views

X

Trustworthy Source

Internal Revenue Service

U.S. government agency in charge of managing the Federal Tax Code

Go to source

Furthermore, if you are a private sector employer than you must pay “interns” the minimum wage unless they are legally exempt. Unfortunately, there is no simple way to distinguish between an employee and a non-employee. Instead, you must analyze a worker’s job duties according to several factors.

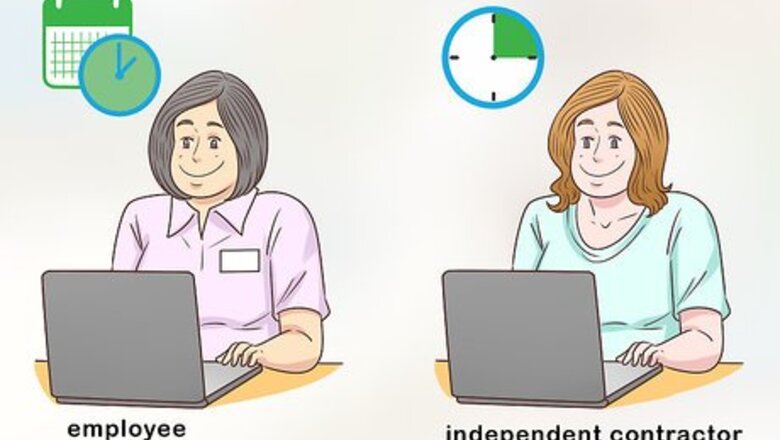

Distinguishing an Employee from an Independent Contractor

Consider how permanent the relationship is. Federal law considers the permanency of the relationship when determining whether the worker is an employee or independent contractor. The more permanent the relationship, then the more likely the worker is an employee instead of an independent contractor. The person does not need to work for you all of the time. However, if he or she works for frequently recurring intervals, then the worker is more like an employee.

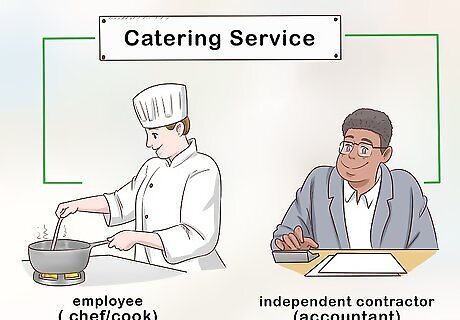

Determine if the work performed is part of your regular business. You might run a catering service. As part of this business, you make and serve food at parties. If the worker makes appetizers for you, then her work is part of your regular business. In this situation, the worker is more like an employee than an independent contractor. If the worker performs only occasional work for you, then she is probably an independent contractor. For example, the owner of the catering business occasionally hires her accountant to look over contracts, prepare tax returns, and answer tax questions. This occasional use suggests that the accountant is an independent contractor.

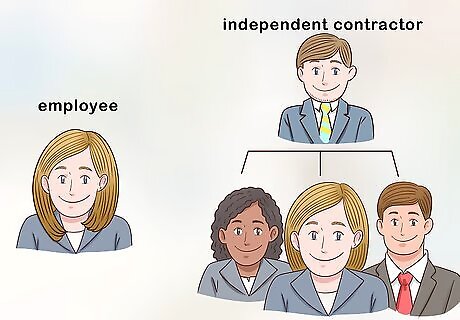

Check if the worker has their own employees. An independent contractor is more likely to have his or her own employees working under them. For example, if the worker outsources part of their work, then this factor would support finding an independent contractor relationship.

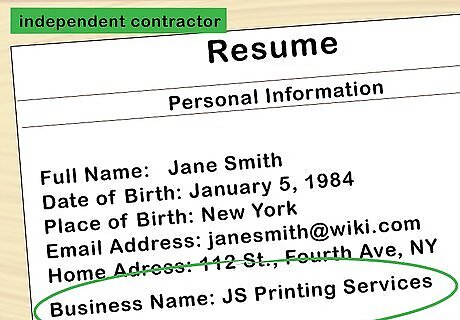

Find out if the worker operates under a business name. Where a worker has incorporated and provides services under the business name, then it is more likely that she is an independent contractor than an employee. You should go through your records and see if the worker listed her business on a resume or in an email when you hired her. Also look to see if the worker has a separate business checking account. This factor will weigh in favor of someone being an independent contractor. An independent contractor will also keep her own business records. However, if you are responsible for maintaining the records, then the worker looks more like an employee.

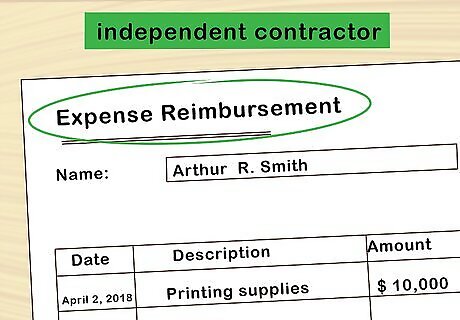

Determine who pays for the worker’s supplies. If the worker pays for his own tools or supplies, then he is more likely an independent contractor than an employee. Look through your invoices. If you are reimbursing the worker for supplies, then this factor might weigh in favor of an employer-employee relationship.

Ask if the worker has other clients. An independent contractor will probably have more than one client. You should ask how many other clients the worker has. The more clients a worker has, then the more likely that he is an independent contractor. For example, a dentist may see over 100 patients in a month. Because he does work for so many different customers, then he is not the employee of any of them. By contrast, a worker might work only for you. If you are the sole client, then it is more likely that the worker is an employee and not an independent contractor.

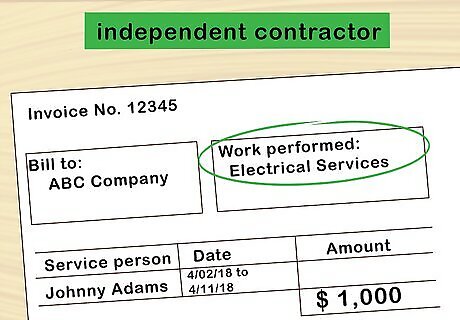

Look at how the worker is paid. When someone invoices you for work performed, then they are more like an independent contractor than an employment. However, if you pay the worker an hourly wage regardless of how much work is performed, then the worker looks like an employee.

Check if you set the worker’s hours. When you tell the person when to work, then you are acting like an employer. Accordingly, if you set the worker’s hour, then this is some evidence that he or she is an employee and not an independent contractor. You may exercise other forms of control over the employee. For example, you could try to dictate where the work is performed. This type of control weighs in favor of the worker being an employee. In particular, if you require that the worker perform work at your jobsite, then the worker is more like an employee than an independent contractor. Another aspect of control is requiring the worker to issue regular reports, whether written or oral.

Review the worker’s level of skill. This is another factor to consider. The more highly skilled the person, the more likely he is to be an independent contractor. An unskilled or semi-skilled individual is more likely an employee. Look at the tasks you have the person perform. Don’t rely solely on the job description, which may not accurately reflect the work that the person is performing.

Check the termination provisions in your contracts. If you are able to fire the worker at will, then he or she is more like an employee. Also, if the worker can quit for any reason at any time, then the worker is more like an employee. Independent contractors, by contrast, cannot be let go for any reason so long as they fulfill the obligations in their contract.

Weigh the totality of the circumstances. There is no bright-line test for whether a worker is an employee or an independent contractor. For example, the worker could have her own business but still qualify as an independent contractor if she works only for you and you dictate her hours and where she can work. Instead, look at all of the factors above. This is a subjective analysis. Trust your gut and ask which way the totality of evidence tilts: does it lean a little more in favor of an independent contractor or an employee? If you are worried about the government classifying a worker as an employee, then you should try to change the work relationship. For example, you should stop setting the work hours for the person and start requiring that the worker invoice you for work performed. You could also stop reimbursing people for supplies.

Meet with a lawyer. This is a very complicated area of law. If you have questions about whether a worker qualifies as an employee, then you should meet with a lawyer. You can find a qualified employment attorney by visiting your state’s bar association, which should run a referral program. For more tips, see Find an Employment Lawyer. Also realize that some government agencies use different tests for determining whether a worker is an employee or an independent contractor. The factors listed above are used by most states and federal agencies; however, each agency could weigh the evidence differently. Accordingly, an employee might be classified by the IRS as an independent contractor but by your state unemployment agency as an employee. To truly know the status of your worker, schedule a consultation with an attorney.

Distinguishing an Employee from an Unpaid Intern

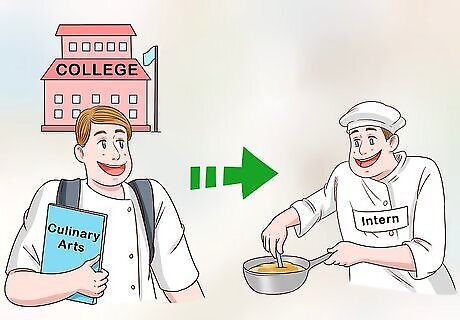

Check if the internship is related to a university. If the internship is overseen by a college or university, which provides educational credit, then the person working is more like an intern than an employee. Where the internship is unrelated to a university or college, then it is more like employment, and the intern could really be an employee who must be paid a wage.

Confirm that the internship is for the intern’s benefit. The internship should also provide general skills and not training in work specific to the employer. In this way, the intern is gaining skills which she can take to a different employer. However, where an intern is doing work specifically for the employer, such as answering phones or filing, then he or she could qualify as an employee and not an intern. In this situation, the internship is benefiting the employer.

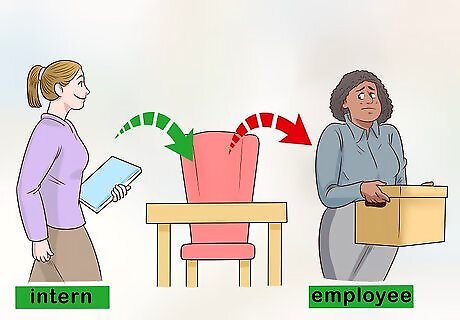

Check that the intern hasn’t replaced an employee. If you use an intern to replace an employee, then the intern is more like an employee. Also, if you use interns as extra help during certain times of the year, then the intern is more like an employee. For example, if a store hires interns only during peak shopping season, then the relationship looks more like employment than an internship. In particular, the work relationship appears to be for the benefit of the employer, who is busy during the shopping season.

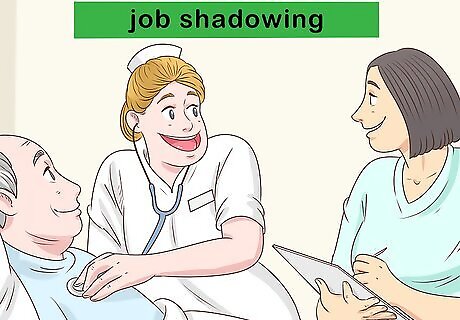

Identify why you are training the intern. Many internships require training, with an experienced worker training the intern. You should identify the purpose of this training. If the training is for the intern’s knowledge—and you do not require that the intern put this training to use by doing work for you—then the arrangement is more like an internship. A common situation would be “job shadowing,” where the intern follows an employee around without doing much work. Instead, the primary purpose of the shadowing is to learn. However, when you supervise a worker in the same manner as you would an employee, then the relationship looks like an employer-employee relationship.

Calculate how long the internship is. An internship should have a fixed length. The end point should be determined before the intern starts working. Additionally, the internship should not be a “trial run” where the intern works for free before you decide whether to hire him or her. The intern’s expectations are a critical component. When the intern expects an offer of employment after the internship, then it is probably not an internship.

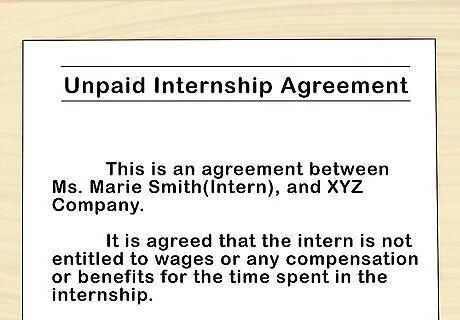

Check your agreement about wages. The unpaid intern should not expect compensation. You should have some sort of agreement in which you state that the intern will not be paid.

Weigh the factors. These factors must all be weighed. There is no simple bright-line test for determining if a person is an intern or an employee. If, after weighing all of the circumstances, you do not know whether the person is an intern or employee, then you should speak to an attorney. You don’t want to fail to pay an employee wages he or she is entitled to.

Comments

0 comment