views

- Petition the court to seal your eviction record if your landlord didn't follow proper legal procedures.

- Ask a judge to seal the eviction record or expunge it if you were evicted in Oregon, Minnesota, or Nevada.

- Set up a payment plan with your landlord so the eviction-related debt doesn't end up on your credit report.

- Apply to rent from private landlords who are less likely to run background checks or pull your credit.

Can I remove my eviction from the public record?

Yes, if your landlord didn't follow the proper procedures for eviction. If you weren't notified about your court date or your landlord locked you out without giving you a chance to work out a payment plan, call your local legal aid office. In these situations, it's likely that your landlord didn't follow proper legal procedures. An attorney will look over your case for free and talk with you about your options. Law schools often have landlord/tenant clinics where you can get free help as well. Your case will be primarily handled by a law student, but a licensed attorney will be in charge. It's fairly common for landlords to cut corners with evictions—and because tenants don't often call them on it, they usually get away with it.

Yes, if the judge ruled against your landlord at the hearing. Even if you win in court and aren't evicted, the public record can still show up on tenant screening reports. Unfortunately, it likely won't mention the fact that you won the case, leaving potential landlords to assume you were evicted. Avoid this by asking the judge to seal the record as soon as you win. You can also enter an agreement with the landlord to seal your eviction record so no one will be able to see that you were evicted. Usually, this is part of a larger agreement for payment of past-due rent. Keep in mind that sealing is not the same thing as having the eviction removed ("expunged"). Even if you have the record sealed, you're still technically required to disclose to potential landlords that you were evicted if you're asked.

Yes, if your state allows evictions to be expunged. Expungement is the only way to have an eviction completely removed from your record, as though it never happened. As of August 2022, only 3 states—Oregon, Minnesota, and Nevada—allow evictions to be expunged. Legislation has been introduced in several other states, including Connecticut, Florida, and California. If you live in a state that allows expungement, call your local legal aid society—they'll help you file a motion in court. If you were evicted for nonpayment of rent, the judge typically won't expunge your case until after you've paid your debt in full. Check the court records after your expungement is granted to make sure the eviction was removed. The court clerk can help you with this.

Removing an Eviction from a Tenant Screening Report

Have the court seal or expunge your eviction record. Tenant screening agencies look up potential tenants in court record databases. The best way to make sure your eviction doesn't end up on a tenant screening report is to have a judge seal or expunge that record. Call your local legal aid office to get an attorney to help you with this. You can also make an agreement with your old landlord not to report the eviction. But if the tenant screening agency goes straight to the public records rather than calling your old landlord, that agreement won't make any difference.

Ask potential landlords what screening agency they use. If a landlord decides not to rent to you based on information contained in a tenant screening report, they're legally required to give you the name and address of the agency that gave them that report. You have the right to get a report from that agency and review it for errors. There's no point in contacting a tenant screening agency before a landlord orders a report from them. These agencies pull these reports together on demand—they don't have a report on you otherwise.

Send a letter to the agency asking for a copy of your report. Write a letter to the agency that includes your name and location along with the name and location of the landlord who used their service. Include an address where they can send a copy of the report they gave that landlord. Make a photocopy of the front and back of your driver's license or state ID and include that with your letter to verify your identity.

Ask the screening agency to remove the eviction from your report. If you have court papers showing that a judge sealed or expunged your eviction record, the screening agency is legally required to remove it from your report. You can also ask if you have an agreement with the landlord that evicted you. Unfortunately, if you don't have any documents to back up your request, there's not much you can do. The screening agency isn't obligated to remove an eviction record if there's a public record of it.

File a statement about the eviction if you can't get it removed. You have the legal right to make a statement about the eviction. Whenever that tenant screening agency reports your eviction to landlords, they are legally required to include your statement. This option is especially valuable if you won the eviction case or moved out before the landlord could take you to court. Even though the record is still there, you weren't technically evicted, and that makes a big difference! This also gives you the opportunity to explain the circumstances that led to the eviction. For example, you might write, "My youngest daughter was sick and I had to stay home with her. As a result, I lost my job and couldn't pay rent. I was evicted before I could make arrangements with the landlord."

Renting After an Eviction

Be upfront about your record if you know what's there. For one thing, if you're honest about the eviction from the beginning, you give the landlord a reason to trust you. It also gives you a chance to tell your side of the story in a non-confrontational way when the landlord will likely be more receptive. For example, you might say, "Before I fill out this application, I need to tell you that I was evicted a couple of years ago. I lost my job and was having a hard time making ends meet. Now, I have a new job that pays a lot more than the one I lost, and I really just want to put that chapter in my life behind me." If you've already applied at a bunch of different places, ask the landlord what tenant screening agency they use. If you've already dealt with a landlord who used the same agency, you'll know what's on that report so you can do damage control. If you won the eviction case or the landlord evicted you illegally, print copies of the court papers that show that and take them with you when you meet with prospective landlords.

Rent from private individuals. Large apartment complexes are typically owned by property management companies that have pretty strict policies regarding who they'll rent to. Even if the property manager is really nice, their hands may be tied in terms of getting you approved for a lease. Look for private individuals who don't use tenant screening services or run background checks—they exist! If you rent from one of these people, you won't have to worry about the eviction on your record at all. Walk neighborhoods looking for signs that say "For Rent." Many private landlords don't advertise their properties online.

Create your own "renter résumé" for potential landlords. Create a brief document with information about your life, your family, your education, and your job history. Focus on information that shows that you're consistent and responsible. For example, if you've been a member of the same church for over a decade and are active in several church groups, that shows that you're dedicated and reliable. Include names, phone numbers, and email addresses of people who are willing to vouch for you as a responsible and reliable person. If you have kids, include information about them that puts them in the best light. For example, you might mention that they're on the honor roll at school or list any awards they've received.

Dress to impress when you go out looking for housing. Wear clean, neat, conservative clothing to make a good first impression with prospective landlords. If you're driving your own car to meet with the landlord, clean it out and take it to the carwash first. The landlord will notice and it gives them an idea of how you take care of your possessions, which carries over to how you'll treat their property. If you have to take your kids with you to meet the landlord, make sure they're on their best behavior. While landlords can't legally discriminate against you for having kids, it definitely helps your cause if your kids are polite, respectful, and well-behaved.

Enter payment plans and agreements to improve your credit. If you have the means to do so, paying off debts you have can improve your credit score and make it a lot easier to find landlords who will rent to you. It can take a little effort on your part, but most creditors are actually willing to work with you if you keep the lines of communication open. Even if you haven't completed your payment plans yet, many landlords will be more receptive if you show that you're actively working to pay back the debts that you owe and are in control of your finances.

Apply to rent places that you can afford. Landlords typically want you to earn double or triple the amount of the rent each month, so start by looking at places that fall into that range. It might help to create a household budget so that you can keep track of your spending and get a better idea of how much rent you can afford to pay. If you have a low or fixed income, contact your local public and subsidized housing office. Most of these offices have wait lists, but they may still be able to help you or point you toward other resources. Even if you're planning on having roommates, if your name is on the lease, you need to make sure you can afford all of the rent on your own. Don't rely on others—if something happens to them, you'll be on the hook for the whole thing.

Ask a friend or family member to cosign your lease. If you know someone who has better credit and more income than you, they can potentially make it easier for you to rent after an eviction. They don't have to live with you to cosign the lease, but they do have to agree to be responsible for the rent payments if you come up short. Landlords don't have to accept cosigners, but a lot of them do. It helps if your cosigner lives in the same state—even better if they're local. Keep in mind that this is a big thing you're asking them—they'll be on the hook if you don't pay your rent in full and on time. Try not to get too upset or take it personally if they're not willing to help you.

How long will an eviction stay on my record?

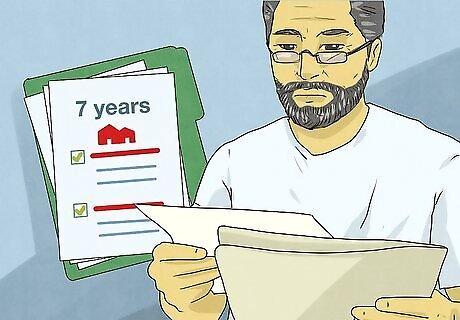

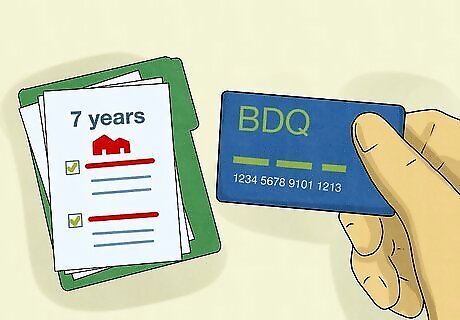

Tenant screening agencies can report evictions for 7 years. The law treats tenant screening agencies as similar to credit bureaus, giving them both the same 7-year time limit. But some tenant screening agencies continue to report evictions that are more than 7 years old, even though it violates the law. If a landlord decides not to rent to you, ask them what tenant screening agency they used. They're required by law to tell you. Use that information to hold the agency accountable if they reported an eviction when they shouldn't have.

The public court record is potentially there forever. Some landlords check the actual court records, rather than relying on a tenant screening agency. Unless your eviction has been sealed or expunged, anybody who checks the court records will see it, no matter how much time has passed.

Rental debt sent to collectors stays on your credit report for 7 years. The 3 largest credit bureaus—Equifax, Experian, and TransUnion—don't report public judgments, such as evictions, on credit reports. But if your old landlord passes on your debt to a collections agency, that information will show up on your credit report. This entry stays on your credit report even after you've paid the debt in full, unless you've specifically negotiated with the collections agency to remove it.

How does an eviction affect my credit?

An eviction alone won't affect your credit at all. That's the good news—since public records aren't reported on credit reports, getting evicted in and of itself won't hurt your credit score. So if you got evicted for any reason other than nonpayment of rent, you should be fine as far as your credit report is concerned. But if you got evicted for nonpayment of rent, having an account in collections could put a serious dent in your score. Once your landlord turns over your account to a collections agency, that agency will report the debt to at least 1 (if not all 3) credit bureaus. Every month that goes by without payment, your credit score takes another hit. To avoid that ding on your credit, get with your landlord and try to work out a payment plan before they send the debt to collections.

Getting Eviction-Related Entries off Your Credit Report

Call the landlord before they send the debt to collections. You'll have a lot more leeway if you work directly with your landlord rather than working with a collections agency. On top of that, there's a chance that your landlord hasn't reported the debt to the credit bureaus, which will keep anything related to your eviction off of your credit report. If your landlord agrees to work with you, be sure to get it in writing! Be upfront about your financial situation and what you can afford to pay to satisfy the debt. The landlord might be willing to accept less than what you owe if you're able to pay it at once. For example, if you owe $1,200, the landlord might take $800 in cash immediately rather than $200 a month for 6 months.

Contact the collector if the landlord forwarded the debt. Call or write the collections agency that has taken over your past-due rent as soon as possible. Ask them to send you information to "validate the debt." They'll send a statement that tells you the total you owe, and you can go from there. Collections agencies are usually willing to settle for much less than the total amount. They might include information about different payment plans you can choose, or you can negotiate your own. Plug the payments into your budget so you know how much you can afford. Don't bite off more than you can chew! Agreeing to a payment that ends up straining your finances could do more harm than good.

Ask for removal as a condition of payment. This is called "pay for delete." Many collections agencies are willing to do it, although some are not. If they aren't willing to delete the entry, try to negotiate for it to be recorded as "paid in full" rather than settled. The distinction doesn't make any difference in your credit score, but it looks a little better to anyone who pulls your credit report.

Get your agreement to remove the entry in writing. If you talked to a representative from the collection agency on the phone, have them send you a written summary of the agreement so you have it for your records. Don't make any payments to them until you have this agreement. Check over the summary from the collections agency carefully and make sure it includes everything you agreed to. If it doesn't, call them back and get them to fix it.

Make all of your payments as agreed. When you make the final payment, call the collections agency and ask them to send you a written statement that the debt has been paid in full. Keep this statement in case you need to prove that you've satisfied your debt obligation.

Check your credit reports to make sure the entry has been removed. Go to annualcreditreport.com. Use this official government website to request free copies of your Equifax, Experian, and TransUnion credit reports. If the collections entry is still there, contact the collections agency and keep after them until it's removed. Check the other information on your credit report as well. If you see anything that's incorrect or looks unfamiliar, contact the bureau and dispute it. The process is free and might boost your credit score.

Comments

0 comment