views

Filing Your Return

Input your new address on your tax return. When doing your taxes for the year, enter your new address on your return. Make sure to fill it out correctly to avoid any mistakes. Check the "Address Change" box on the first page of the return if you are filing a business tax return. This is the easiest and most hassle-free method to change your address.

Send in your return. You can mail in your return in or electronically file your taxes. Keep in mind that if you mail in your tax return, the correct mailing address depends on the state or territory you live in. To find this address, you can consult the IRS website under "Where to File Addresses for Taxpayers and Tax Professionals."

Wait for your return. When your return is processed, the IRS will update your records. You can confirm online that the address has been successfully changed.

Contacting the IRS

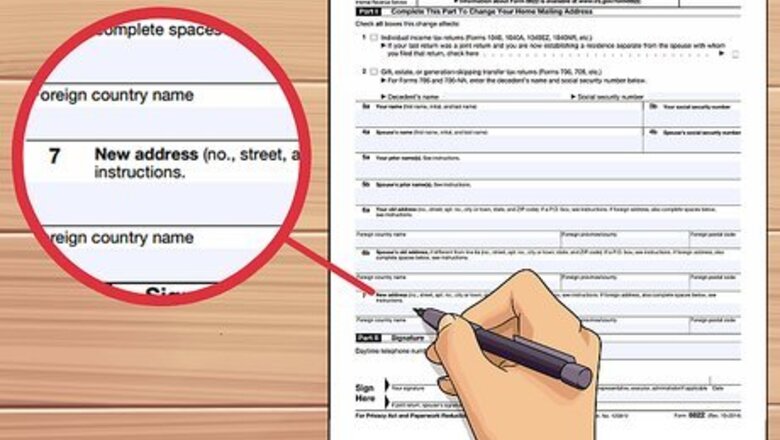

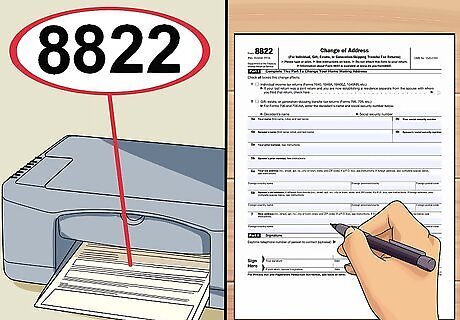

File the Change of Address form with the IRS. Form 8822 (http://www.irs.gov/pub/irs-pdf/f8822.pdf) is the Change of Address form for individuals and Form 8822B (http://www.irs.gov/pub/irs-pdf/f8822b.pdf) is for businesses. Print the correct form, complete it as per the instructions on the form, and mail to the IRS office listed on the form. Call 800-TAX-FORM (800-829-3676) to order copies of these forms if you don't want to download them online. Starting January 1, 2014, any person with an employer identification number (EIN) must send in Form 8822-B to the IRS and report any address changes to the responsible party. The responsible party is the principal officer, general partner, grantor, owner, or trustor of the business. Form 8822 and 8822-B can be submitted at any time during the year.

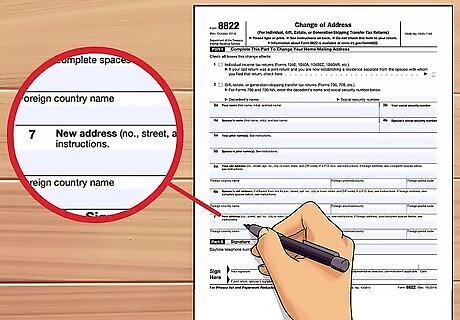

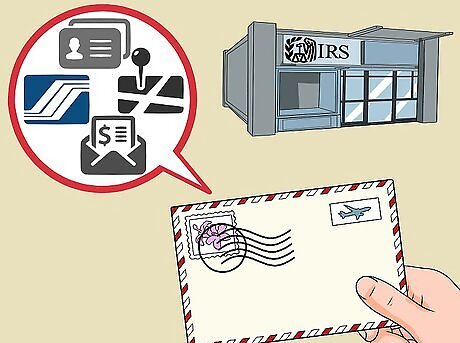

Send a letter with original signature to the IRS. This written letter must include your name (your full, legal name), your old and current addresses, and your Social Security number, Individual Taxpayer Identification Number or Employer Identification Number, depending on your particular situation with the IRS. When mailing a letter or notification to the IRS, it's a good idea to send it through USPS with proper postage and return receipt requested. You will want to know if and when the IRS receives it by getting the recipient's signature. Anyone filing a change of address on behalf of another individual (either by form or letter) must attach a copy of their power of attorney or Form 2848 Power of Attorney and Declaration of Representative (http://www.irs.gov/pub/irs-pdf/f2848.pdf). Unauthorized third parties cannot change a taxpayer's address.

Speak with an IRS representative. You can inform the IRS in person or by phone of your change in address. The IRS will need to verify your identity and address, so be prepared to supply your full name, address, and your Social Security number or Individual Taxpayer Identification Number or Employer Identification Number (depending on your situation with the IRS).

Notify the IRS electronically. You can only use this option if your refund check was returned, meaning that you received a CP31 notice. A CP31 notice is a form that informs you that your refund check has been returned to the IRS because the address was incorrect. Click on "Where's My Refund?" on the IRS website to change your address. You will need your Social Security number, filing status, and the amount of your anticipated refund check.

Comments

0 comment