views

- Before you can start your ministry, refine your vision and write up a mission statement and bylaws. Assemble a board of directors and establish a structure for your ministry.

- Register and incorporate your organization. Get an EIN number, file for tax-exempt status, and choose an insurance policy to manage your ministry’s risks.

- Maintain transparency as your organization grows. Keep bylaws up to date and foster a safe space for staff and congregants to report any incidents of abuse or neglect.

Clarifying Your Ministry’s Purpose

Refine your idea. Before you can adopt a legal structure for your ministry, you must narrow down your concept to its most essential and specific parts. What precisely do you want your ministry to accomplish? What will it be called? Who will it help? Will you have a physical location, or be an online ministry? Do some research to find out if there any similar organizations doing the same thing already. What makes yours different and/or necessary? What can you learn from these other organizations? Create a schedule of goals you must accomplish to get your ministry off the ground. Dream big, but be realistic about the resources you currently have to invest in your ministry. Think about how much it’ll cost to run your ministry. Before establishing your ministry, try to save up enough money to run operations for at least 3 months. Common ministry expenses include: application and consulting fees purchase or rental of a building to host your ministry (plus utilities) payroll insurance equipment and supplies

Write up your ministry’s mission statement. Now that you’ve refined your idea, record your ministry’s goals and purpose in a mission statement. Clearly state your organization’s principles and intentions in a sentence or 2—shoot for no longer than a paragraph. If you plan to register as a nonprofit, as most ministries do, be sure to reference relevant Bible verses and address the charitable work you intend to perform. If your ministry is for a specific demographic—say, women, youth, children, or LGBTQ+ folks—identify this in your mission statement. Write a statement that addresses these 3 fundamental elements: The Cause (What is the issue? Who are you trying to help?) Your Actions (What do you do to help?) The Result (What impact does your organization's actions have on the cause?) Go for simple, accessible, and clear-cut over longwinded and jargony. Consider wikiHow's mission statement: "By creating the world’s most helpful instructions, we will empower every person on the planet to learn how to do anything."

Create your ministry’s bylaws. While the mission statement describes your ministry’s purpose and values, the bylaws explicitly address how your organization will carry out its mission. What is the structure of your ministry? How will you make decisions? Be sure to clearly define your bylaws, as there may be legal ramifications if they aren’t explicit enough or if your ministry doesn’t follow them. Bylaws commonly explain: how an organization’s leaders are selected and what power they have how those leaders make decisions, including financial decisions and decisions regarding hiring and firing employees when the organization’s leaders will meet and how meetings will be conducted what the relationship is between the board of directors and the ministry’s congregation Before putting your bylaws into effect, have a licensed attorney review them to make sure they make sense and that you can follow them consistently.

Assemble a board of directors. Identify and reach out to people you believe would bring something to the table. Gather people who share your ministry’s goals, but also try to assemble folks who have relevant experience—for instance, experience with law, finance, business, or social services. The number of people you'll need on your board will depend on what state your ministry is located in, but you'll need at least 3. At your first meeting, have your board read over your bylaws and mission statement, as well as your budget and schedule for establishing and running your ministry. Have someone in your meeting record the minutes. Be sure to do this at every meeting from here on out. Not only will it help you all to have a record of what happened in different meetings, but it’s important to have a legal record of what occurred in your meetings.

Establishing Your Ministry

Register and incorporate your organization. Choose a business structure for your ministry and file your articles of incorporation with your Secretary of State. The business structure you pick will determine how much you pay each tax season, what paperwork you must file, and your personal liability. Most ministries are nonprofits, otherwise known as 501(c)(3) corporations. If you file as a nonprofit, it’ll likely come with tax exemption status, since nonprofits benefit the public. You may also be eligible for grants and reduced mailing rates. Most businesses don’t need to register with the federal government, but you’ll likely have to register with any state(s) in which you’ll be conducting business activities—that is, any state where your business has a physical location and/or in-person meetings, obtains revenue, or has employees. You’ll need to register your ministry’s legal name when you submit your articles of incorporation. Use the IRS’s nonprofit search engine to make sure your ministry’s name is available.

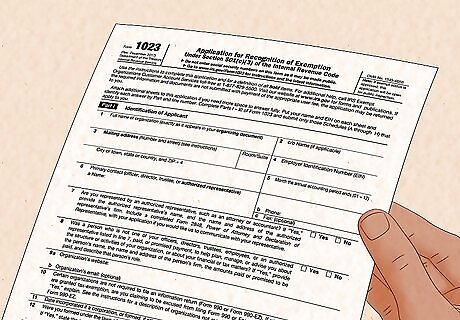

Apply for tax-exempt status. When you apply as a 501(c)(3), or a nonprofit, you’ll have the opportunity to apply for tax exemption status. The tax exemption application is IRS Form 1023. If your ministry is already part of an existing organization (such as a church), you might already have a 501(c)(3) with tax-exemption status.

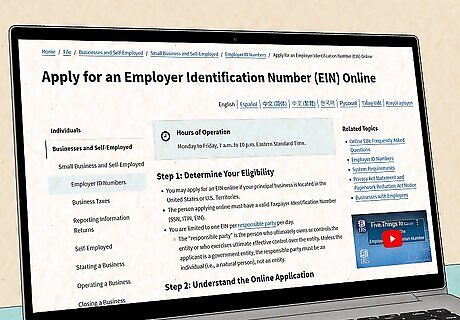

File for an EIN. After you’ve registered your business, you must obtain an EIN (Employer Identification Number). It’s free to apply, and you need it in order to pay taxes, hire employees, open a bank account for your ministry, and apply for business licenses or permits. You can apply for an EIN online via the IRS’s website. You can also apply by fax, phone, or email. Once you have an EIN, you can open a bank account, but be sure to get tax-exempt status first, as tax-exempt bank accounts have lower fees and may come with perks.

Secure an insurance agent. Choose an insurance agent who specializes in ministries, if possible, as standard agents’ policies may not cover the specific needs of your ministry. Opt for an independent agent, not a captive one: captive agents work with a specific insurance company and can therefore only offer you insurance from them, meaning your insurance options are limited; if you choose an independent agent, they’ll be able to offer you a multitude of insurance options. Ask your prospective agent for a list of client recommendations to help you make your decision. Also look the agent up online to find other customer reviews.

Choose an insurance policy. You’ll need to find a policy that ensures the bare minimum coverage that you need to obey the law. However, to be safe, consider getting property and liability coverage, commercial auto coverage for ministry-owned vehicles, workers’ compensation and employer’s liability coverage, umbrella coverage, and medical payments coverage. To figure out what sort of coverage you might need, evaluate your ministry’s assets and potential risks. What risks do your ministry’s grounds, equipment, or vehicles pose? The more risk you’re comfortable assuming, the less coverage you may need. Keep in mind that as your organization grows, you may need to readdress your coverage over the years as you incur more risk.

Hiring Employees for Your Ministry

Create an employee handbook. You’ll likely need to hire a few employees to help you run operations, but before you can do this, you must make sure all your ducks are in a row. Establish pay periods based on your state’s laws and select insurance policies for employees, and then record this info in an employee handbook, along with workplace policies and what obligations employees are expected to fulfill. Then you’re off to the races. Ask your accountant if you need to file with state or local tax agencies. Stay organized by using a chart to track payroll and taxes. Consider including employee incentives in your handbook to boost morale and retain employees for the long haul, such as stock options, wellness programs, flex time, corporate membership, and company events.

Have new employees fill out necessary tax forms. Once you’ve onboarded new hires, they’ll need to fill out certain tax documents, including Form I-9 and Form W-4. The I-9 verifies your employee’s eligibility to work in the United States, and the W-4 tells your organization how much of your employee’s wages to withhold for taxes each pay period. Be sure your employee fills out their I-9 within their first 3 days of employment. You’ll also have to fill out a W-2 for every employee each year and submit it to the IRS by January 31.

Adhere to the Fair Labor Standards Act. The Fair Labor Standards Act (FLSA) is a law that ensures businesses (including ministries) are paying minimum wage. It also governs overtime pay, the employment of minors, and other matters. To stay compliant with the law and to treat your employees well, be sure to adhere to the FLSA’s guidelines. You as an employer must follow the FLSA, and you must also display an official poster detailing FLSA guidelines and make it accessible to employees. The FLSA dictates the legal bare minimum requirements of managing employees, but if you want to make your staff feel valued and hopefully retain them for a long time, go above and beyond the bare minimum. For instance, the federal minimum wage is $7.25 an hour, but this isn't a living wage for most people.

Following Best Practices

Maintain transparency within your organization. Be open and transparent with your congregation about how your ministry operates. Encourage board members to ask questions at your meetings, and regularly review your organization’s finances with the board so everyone is on the same page. The bylaws you made when you began your ministry may change over time. This is normal! Just make sure an attorney reviews every amendment. Keep your bylaws current and transparent, and make sure everyone, from your board of directors to your staff to your congregants, are able to access and understand them. Everyone involved in your organization must know how authority is structured within the ministry and how financial decisions are made.

Report all income. Down the road, your ministry may expand and begin taking in income from non-ministry-related business ventures—for instance, you might add a coffee shop or a bookstore to your ministry. Ask your accountant if your ministry must pay Unrelated Income Business Tax for such income accrued. Your ministry’s side business venture may qualify for Unrelated Income Business Tax if it: is regularly carried on (for instance, a pop-up café during a church concert would be exempt, but an established bookstore in your ministry’s atrium would likely not be) is a trade or business doesn’t contribute to your ministry’s primary mission

Take steps to cultivate a safe environment. The larger your organization, the greater the potential for harm or abuse to slip through the cracks. Be sure to perform background checks on all incoming employees, and encourage them to report any incidents of abuse they witness or hear about. Moreover, work to foster an environment where staff and congregants, especially young people and children, feel comfortable coming forward about transgressions. Being transparent with staff and congregants includes making sure everyone knows how to report occurrences of abuse. Have all employees trained on what sorts of incidents need to be reported and how to go about reporting them. Different states have different laws pertaining to who is a mandated reporter for child abuse or neglect, elder abuse or neglect, abuse or neglect of the mentally or physically disabled, suicidal threats, or threats to the well-being of others. Review these guidelines by the Child Welfare Information Gateway for information on who (for instance, clergy) is a mandated reporter in your state. See the National Adult Protective Services Association’s guide to mandatory reporting for information on mandatory reporting laws in your state.

Comments

0 comment