views

Calculating How Much It Costs to Own

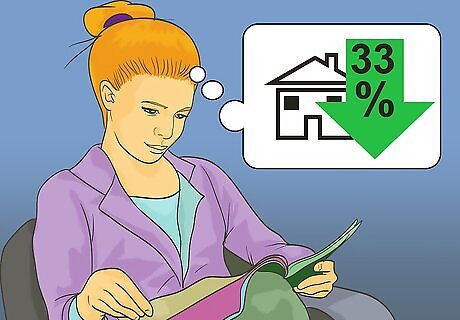

Look at home prices where you want to live. Generally, buying is cheaper than renting, though it will depend on location. For example, buying in Hawaii is barely cheaper than renting. However, buying in Detroit is substantially cheaper. You should look at homes in the area where you want to live. Find houses in the area that meet your requirements. For example, if you want a two-bedroom home, then look at prices for two-bedroom houses. Make sure your comparison homes are as close to the home that you want as possible. If you want two acres for a yard and a swimming pool, then look at homes that have those features. Also only look at houses you can afford. Experts recommend that you should spend no more than 33% of your gross monthly income on housing. If you make $4,500 a month, then no more than $1,500 should go to housing. Write down the prices for all the homes that meet your specifications. Average them together.

Estimate whether prices are rising or falling. Buying into a hot real estate market is less risky because you’ll be able to sell your home quickly if necessary. If you buy into a market with declining prices, by contrast, then you may have to stay in the home much longer before you reap any financial benefit. Try to estimate how much home prices are increasing (if at all) in the area where you want to buy. Look online. If you live in a large city, then the media regularly reports how much real estate prices have increased over the past month, year, and decade. Talk to a Realtor. Feel out the state of the market over the past year and five years. Ask if prices have been increasing and, if so, by how much. Obviously, there are no guarantees that prices will rise in the future. But you need some number to do a calculation. Avoid looking at the national increase in prices. The housing market is segmented by geographic area, with some cities and states doing much better than others.

Decide how long you intend to stay. A key factor in deciding between renting and buying is how long you intend to stay in the home. For example, can you stay for five years or more? Or are you planning on moving sooner? The length of time you intend to stay matters because you don’t immediately start building equity in your home. Instead, your early mortgage payments mostly go toward interest on the loan. Typically, you need to stay in the house for at least three years before you build equity, and it’s preferable to stay for at least five. If you move in the first few years, then the costs of selling the home and moving could also cost you money.

Calculate your down payment. Look into your savings accounts and decide how much you can contribute to a down payment. You might also get a down payment by using money in a retirement account or obtaining a loan from family. Determining your down payment is important for a couple reasons: Generally, mortgage lenders want to see 20% of the purchase price as a down payment. For example, if you buy the home for $250,000, then you’ll need $50,000 as a down payment. If you can’t scrape together a down payment, then home ownership might be out of reach for you. Some lenders will accept less than 20%. However, you’ll probably pay more in fees. Your monthly payment will also be higher. Your down payment is sitting somewhere, earning money (or not). If you choose to rent, you will need to analyze whether you will invest that money and what kind of return you can anticipate.

Decide if you want to invest your down payment instead. Let’s say you don’t buy a house. You can now use the money you saved as a down payment and instead invest it. You should decide whether you would invest this money and the kinds of investments you would purchase. For example, you might invest the money in stocks, bonds, or CDs. Each has a different rate of return. You can find the average rate of return online.

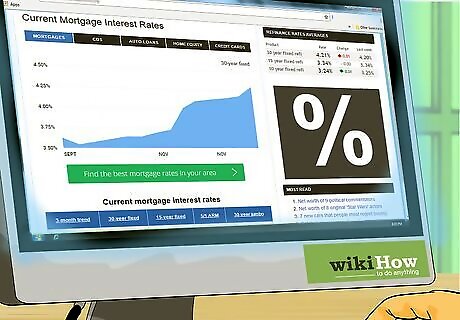

Research mortgage rates. The mortgage rate on your loan will also determine whether renting or buying is cheaper. Look online. Many websites post the current mortgage rate, which will vary depending on the length of the loan. Mortgage rates also vary depending on your credit score. Borrowers with scores above 740 typically qualify for the best interest rates. Meanwhile, those with scores around 620 may struggle to get a loan. You can also get an adjustable-rate mortgage. Generally, you can get a lower rate and initial payment this way. However, rates can fluctuate over time and may suddenly increase.

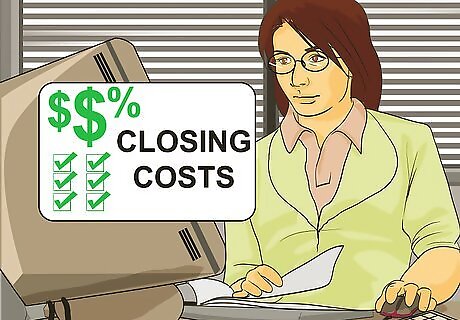

Estimate closing costs. Don’t forget about these fees, which are collectively called “closing costs.” You won’t be able to purchase the home without them. Closing costs generally run about 2-5% of the home purchase price, and cover the following: application fee appraisal escrow fee attorney’s fees credit report property taxes insurance home inspections origination fee title insurance recording fees transfer taxes

Identify the costs of owning a home. You might think you can compare your rent payment to your likely mortgage payment. But home owning has hidden costs you need to be aware of. For example, owners are responsible for the following: property taxes home insurance repairs dues (if you belong to a homeowner’s association)

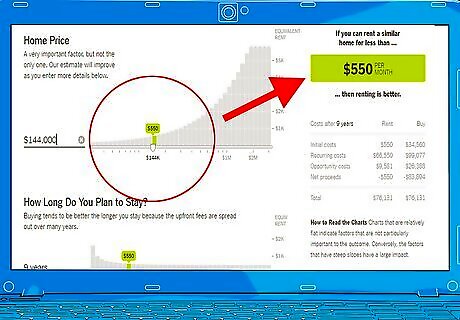

Use a calculator to estimate the costs of owning. There are many calculators online that will ask you questions and then tell you how much it will cost to own a home. Some calculators are more simple than others. The New York Times has an excellent calculator available here: http://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html?_r=0. This calculator will ask for the following information: home price length of time you will stay mortgage details (mortgage rate, down payment, and length of mortgage) anticipated rate of growth for home prices and rent expected investment return rate property tax rate closing costs expected maintenance costs

Compare the cost of ownership to renting. Based on the information you enter, the calculator should produce a number of how much it costs each month to own a home. For example, the New York Times will say something like, “If you can rent a similar home for less than $550 per month, then renting is better.” Check whether similar rentals are available for that amount. You might be in a current apartment. If so, compare your rent amount. Realize that your rent will probably increase each year. If you don’t have an apartment in the area you want to move to, then research rents. You can find rents by doing an online search.

Analyzing Personal Factors

Decide how much work you want to put in your home. Renting is typically easier because your landlord is responsible for maintenance. When your faucet leaks, you can call the janitor. When the leaves fall off the trees in autumn, your super should rake them. Ask yourself how much work you are willing to put into maintenance. When you own a home, you’re responsible for cutting the grass and shoveling the sidewalk in front of your house. Although you can hire people to do this, it’ll usually cost money. If you don’t want to worry about a leaky roof or other maintenance tasks, then renting is ideal for you.

Consider your risk tolerance. Renting is much more predictable. Although the rent might rise annually, you know how much you’ll pay each month. By contrast, home ownership costs can fluctuate depending on repairs and property taxes. You should consider whether your budget can weather these fluctuations and how comfortable you are if home ownership costs suddenly rise. If the home value were to decline, what would you do if you had to sell the house? Would you be able to wait it out and not sell right away? Would you be able to turn it into a rental property if you were stuck and could not sell it for enough to pay off the mortgage and had to move? Would you be able to maintain it and rent it out for enough if you had to rent it out? Are you barely getting by as it is? If so, then you might prefer the predictable nature of renting. Even if you can afford to buy, the stress alone might be too much. Do you have a financial cushion for home repairs? And if you do, are you comfortable using it when you could be investing it instead? How stable is your job? It can be a risk to purchase if you don’t feel secure in your job. You should analyze your own tolerance for risk.

Ask how important control is to you. Ownership gives you more control than renting. Generally, you’ll face fewer restrictions in terms of pets and what you can do in your own home. These can be important considerations for some people. When you rent, you have little control over who lives right beside you or above you. You also must abide by the landlord’s rules regarding how you use the property.

Determine how much you value home ownership. Some people consider home ownership a pillar of the “American Dream.” For them, home ownership carries tremendous emotional satisfaction. Decide if the appreciation expected during your home ownership is worth the expenses that need to be put into it. You might not care whether you rent or own. In that situation, you might want to stay renting until you face a pressing need to buy a home.

Balance all of these factors. Everyone’s situation is unique, and there’s no right answer for everyone. You should compare which is cheaper—renting or buying—and then analyze how comfortable you feel with each choice. Be sure to include everyone affected by the choice. For example, you should include your spouse and older children. Their personal comfort with buying property is central to any decision to buy or rent.

Comments

0 comment