views

X

Research source

Opening a Trading Account

Use a virtual trading account to practice trading. Some online brokers will allow you to set up a virtual account that trades with fake money. If you're a beginning investor or don't have much experience trading in futures, this practice can help you understand how the futures market works and whether futures will be good investments for your portfolio. When comparing virtual trading accounts, find out how many tools and services will be available to you. Some sites make everything available on a virtual account that you would have for a real trading accounts. Others may limit resources for research and analysis on virtual accounts. Many online brokers provide additional guidance for beginning investors working in a virtual account. Use this guidance to shape your investment strategy before you start buying futures with real money.

Research futures trading. Before you start trading futures, you need solid knowledge of the way the futures market works. You also need to fully understand the risks and opportunities involved in trading futures. The National Futures Association (NFA) has many online learning programs and publications available on its website for American investors. Go to https://www.nfa.futures.org/investors/index.html to access these resources. You can also read about US oversight regulations and futures industry standards on the website of the U.S. Commodity Futures Trading Commission (CFTC), available at https://www.cftc.gov/. Online brokers often have educational resources available on their websites. Once you've chosen a broker, take advantage of these resources.

Compare commissions and fees. Unlike other markets, there is no industry standard in futures trading. Fee structures and commission rates may depend on the services the brokerage offers, or the amount of advice and assistance you'll receive. The brokerage firm with the cheapest fees and lowest commissions may not necessarily be the best option for you, even though you want to control expenses as much as possible. Make a list of the services you'll need, then choose a rate you're comfortable with that ensures access to all or most of those services.

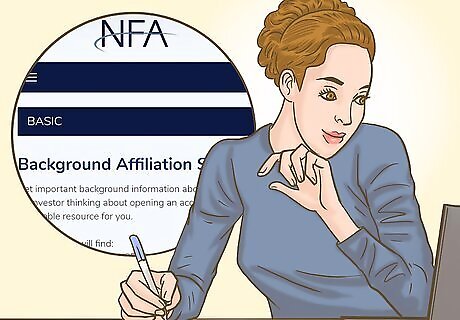

Check the firm's background with the NFA. US brokerage firms that trade in futures must be registered with both the CFTC and the NFA. You can use the NFA's Background Affiliation Status Information Center (BASIC) to review a broker's history, registration, and any regulatory actions before opening an account. To access the BASIC system, go to https://www.nfa.futures.org/basicnet/. You can search names of firms as well as individual brokers.

Apply to open an account. When you apply to open a futures trading account, the broker will ask questions about your income, net worth, investment or futures trading experience, and your investment goals. Based on this information, the broker will assess the level of risk you can tolerate in futures trading. The broker will give you a number of disclosure forms along with your account agreement. Don't simply sign on the dotted line – read these documents carefully and make sure you understand everything in them before agreeing to them. If you don't understand something, ask the broker to explain it to you.

Ordering Futures Contracts

Evaluate the contracts available. Various futures contracts are available on different markets. All contracts are for a specified amount of the underlying commodity or stock. Some markets also have mini contracts, which are a fraction of a standard contract amount. For example, a futures contract of corn is worth 5,000 bushels of corn. You can also by a mini contract of corn, which is worth 1,000 bushels. Futures contracts are either long or short. If you are long on corn, you are agreeing to buy corn at the price stated in the contract. If you are short on corn, you are agreeing to sell corn at that price. In a long position, you make money when the market price increases. In a short position, you make money when the market price decreases. Use the resources from your broker to look at trends in various commodities or stocks so you can choose a futures contract wisely. If you previously used a virtual account, you may want to stick with commodities or stocks you already played with.

Place your order with your broker. Each broker has their own specific method for placing an order. Generally, you'll place an order for futures the same way you would place an order to buy stock or any other equity. Your order must specify the size of the contract, the number of contracts you want, and the expiration date. Brokers typically have a list of types of futures contracts available for different commodities or stocks. You can simply select the one you want from the list, and all the details will already be included.

Deposit margin money with your broker. The margin money for your contract is the amount of money required to "open the position" (essentially, to purchase the contract). This amount will be a fraction of the potential value of the contract. Margins are set by the market or exchange where the futures are traded. Your margin money is paid directly to the market or exchange by your broker. This money is held by the market or exchange for the entire period of time you hold your position (essentially, own the contract). If the margin increases during that time, you may need to add money to your account.

Settling Futures Contracts

Watch the price of the underlying stock or commodity. Once you own futures contracts, checking market activity for the underlying stock or commodity lets you know whether your contract will be profitable. For example, if corn is trading at $6.00 a bushel, and a contract for corn is 5,000 bushels, a single futures contract for corn would be worth $30,000. If corn moves up 1 cent to $6.01 a bushel, the value of your futures contract would increase by $50. Figure out how much 1 cent equals for your futures contract. Then you can look at the increase or decrease in price on the market and easily calculate the change in value for your contract. For example, if 1 cent is worth $50 in a standard contract for corn, and you see that corn is up 7 cents, you know that the value of your contract has increased by $350 (7 cents x $50).

Maintain margin money in your account to hold your position. The initial margin money was the amount you had to deposit to purchase your futures contracts. The maintenance margin is a lesser amount that you're required to have in your account as long as you hold the contracts.. Exchanges set initial margins and maintenance margins. If your account falls below the maintenance margin, you'll be asked either to close your position or deposit more money in your account.

Offset your position to close it out. If the underlying stock or commodity is not moving in the direction you predicted in your futures contract, you can order a reversing trade that would cancel your position out. When margins are settled at the end of the day, your original position would be closed. For example, if you held a long position on corn, you could offset it by taking a short position on corn. The short position must exactly match the long position contracts, with the same amounts and expiration dates. Otherwise, the offset won't be complete.

Roll your contract to maintain your position. As the expiration date approaches, you have the option of rolling your contract over into another contract that expires at a later date. If the contract is doing well for you, and you expect the trend to continue, this may be a good option. You can also simply wait for your contract to expire and then buy additional futures that expire on a later date.

Wait for your broker to close your position. If your contract is profitable, you can simply hold it until it expires. On the expiration date, your broker will close it for you. The money you made off of your investment will be deposited into your account, minus any applicable commissions and fees. On the other hand, if you lost money on the contract, your broker would take money from your cash account to cover the loss. Some futures contracts are "physically settled," meaning that you receive the underlying commodity or product when the contract is settled. However, most online brokerage firms don't trade in physically-settled futures.

Comments

0 comment