views

X

Research source

Gathering Information

Find the legal description of the property. The easiest way to get the correct legal description for the property you want to transfer is to go to the county recorder's office in the county where the property is located and get the existing deed for the property. While you should also include the address, the full legal description of the property can eliminate any future confusion. You'll need a copy of the existing deed on the property, and you'll want to copy the property description exactly as it appears on that document in your quitclaim deed form. Keep in mind that if you don't include a legal description, the deed could be challenged by someone else with an interest in the property, which could result in a judge rejecting the transfer.

Check the tax status of the property. Transferring property doesn't necessarily transfer the tax obligation, and in most states the property taxes must be up to date if you want to transfer any interest in the property. Transferring your interest in the property may have nothing to do with property taxes, particularly if someone else was already paying the property taxes on the property. If that is the case, tax statements typically will continue to be sent to the person to whom they've been sent in the past. However, if you paid the property taxes on the property, you'll have to make sure the taxes are paid in full up to the date of the transfer, and that the tax liability is transferred appropriately. If you're unsure about the tax status of the property, you can check the county recorder or tax assessor's records for the property, or look on the most recent property tax statement. Any questions regarding the transfer of property taxes and future tax liability should be directed to an accountant or tax professional.

Decide when you want the transfer to take place. While typically if you're filling out a quitclaim deed you want the transfer to take place immediately upon execution of the document, you also can date it so that the transfer doesn't occur until a later date, or even at the occurrence of a specified event. You may want to use a quitclaim deed to transfer the property to someone else at your death. However, check your state's property laws or talk to an attorney before you do this. In some states, you need to use a transfer on death deed rather than a quitclaim deed. The documents you use also may depend on whether the property is addressed in your estate planning documents. In situations where you intend to make the transfer conditional on a certain event happening, or set the transfer to occur on a future date, you may want to consult a property law attorney to make sure you're filling out the form correctly to achieve your intended result.

Confirm you're using the right kind of deed. Quitclaim deeds are most frequently used between family members or co-owners of property who are already familiar with the property itself as well as with each other. Keep in mind that a quitclaim deed comes with no guarantee regarding the ownership interest you may have in the property. You may have no interest at all, and that may match the intent of the transfer. For example, if there's some question as to whether you might have a claim to the property as a result of some confusion in the current owner's estate documents, but you don't want the property, you might use a quitclaim deed to negate any possible claim the probate judge decides you have in the property. On the other hand, if the person to whom you're transferring the property is under the impression that you have a particular ownership interest in the property, a quitclaim deed may not be the right vehicle of transfer. In that situation, the other party may want a little more of a guarantee that they're getting exactly what they think they are. A quitclaim deed also may not be the appropriate document if you are actually selling the property and a significant amount of money will be changing hands.

Completing Your Deed

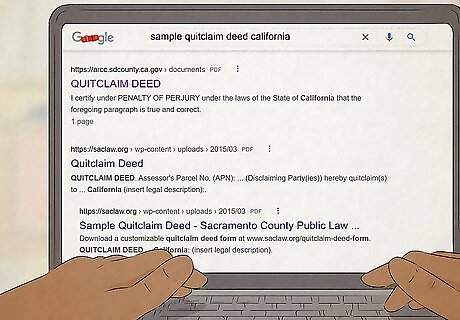

Search for forms or templates. Most states have fillable forms available online in PDF format that you can download. Check the website of the state court system or of the county recorder. You also can find forms from legal document websites and services. These forms typically are identical throughout the state, so if your county recorder doesn't have a website you may be able to find a form that would work by searching by the name of your state. While you can easily find forms online, you still need to make sure the form you're using is approved in your state. For this reason, the easiest thing to do is find a form with the county recorder. The form is available free of charge and you automatically know you can use it to achieve the transfer you want.

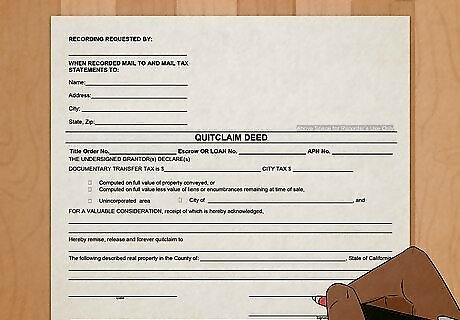

Enter information about the property. The form you use typically will indicate the type of information you need about the property, in addition to the street address. You may need the parcel number, or to copy a metes and bounds or other description from any existing deed associated with the property. If a parcel number is required, you typically can find this information on the existing deed for the property or on a property tax statement. Make sure you copy the legal description of the property exactly. This covers the specific legal boundary lines of the property and will be necessary in the event of a boundary dispute, so it's important that all deeds list the same description.

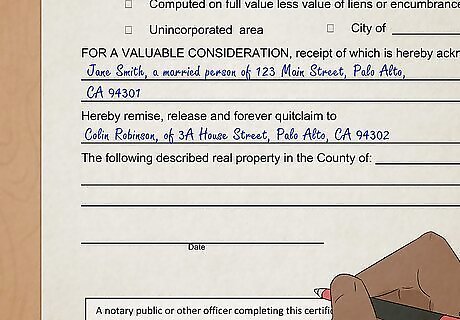

Provide names and addresses for the grantor and the grantee. Since you are transferring your interest in the property, you are called the "grantor." The person to whom you're transferring that interest is called the "grantee." For the grantee, you will need to include their full legal name and the address of their legal residence, even if they currently live on the property you're transferring to them. For yourself, you must include your full legal name and the address of your current legal residence.

Fill in information about the transfer. A quitclaim deed simply transfers any interest you have in the property – even if you have no interest at all. However, in some states you'll need to note whether mineral rights are included. Keep in mind that a quitclaim deed only transfers any interest you have at the time of the transfer. This means if you have a mortgage on the property, you typically are still responsible for that mortgage unless you make other arrangements. The quitclaim deed in and of itself does not make the grantee responsible for that mortgage. Most states do not allow you to transfer an interest you don't acquire until after the date of the transfer. So if you date your quitclaim deed before you've actually acquired any interest in the property, you will retain that interest and the quitclaim deed won't transfer anything. You also must address the amount of money changing hands. It may be that the transfer doesn't involve any money at all, which is often the case if you're merely clearing title among joint owners of property or family members. However, in many states the quitclaim deed still includes a recital wherein at least one dollar must be exchanged to transfer real property. In legal terms, this is called symbolic consideration or nominal consideration. The language is based on the basic precept of contract law that a contract (including a deed for the transfer of property) is not valid without consideration.

Executing Your Deed

Determine your state's legal requirements. States differ regarding who must sign a deed for it to be legally valid. At a minimum you must sign it, and some states require the grantee to sign it as well. Nearly all states require the deed to be signed in front of an authorized notary public. Some states also require one or two witnesses in addition to the notary. If you're unsure of the laws in your state, you can get information at the county recorder's office. The same information also may be available on the county recorder's website. Another way to find out the legal requirements is simply to look at the form. If the form you used was created or approved by your state government, it will have blanks for the requisite witnesses or notary to sign.

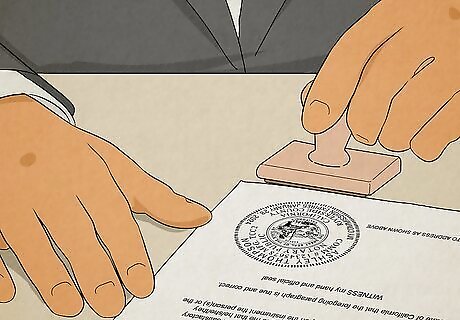

Find a notary public. Typically any document transferring real property must, at a minimum, be signed in the presence of a notary. The notary public verifies the identity of those who sign the document, but they don't review the contents of the document itself. Notaries are public servants who often work in city or county clerk's offices and courts. You also can find a notary at banks, or many real estate and law offices. While you don't have to be a client or account holder at the bank or office to use the notary, many banks offer notary services free of charge to their customers. Ordinarily, you should expect to pay a few dollars for the notary's services. They will need to verify your identification, so bring along a state-issued or military ID, passport, or other government-issued photo ID.

Sign the deed. While you're in the presence of the notary, all individuals required to sign the deed must sign and date it. The date you sign the deed doesn't have to be the date the transfer takes effect. After the notary checks your ID and logs the required information, you will need to sign your quitclaim deed. If your state requires a signature from the grantee, or from witnesses, they must sign after you. Finally, the notary public will sign and affix their seal to the deed. When all signatures and seals are on the document, you should make at least two copies – one for your records and one for the grantee's records. You'll want to take the original to the county recorder's office and record it.

Record the deed. Although it typically isn't legally required that you record your quitclaim deed, if it isn't recorded no one will know that the transfer took place. This can cause problems if, for example, the grantee attempts to get a mortgage on the property. The deed should be recorded with the county recorder in the same county where the property is located. You'll be charged a fee to record the deed, typically less than $100.

Comments

0 comment