views

X

Research source

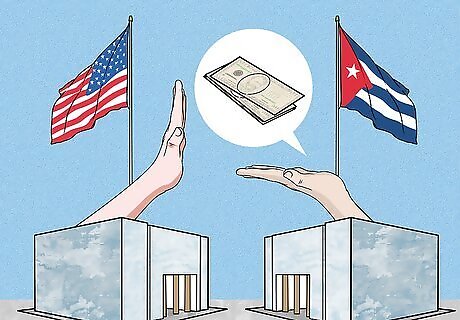

Below, we've provided answers to your most common questions about how to send money to Cuba.

Can I send money to Cuba through PayPal?

No, PayPal is not available in Cuba. As of March 2021, you can use PayPal to send money to individuals in more than 200 countries. Unfortunately, Cuba is not one of them. The same is true for any online or app-based money transfer service headquartered in the US, due to federal restrictions on direct financial transactions with Cuban entities. These services aren't available in Cuba at all, so it's not as though you can send money to someone in another country and they can send it to Cuba on your behalf. The person in Cuba wouldn't be able to access the app to get the money.

Does Western Union transfer money to Cuba?

No, as of March 2021, Western Union has suspended service to Cuba. The last opportunity to send money to Cuba through Western Union was November 22, 2020. The company is exploring other options to restore services but has no timeline for when you might be able to use the service to transfer money again, unless US restrictions are lifted. Unfortunately, Western Union has also closed its offices in Cuba, so you can't send money through someone in another country to get around US restrictions either.

Who can I send money to in Cuba?

As of March 2021, you can only send money to close relatives. But who qualifies as a close relative? According to the regulations, it includes anyone related to you by blood, marriage, or adoption who is not more than 3 generations removed from you. This means you can send money, generally, to parents, grandparents, siblings, aunts and uncles, or even first or second cousins. Even if someone is a close relative, however, you can't send money to them if they are a prohibited member of the Cuban Communist Party, a Cuban government official, or a close relative of a prohibited party member or government official.

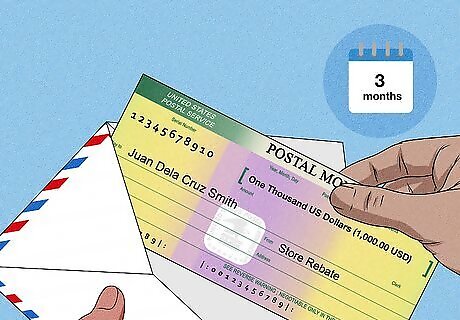

How much money can I send?

Transfers from the US are limited to $1,000 per consecutive 3-month period. This limit applies to each Cuban national you send money to. Even if your close relatives live in the same household, you can still send up to $1,000 to each of them without breaking the cap. For example, if your mother, brother, and sister all live in Cuba, you could send each of them $1,000 every 3 months.

How do I use online money transfer services?

Start by opening an account and linking your American bank account. Different money transfer services have different setup processes, but basically, you go to the website and click on the link to create a new account. Fill out information about yourself, including your name, address, phone number, and email address, to set up your account. Before you set up your account, check from the home page and make sure the service transfers money to Cuba—many don't, especially those based in the US. There's usually a link or drop-down menu on the home page that lists countries the service operates in.

What information do I need to send someone in Cuba money?

For most online services, all you need is their name and address. Some services also ask for the person's national identification number. Although this is optional, it can help you make sure the right person gets the money. While most services load the money directly onto the recipient's debit card, some may ask you to specify a location in Cuba where the person will pick up their funds. If you're not sure which location to choose, share the options with the person you're sending money to and let them pick the one that's most convenient for them. If you're trying to deposit money directly into the person's bank account, you'll need their bank account number.

Can Americans use Canadian money transfer services?

Yes, you can use a Canadian money transfer service as a US resident. Canadian money transfer services, such as EnvioDinero, send money to Cuba without government restriction. Once you create your account, you can use a major debit or credit card to make a payment to the service. The money is then loaded onto your recipient's AIS card, a Cuban national debit card that they can use at ATMs or for purchases. If the recipient does not yet have an AIS card, some services (including EnvioDinero) will automatically create one. Any money you send to the person after that would be loaded onto that card. Your transaction will be processed in Canadian dollars, not US dollars. Keep this in mind when you're looking at your card statement.

How can I use cryptocurrency to transfer funds?

Buy cryptocurrency and give the codes to the person in Cuba. There are cryptocurrency markets that are designed specifically as a workaround to US sanctions, but it isn't really necessary to use them. The nature of cryptocurrency is that anyone with the codes has access to the cryptocurrency, so all you would have to do is transfer the codes. The biggest problem with using cryptocurrency is internet access. Your recipient needs readily available WiFi to effectively use cryptocurrency, which isn't easy to come by in Cuba. It can also be difficult for people in Cuba to find places that will accept cryptocurrency for payment, so that can also be an issue. Only send cryptocurrency if the person you're sending it to is familiar with it and understands how it works.

Will my bank transfer money to a Cuban bank?

No, most US banks won't transfer money to a Cuban bank. Technically, US banks are not prohibited from initiating a money transfer to a Cuban bank. But as a practical matter, most of the services commonly used to facilitate bank transfers to Cuba are on the State Department's restricted list. Since US banks can't engage in direct financial transactions with any entity on the restricted list, the transfer can't be completed. If your bank is headquartered in another country, you might be able to make a transfer—but usually, you would have to have an account in that country first (not an American account). For example, if your bank is headquartered in Canada, and you can travel to Canada and open a bank account in Canada, you might be able to do a bank transfer from that account.

Can a Cuban national open a US bank account?

Yes, as of 2021, regulations allow Cuban nationals to open an account with a US bank. Even in Cuba, a Cuban national can go online or call a US bank and open a US bank account, subject to that bank's own internal regulations. This might be the easiest way to get money to Cuba because you could simply deposit money into the US bank account—but it assumes that a US bank would allow a Cuban national with a Cuban address to open an account. It also assumes that they would be able to access the account or use a debit card associated with the account in Cuba. Money deposited in this account is still subject to federal restrictions, meaning you can only deposit money in the account that's authorized under federal law or exempt from one of the prohibitions under federal law. Even in 2016, when the Obama Administration had lifted many of the US restrictions, most US banks did not validate their cards for use in Cuba.

Can I pay a Cuban family member's bills?

Yes, in some circumstances you might be able to pay their bills directly. Some service providers take payments from the US and other countries to pay the balance owed on a Cuban account. Find out what services your family members use and contact the company directly to see if this is possible. For example, the company Ding is offering Cubacel balance transfer promotions that allow you to send a recharge to a Cuban national's Cubacel phone. The person can then transfer that amount to other Cubacel numbers, allowing everyone to share that balance. They could also potentially sell the balance for cash in the private sector.

What happens if I violate US regulations?

Civil and criminal penalties for violations can add up to millions of dollars. If you're found in violation of the regulations, any money or property can be seized by the US government. In addition to that, you might face civil and criminal fines or even jail time. Financial institutions are generally required to report suspected violations to the Treasury Department.

Comments

0 comment