views

Spending Basics

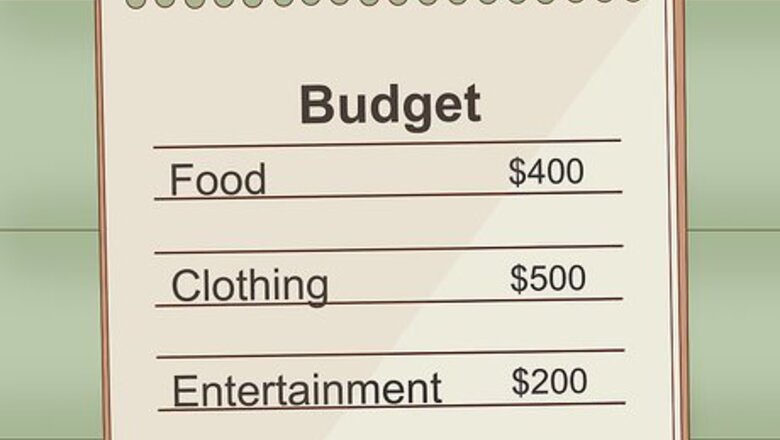

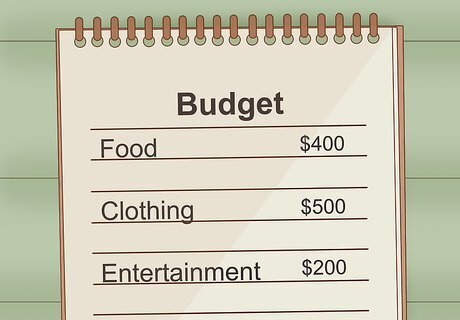

Create a budget. Track your spending and income to get an accurate picture of your financial situation. Save receipts or write down your purchases in a notebook as you make them. Review your bills each month and add those expenses to your budget. Organize your purchases by category (food, clothing, entertainment, etc.). Categories with the highest monthly amounts (or monthly amounts you consider surprisingly high) may be good targets for saving money. Once you've tracked your purchases for a while, create a monthly (or weekly) limit for each category. Make sure the total budget is smaller than your income for that period, with enough leftover for savings if possible.

Plan your purchases in advance. Making spur of the moment decisions can balloon your expenditures. Write down what you need to buy while you're calm and at home. Make a preliminary trip before you go on your real shopping trip. Note the prices of several alternatives at one or more stores. Return home without buying anything and decide which products to buy on your second, "real" expedition. The more focused you are and the less time you spend in the store, the less you'll spend. If you are motivated to treat each purchase as an important decision, you will make better decisions. Do not accept free samples or try something on just for fun. Even if you don't plan on purchasing it, the experience can convince you to make a decision now instead of considering it carefully in advance.

Avoid impulse purchases. If planning your purchases in advance is a good idea, buying something on the spur of the moment is a terrible one. Follow these tips to avoid making shopping decisions for the wrong reasons: Don't browse store windows or shop for fun. If you're only buying something because you find the act of shopping fun, you'll likely end up spending too much on stuff you don't need. Don't make purchasing decisions when your judgment is impaired. Alcohol, other drugs, or sleep deprivation can harm your ability to make sensible decisions. Even shopping while hungry or listening to loud can be a bad idea if you don't stick to your shopping list.

Shop alone. Children, friends who love shopping, or even just a friend whose tastes you respect can influence you to spend extra money. Do not take advice from store employees. If you need a question answered, politely listen to their response but ignore any advice on purchasing decisions. If they won't leave you alone, leave the store and return later to make your decision.

Pay in full and in cash. Credit and debit cards increase spending for two reasons: you have much more money available to spend than you normally would, and because no visible money is changing hands, it doesn't register as a "real" purchase. Similarly, running up a bar tab or using a delayed payment scheme makes it harder to realize how much you're actually spending. Don't bring more cash with you than you need. If you don't have the extra money, you can't spend it. Similarly, withdraw your weekly budget from an ATM once a week rather than filling up your wallet whenever you run out.

Don't be fooled by marketing. Outside influences are a huge factor affecting what we spend our money on. Be vigilant and try to be aware of all the reasons you're drawn to a product. Don't buy something on the basis of an advertisement. Whether on television or the product's packaging, treat ads with skepticism. They are designed to encourage you to spend money and will not provide an accurate portrayal of your options. Don't purchase something just because it's reduced price. Coupons and sales are great for products you were already planning to buy; purchasing something you don't need just because it's 50% off does not save money! Be aware of pricing tricks. Translate that "$1.99" price into "$2". Judge the price of an item on its own merits, not because it's a "better deal" than another option by the same company. (By making the "worse deal" atrocious value, someone can trick you into paying more for add-ons you don't need). Don't automatically buy the mid priced product within a category. Marketers know that if they want you to buy a high-priced product instead of a low-priced product, they can influence your decision by adding an outrageously expensive product to make the high-priced product intermediate in price and look reasonable in comparison.

Wait for sales and discounts. If you know you'll need a particular item but don't need it today, wait until it ends up in the bargain bin or try to find a coupon for it. Only use a coupon or take advantage of a discount for an item you absolutely need or decided to buy before the discount occurred. The attraction of a cheaper price is an easy way to get customers to buy something they don't need. Buy products only useful at particular times of year during the offseason. A winter coat should be cheap during summer weather.

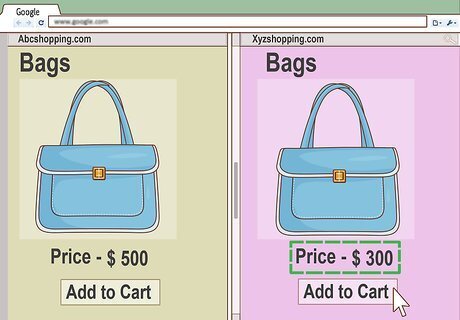

Do your research. Before making expensive purchases, go online or read consumer reports to find out how to get the most bang for the least buck. Find the product within your budget that will last longest and meet your needs best.

Take all the costs into account. You'll end up paying a lot more than the sticker price for many big-ticket items. Read all the fine print and add up the total amount before making your decision. Don't be fooled by lower monthly payments. Calculate the total amount you'll spend (monthly payments x number of months until fully paid) to find out what the cheapest option is. If you're taking out a loan, calculate how much total interest you'll have to pay.

Give yourself occasional, inexpensive treats. This may sound paradoxical (isn't this buying something you don't need?) but in fact, it's easier to maintain your spending goals if you give yourself the occasional reward. Try to go cold turkey on unnecessary spending and you may eventually "crack" and splurge much more than you should. Set aside a very limited amount of money in your budget for these treats. The goal is to give yourself a small reward to keep your spirits up and prevent a giant splurge later. If your usual methods of treating yourself are expensive, find cheaper alternatives. Take a bubble bath at home instead of going to the spa, or borrow a movie from the library instead of going to the theater.

Spending on Clothing

Only purchase what you actually need. Go through your closet and see what you already have. Sell or give away anything you don’t wear or that doesn’t fit so you have a better idea of your situation. Clearing out your closet is not an excuse to buy replacements. The goal is to find out what types of clothing you have enough of, and which you actually need more of.

Know when to spend more for quality. It's foolish to buy the priciest brand of socks, since socks wear out quickly. However, spending more money on a pair of higher quality, longer lasting shoes may save you money in the long run. Remember that price doesn't guarantee quality. Research what the longest lasting brands are rather than assume the most expensive option is best. Similarly, wait until the item you need goes on sale when possible. Remember not to use sales an excuse to purchase items you don't require.

Shop at thrift stores. Some secondhand clothing shops carry surprisingly high-quality items. At the very least, you should be able to purchase basic items for a fraction of brand new prices. Thrift stores in more affluent neighborhoods usually receive higher-quality donations.

If you can't find it in a thrift store, buy cheap, generic brands. A designer logo does not indicate a higher quality.

Spending on Food and Beverages

Compile a weekly menu and shopping list. Once you have an amount budgeted for food, write down in advance the exact meals you will eat and what you need to purchase at the grocery store to make them. This will not only prevent you from making impulse buys at the grocery store, but also prevent wasting money due to food waste, a major expenditure for many people. If you find yourself throwing away food, reduce the size of your planned meals.

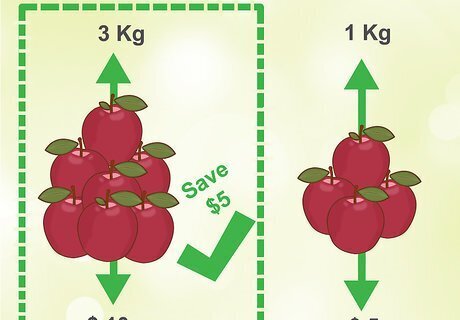

Learn tips for saving money on food. There are many ways to save money while grocery shopping, from buying food in bulk to knowing the times of day when various products are cheaper.

Minimize dining at restaurants. Eating out is much more expensive than preparing your own food, and should never be done as an impulse by someone who is trying to save money. If you're going out for drinks and usually have two drinks, have one at home. When you notice you're spending a lot on dating or going out, either limit yourself or cut back on other expenses (like cable TV). Pack a lunch at home instead and bring it with you to work or class. Fill a water bottle using your tap at home instead of buying expensive bottled water. Similarly, if you drink coffee frequently, buy a cheap French press and save money by preparing it at home.

Saving Cash Wisely

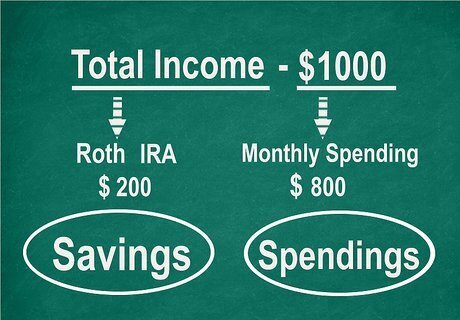

Save Money. Making wise spending decisions goes hand in hand with saving. Budget as much as you can each month toward a savings account or other reliable, interest-accumulating investment. The more money you save each month, the better your overall financial health will be. Which is pretty much the point of spending money wisely, isn't it? Here are some savings ideas for you to consider: Establish an emergency fund. Start a Roth IRA or a 401(k). Avoid unnecessary fees. Meal plan your meals for the week

Break free of expensive habits. Compulsive habits such as smoking, drinking, or gambling can easily consume any money you save. Eliminating them from your life is both a boon to your wallet and your health.

Don't buy what you don't need. If you're unsure about a particular purchase, ask yourself these questions. If you don't answer "yes" to all of them, that's a strong sign you shouldn't spend the money. Will I use this item regularly? Make sure you'll drink all that milk before it goes bad, or that you have enough summer months left to wear that skirt more than a couple times. Do I lack something that serves the same purpose? Beware specialized products whose role can be performed by basic items you already have. You probably don't need ultra-specialized kitchen equipment, or a special workout outfit when sweatpants and a T-shirt will work just as well. Will this item change my life for the better? This is a tricky question, but purchases that encourage "bad habits" or cause you to neglect important parts of your life should be avoided. Will I miss this item if I don't buy it? Will this item make me happy?

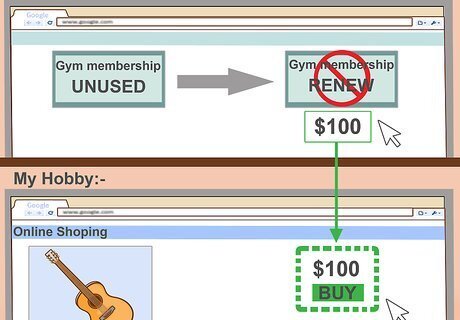

Prune your hobbies. If you have a gym membership and don’t use it, don’t renew it. Avid collector turned to lukewarm possessor? Sell it. Devote your finances and your energy only into areas you are truly passionate about.

Comments

0 comment