views

Reliance Industries (RIL's) jumbo rights issue opened on May 20 for subscription for existing shareholders. This is not only RIL’s first rights issue in nearly 3 decades, but also by far the biggest equity offering.

The company proposed to raise Rs 53,125 crore through biggest ever rights issue, which will close on June 3, 2020, while the ratio is one rights issue share for every 15 equity shares held by existing shareholders as on record date (May 14).

India's biggest ever right issue has been priced at Rs 1,257 per share which had ex-rights date on May 13, 2020. The rights entitlement ratio is 1 equity share for every 15 equity shares held by eligible shareholders as on the record date which was May 14.

Last year in May, Bharti Airtel raised about Rs 25,000-crore via rights issue. Shareholders of Bharti Airtel were eligible to apply for 19 rights equity shares for every 67 equity shares held.

Comparing it with other mega equity offerings in the primary market space, Coal India's IPO, which came in 2010, tops the chart of the largest IPOs, with an issue size of Rs 15,475 crore. It was followed by Reliance Power IPO which came in 2008 with an issue size of Rs 11,700 crore.

General Insurance Corporation of India's IPO is in the third spot. It came in 2017 with an issue size of Rs 11,372 crore. ONGC is at the fourth spot with an issue size of Rs 10,694 crore. ONGC IPO had come in 1996.

What is a Rights issue?

Rights issue is when a listed company proposes to issue fresh securities to its existing shareholders as on a record date. The rights are normally offered in a particular ratio to the number of securities held prior to the issue.

This route is best suited for companies that would like to raise capital without diluting the stake of its existing shareholders unless they do not intend to subscribe to their entitlements.

What is Record Date?

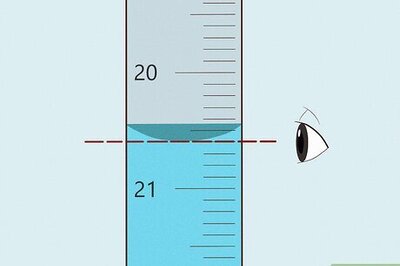

It is the date set by a company on which the investor must own shares, to be eligible for dividend, share split, bonus, rights issue or other capital gains as declared/announced by the company.

It is the date established by the company for determining the shareholders who are entitled to receive dividends, bonuses, or rights shares of the company.

Also read: RIL's jumbo Rs 53,125 crore rights issue opens today: Should you buy?

How to apply for the right issue?

Manoj Nagpal, Business Head at Moneycontrol explained how investors can apply for the RIL rights issue in a Twitter thread:

Reliance Rights issue will open on 20 May and the last date is 3rd June:

1. If you have Reliance Shares as of 14th May, you are entitled to apply for the Rights, too. This entitlement is currently shown in your Demat account

2. There is no max limit. You can apply for any number of shares in this issue.

3. Up to entitled shares are guaranteed allotment for you (i.e. your rights entitlement based on 1 for every 15 shares currently held).

4. Anything more than entitled shares will be decided by the company, if you apply for more shares.

4. If you don't want to apply for these rights shares, then you could sell your rights entitlement in the stock market also just like any other stock.

5. If you want to sell in the stock market, option will be available from 20th May i.e. Wednesday. The current price is Rs. 163

6. Similarly if you want more of these rights entitlement, you can buy from the stock market

7. If you buy another 100 of these rights entitlement from stock market then you will have total guaranteed allotment of 100 in rights

8. Rights shares will be allotted at Rs. 1,257/- per share.

9. Out of this, 25% i.e. Rs. 314.25 per share, has to be paid now.

10. The balance will be paid in two future installments. Expected 25% in May 2021 and 50% in Dec 2021

Now how to apply for these rights.

11. There are 3 methods.

12. Two are online and one is an offline method

We will discuss each of these methods below.

First Method - Online Method 1 - From your internet banking account.

(a) Log in to your own online bank account

(b) It will have the option to invest in IPO/Rights - if your bank has enabled it

(c) In that, it will show these Reliance Rights apply button

(d) You will have to fill basic details of your folio, number of rights shares you want to apply, etc.

(e) In this method, no amount will be debited from the bank. However for every share applied, you have to block 314.25 per share in the bank. This process is online ASBA

(f) Your bank may want you to enable ASBA online, if not done already

(g) On allotment, amt will be debited in ur bank depending on the number of shares you are allotted. Till then this money stays in your bank account but is blocked.

Method 2 - Online Through RTA website.

(a) Go to this website https://rights.kfintech.com

(b) Here click on the tab - Apply for Rights issue thru RWAP.

(c) Only for Resident investors. NRIs cannot use this

(d) It will then ask for basic details like PAN, DP ID, Folio no, etc. You will have to fill this online.

(d) And then u have to make payment. Either through Net Banking or thru UPI.

No other payment method is allowed. Remember in UPI there is a limit of 2 lacs

(e) In this method, the money will be debited from your bank immediately i.e. 314.25 for every share applied.

Balance Refund amount if any, will be refunded back to your bank later by the company in case you are allotted lesser than shares applied for.

https://twitter.com/NagpalManoj/status/1262957415596769280

(The above article is for reference only and not a recommendation)

Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Comments

0 comment