views

Receiving a Prepayment Deposit

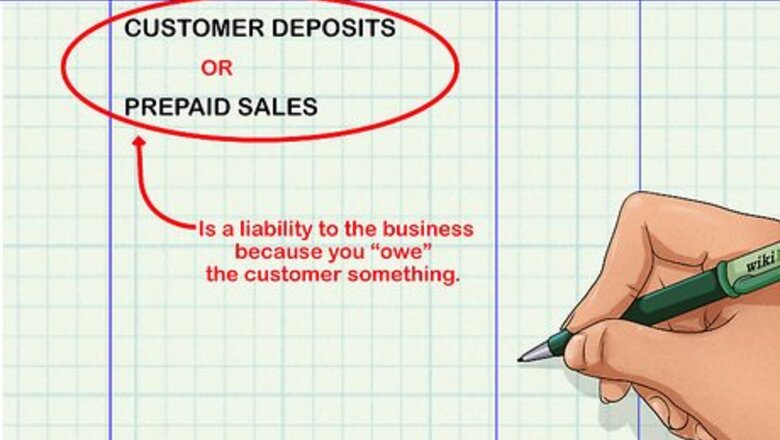

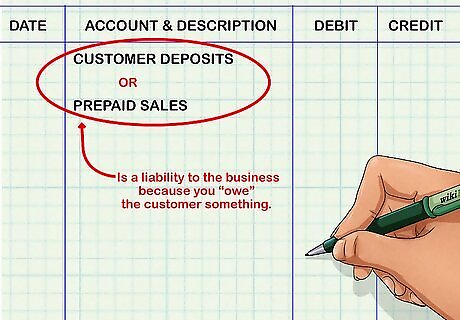

Create an account called "Customer Deposits" or "Prepaid Sales" in your accounting journal. While a customer deposit sounds like straight income to you, it is in fact a liability to the business because you "owe" the customer something. This is why you need to create a special account. Think of an account as like a line item on your personal budget. Check to make sure that this "Customer Deposits" account has not already been created under another name.

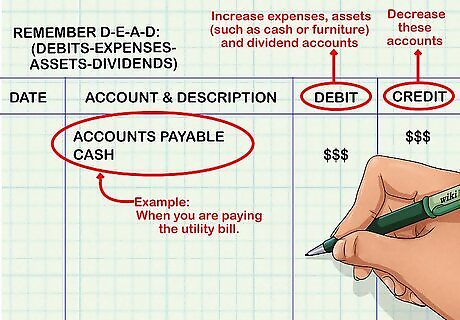

Determine which accounts to debit or credit. All financial transactions must be entered in the company's general financial ledger. Each transaction is listed as a debit or credit and for every debit there must be a credit. Debits increase expenses, assets (such as cash or furniture) and dividend accounts. Credits decrease these accounts. An easy way to remember this is D-E-A-D (Debits-Expenses-Assets-Dividends). For example, if you are paying a utility bill you would debit accounts payable and credit cash.

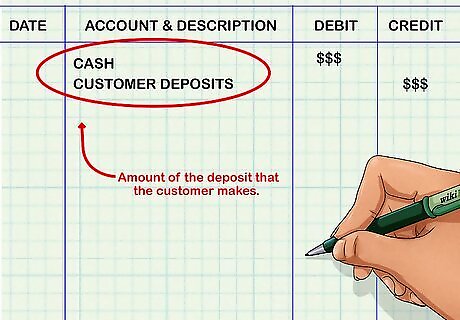

Record the amount of the deposit that the customer makes. In your accounting journal, debit the Cash account and credit the Customer Deposits account in the same amount.

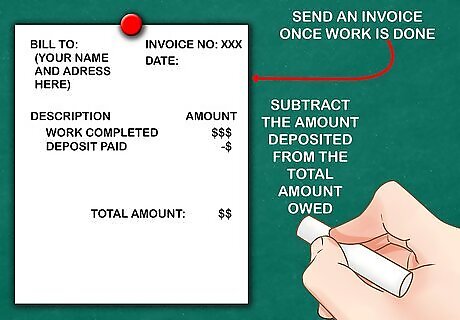

Send an invoice to the customer for the work after it has been completed. Note on the invoice the amount of the deposit previously paid and subtract it from the total amount owed.

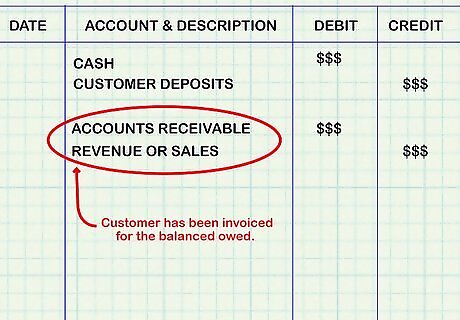

Record that the invoice has been created and apply the deposit amount. Credit the Revenue account while debiting Accounts Receivable and Customer Deposits. Revenue is recognized when the work has been done and the customer has been billed, not when the money is received.

Making a Prepayment Deposit

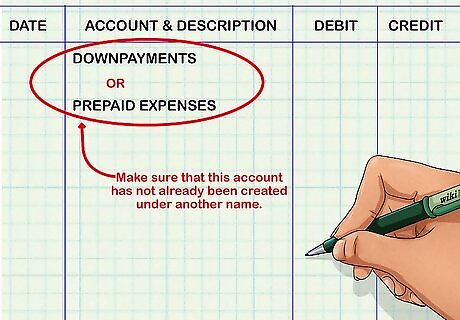

Create an account called "Down Payments" or "Prepaid Expenses" in your accounting journal. Check to make sure that this "Down Payments" account has not already been created under another name.

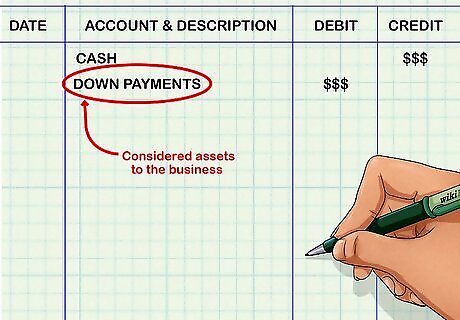

Record in your accounting journal the amount of the deposit you paid. Credit your Cash account and debit the "Down Payments" account for the amount paid. Down Payments are considered assets to your business.

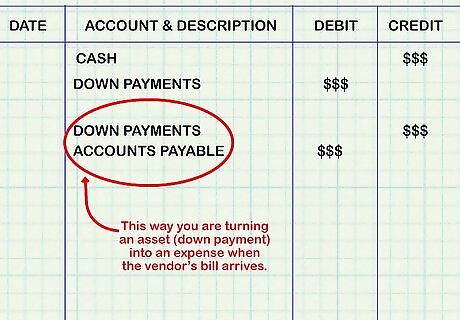

Make a record in your accounting journal when you receive the goods or services you ordered along with the invoice. This way you are turning an asset (down payment) into an expense when the vendor’s bill arrives. Credit Down Payments and debit Accounts Payable, which is a short-term debt payment that needs to be paid in order to avoid default.

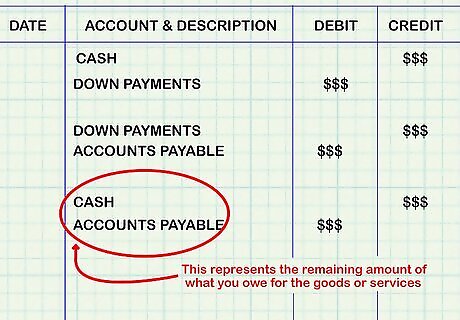

Record in your accounting journal when you pay the balance of the invoice. This can include the balance of what you owe plus any shipping charges, for example. The remaining amount of what you owe for the goods or services will require a credit to Cash and a debit to Accounts Payable.

Keeping Detailed Records

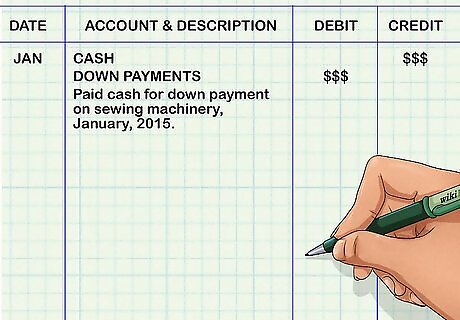

Include a brief description for each transaction you enter into the journal. For example, "paid cash for down payment on sewing machinery, January, 2015."

Keep backup documentation on your journal entries. This is very important in case there are errors or for any questions later. Documentation on all entries can be filed by assigning a journal entry number and date as a packet. Anyone should be able to look up a journal entry in the general ledger and then go to the backup documentation easily.

Keep paper copies of all documentation for at least one year. You will need these until your accounts have been audited and your taxes filed.

Save documentation electronically for at least seven years. Scan them, front and back, and keep those copies on two disks, one to be stored in the office and one off site to be used in case of emergency.

Comments

0 comment