spoke to several analysts, customers, competitors and employees at HCL Tech. A common strand that emerged was predatory pricing. “Their average price points are lower than other Tier 1 Indian vendors by at least 15 percent,” says Bhavtosh Vajpayee, head of technology research at CLSA, an equity research firm. “If HCL wins a deal, everybody says we undercut,” counters the company’s CFO, Anil Chanana.

Then there is the issue of margins. Margins for IT outsourcing deals tend to be lower than selling discrete services. Last year HCL Tech earned margins of 15 percent in infrastructure services, compared to 19 percent for software services. Among the top tier players, HCL Tech’s margins are among the lowest and data over the last eight quarters show margins fluctuated between 16-19 percent. “HCL is on the mend, but reputations don’t change in two-three quarters. It needs consistent performance like its peers” says Vajpayee.

Competitors too are not enthused with HCL Tech’s sales strategy. Says Sanjay Gupta, Senior VP, Wipro Technologies, “Selling horizontal services is an old model, this is how the industry was positioned four-five years ago.

It has now been commoditised. Instead, companies are moving towards providing vertical solutions like a mortgage origination platform, which is where the premium lies.”

On his part, Nayar doesn’t think much of doomsday soothsayers. “On a straight road, the guy with more momentum will always be ahead of you. But when you hit a dark tunnel, somebody presses the brake and somebody the accelerator. We hit the accelerator,” says Nayar.

Don Corleone

As for Nadar, he spends most of his time on philanthropic activities. But in the days to come, Nayar will need Nadar’s counsel to tackle the even tougher parts that are coming up. Of the 12 vice presidents who report to Nayar, many have the title but not the power say those at HCL Tech. History and blood ties continue to influence things. For instance, the CFO Anil Chanana reports to Nadar, not Nayar. The Chennai-based Ranjit Narsimhan, Nadar’s nephew and the head of the BPO business too does not report to Nayar. And for some inexplicable reason, executives say the non-voice BPO business, which ideally should fall under the BPO arm is now being clubbed under a separate business unit called B-Serv.

“Do not go by the designation. Inside the company there is a very distinct formal and an informal organisation that runs on parallel tracks,” says a senior Delhi-based HCL Tech executive who has worked within the group for 15-plus years in different capacities. Not surprisingly, HCL Tech’s media managers declined to share names of Nayar’s top team and their reporting structure, calling it “information sensitive”.

That there’s a huge gap between Nayar and his top team, consistently comes through at various levels. Access to Nayar’s second rung is still an issue unlike, say, an Infosys or Wipro which allow access to senior executives below the top layer. Says Sudin Apte, Country Head, Forrester, “HCL’s success is too personality centric, they have not been able to institutionalise or create processes like Infosys.”

At least three old timers who have spent long years at HCL Tech in various capacities reckon HCL Tech is just too important for Nadar to completely let go. So while Nayar may have the operational freedom, it is unlikely he has the freedom to pick his A-team.

PAGE_BREAK

A senior Delhi-based executive who was hired by Nayar after he became the CEO, left within three years. “It was a great stint. When I look back I realise how much Vineet put in to support and help me settle down. One of the best CEOs I have worked for,” he says. So why did you leave? “I saw myself hitting a wall. Career progression was an issue,” he says.

So can Nadar be like Don Corleone and look the other way as he did once

Michael took over the family business in Godfather? He better had. You can’t hold once you let go. n

THE TRANSFORMER

Post 2005, under Vineet Nayar, HCL Tech has undergone a makeover

A new leader

Nadar to Nayar is a big generational shift. Nadar was relatively reserved and inaccessible. Nayar is very accessible, addresses quarterly town hall meetings and regularly responds to staff questions on the intranet. His hands-on style is a big hit. Nayar is in the forefront in all the big deals and customer meetings.

Organisational overhaul

HCL Tech operated like a federated company with each delivery centre run like fiefdoms. Nayar centralised internal processes to give it a common identity. One intranet for the whole company and centralised people management helped. Thus, pet peeves like leave issues to settling dues, transport delays to bad food could be aired and sorted out.

Sprucing up the image

HCL Tech was very old-world in its external communication. Nayar changed that. He blogs for Harvard Business Review (HBR). His smart positioning--“employee first, customer second”, “Blue Ocean” strategy--has got HCL Tech attention. Harvard Business School and Darden Business School teach case studies on the company. Awards have come in (Hewitt Best employers; FT-Arcelor Mittal Boldness award). Industry trackers like Forrester and IDC have given it a thumb’s up.

A new business model

Although Wipro, Infosys and HCL Tech were roughly the same size in FY 2000, HCL Tech has been left far behind its peers due to some strategic miscalculations. Shiv Nadar did not think that Y2K and later the ADM business was worth chasing. The company is now gradually bridging that gap. Nayar correctly sensed that Infrastructure Management Outsourcing would be a fast-growing business line. In a recessionary market, HCL signed about $2.65 billion worth of new deals in 2008 and 2009.

(additional reporting by Pravin Palande)

Comments

0 comment