views

Documenting a Vehicle’s Lien History

Check the title. When negotiating the purchase of a car, you should be allowed to inspect the vehicle’s title. Titles vary from state to state, but typically they will list information such as: Current owner Past owner(s), if any Outstanding liens, if any Past liens, if any

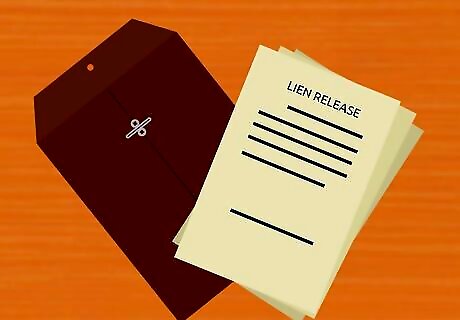

Ask to see the lien release if any liens are listed on the vehicle’s title. A lien release is an official document or certification that an outstanding lien has been fully satisfied. Depending on the state issuing the vehicle’s title, the lien release may either be noted on the title or in a separate document. Ask to see any lien releases even if the title shows the vehicle has transferred ownership from the lienholder. Vehicles can be sold even with outstanding liens, so you want to make sure that one is lien-free before you buy it. Any lien release documents should be transferred to you if you purchase the car, so that you can show proof any time it is necessary (such as if you sell the car yourself in the future).

Watch out for suspicious practices. Reputable dealers and sellers will have all documents completed and ready for you to review, or else will be able to request them. If the seller cannot or will not produce the proper documents, it may be a sign that something is wrong with the car or the sale. Never buy a vehicle if the seller can’t show you the title in the seller’s name, or can't produce lien releases for any liens listed on the title. The title is proof that the seller owns the vehicle and is permitted to sell it. If the seller can’t find the title, he or she should be able to request a new one from their department of motor vehicle services (or equivalent). It is the seller’s responsibility to do so. If the seller won’t request a new title, it may be a sign that the title is held by a bank or other lending institution and has an outstanding lien, or that the car is not the seller’s to sell. You will need the title and for the vehicle to be lien-free so that you can properly insure it, and so that no one requests the remainder of the lien payment from you.

Checking the Vehicle History Report

Get the vehicle’s VIN. Each vehicle has a unique Vehicle Identification Number (VIN). Typically, you can find this number in one or more standard locations, including: The dashboard on the driver’s side. This is the most common location. Normally, the VIN is visible by looking at the dashboard through the bottom corner of a vehicle’s windshield on the driver’s side Under the hood at the front of the engine. In the trunk under the spare tire On the driver’s side door jam Older cars (pre 1981) may not have standardized VINs, or any at all.

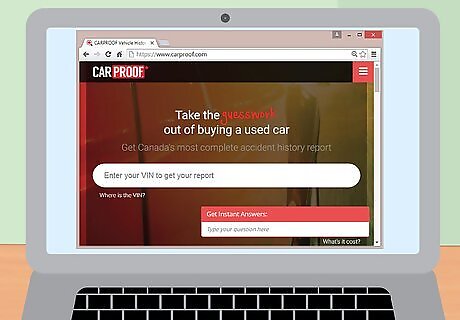

Use the VIN to do a lien history check. The VIN can be used to trace any liens on a vehicle. Motor vehicle services departments in individual states will allow you to search this information by VIN number. In addition, private organizations such as CarFax and CarProof can provide this service. In many states, you can do an online lien history search on a vehicle by using its VIN. Check the website of your local department of motor vehicle services (or equivalent) to see if this method is available to you. In other cases, you should be able to do a lien search either by mail or in person at your local tax office or department of motor vehicle services. Contact the relevant office or visit its website for details about applying for a lien search. Check the websites of private vehicle history services to determine availability in your area. There may be a fee associated with a lien history search, whether you use a private organization or contact your local department of motor vehicle services. The amount of this fee will depend upon your location.

Determine if a lien notice is on a title by mistake. Local laws typically require either the lender or buyer to notify a tax office or department of motor vehicle services once a lien has been satisfied. If the car you want to purchase carries a lien notice on its title, even though the seller (or previous owner) has satisfied the lien, then it may be because the tax office/department of motor vehicle services has not been properly notified. Usually, this problem can be corrected without much hassle by going to the tax office or department of vehicles with the title and certification of lien release. There may be a fee to correct the title. If the lien release is lost, you will have to contact the lending institution for a new copy. If the lending institution is out of business, has merged, or does not respond to your request, contact your department of motor vehicle services for more information. If you have receipts, cancelled checks, or other proof that the lien was satisfied, it will make the process easier. You may also contact an attorney for assistance.

Getting a Lien Removed

Satisfy the lien. If you determine that a lien against a vehicle is outstanding, and you still want to purchase the vehicle, then you will need to have the lien removed. Have the seller or whoever owes the lien pay whatever balance remains of the lien before pursuing the official release of the lien. If you do not properly remove the lien against a vehicle, then you risk having the vehicle repossessed by the lender/creditor.

Receive the lien release. Once the lien is satisfied, the lending institution will send a notice (either electronically or by mail, depending upon how the lien was recorded) certifying that the debt has been repaid in full. This certification will be used to clear the title of the document. In many cases, the lending institution will have a period of time (such as ten days) after the receipt of final payment in which to supply a certification of lien release.

Apply in person, if possible, to have the lien removed and the title transferred. Visit your local tax office or motor vehicle services department (depending on your state) and complete an application to have the lien removed from a title. If you apply in person to have the lien removed and the title transferred, and agent will be able to review and make sure all information is correct. You will need to bring documents with you (typically the vehicle’s title and the official release of lien document from the lender). Normally, there is a fee for this service, which will vary depending upon your location. Your method of removing the lien will also depend on how the lien was recorded. In many cases, liens are recorded on paper, but in others they are recorded electronically. If you are applying to transfer the title by mail, you may have to send old title to the department of motor vehicle services (or equivalent) so that it can issue you a new title showing that you are the owner of the vehicle. Contact your tax office or motor vehicle services department if you’re not sure whether you can apply in person.

Comments

0 comment