views

Setting Up Your Cash Register

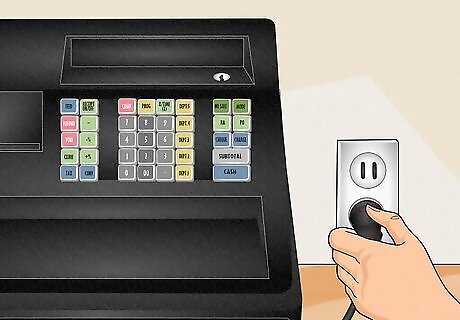

Set up your cash register and plug it in. Find a hard, flat surface to set your register on. Ideally, this will be on a countertop with room for customers to place their merchandise. Plug the register directly into an outlet (do not use an extension cord).

Install batteries. Batteries provide backup memory for the cash register in case of power failure and should be installed before you program any functions in the cash register. Take off the receipt paper cover and locate the battery compartment. You may need to use a small screwdriver to unscrew the lid to this area. Install the batteries according to the directions on the machine. Put the lid back on the battery compartment. Some battery compartments are located underneath the receipt paper area. Change batteries once per year to ensure that they will work properly.

Install the receipt paper. Take off the cover to the receipt paper compartment. Make sure the end of your paper roll has a straight edge so it will be fed easily into the paper feeder. Feed the paper roll through so that it will run up through the front of the register where you will be able to tear off receipts for customers. Press the FEED button so that the register will catch the receipt and feed it through.

Unlock the till drawer. The till drawer usually has a key that locks it up for safety. Do not lose this key. You can just leave the key in the drawer when it is unlocked so that it is easily found when you need to lock it up.

Turn the cash register on. Some cash registers have an ON/OFF switch on the back or side of the machine. Others may have a key on the front top of the machine. Turn on the machine, or turn the key to the REG (register) position. Newer registers may have a MODE button instead of a physical key. Press the MODE button to scroll into a REG or operational mode.

Program your register. Most registers have buttons that can be programmed to categorize similar items. These categories, or departments, can also be associated with taxable or non-taxable items. You can also set the date and time. The program function is usually accessed by either turning the key to PRG or P, or pressing the mode button to PROGRAM. Other registers may have a manual lever underneath the receipt tape cover that needs to be switched to a Program option. Many cash registers have at least 4 tax buttons. These can be programmed at different tax rates, depending on if you have a flat sales tax as some states in the U.S. do, or if you have other types of taxes, such as GST, PST, or VAT rates (depending on your location). Follow the specific instructions in your register's manual to program these functions.

Making a Sale

Enter a security code or password to use the register. Many registers will require that you enter a clerk number or other security code to use the register. Clerk numbers are useful so that each sale is attributed to a particular person. This is helpful in tracking sales and clearing up errors. If you work in a restaurant, you may need to enter your employee code along with the table number and number of customers. Newer cash registers (such as the Square cash register) may require that you log in with an email address and password.

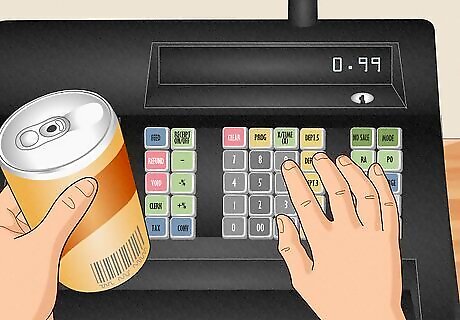

Key in the amount for the first item. Use the number keys to type in the exact amount of the item. Typically you do not need to add a decimal, as cash registers do this for you. Some registers will use a scanner, rather than asking you to manually enter in item prices. The scanner will read a barcode and enter the product's information automatically. If this is the case, you won't need to press the department button in the next step.

Hit the corresponding department button. Most registers require that you hit a button after the amount that assigns that item to a category of sale (for instance, clothing, food, etc.). Department keys can be programmed to be taxable or nontaxable. Consult your machine's manual for instructions on programming tax rates to correspond with keys. Looking at the receipt: press arrow or FEED key to have the register feed the receipt upwards so you can read what totals are being recorded on the receipt. Every item you add on will be added to a running total, which is usually displayed on the cash register reader or screen.

Add any necessary discounts to the price. If an item is on sale, you may need to enter in the percentage discount. Key in the price of the item, hit the department button, key in the discount percentage number (15 for 15% off, for example), and then press the % key. This key is usually in the bank of buttons to the left of the number pad.

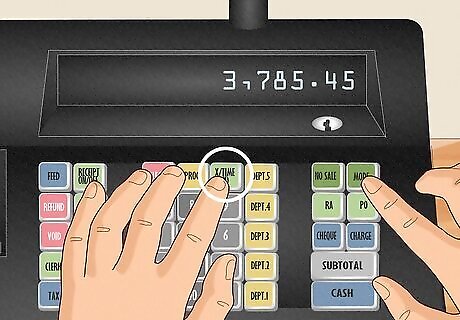

Key in amounts for the remaining items. Use the number keys to enter in the exact dollar amount for each remaining item. Be sure to press the corresponding department key after each item is entered. If you have multiple copies of the same item, press the number of items, then the QTY/X-TIME button, then the price of a single item, and then the department key. For example, if you have 2 books priced at R6.99, press 2, then QTY/X-TIME, then 699, then the department key.

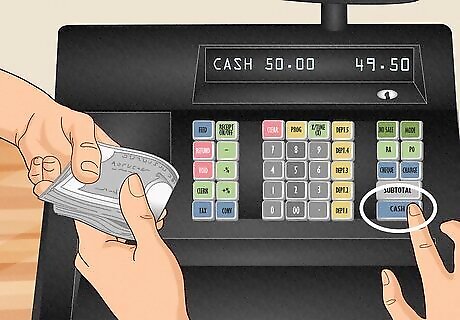

Hit the subtotal button. This button will give the total of the merchandise rung up. It will add any necessary tax that has been pre-programmed into the department buttons.

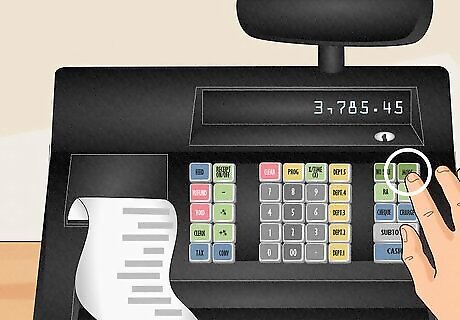

Determine how the customer is going to pay. Customers may pay in cash, with a credit card, or with a check. You may also accept gift cards or certificates, which are most often treated as cash. Cash: Type in amount of cash they give you and press CASH/AMT TND button (this is usually the largest wide button on the bottom right hand portion of the register's set of keys). Many registers will tell you how much change to give the customer. Some do not, however, and you will have to do the math in your head. Once the till drawer pops open, you can place the cash or check in the drawer and count out any necessary change. Credit card: Press CREDIT button (sometimes CR) and use credit card machine to run the credit card. Check: Key in the exact amount of the check, press the CK or CHECK button, and put the check in the drawer. To open the till drawer if you have not made a sale, you can press the NO SALE or NS button. This function may be protected for manager use only and may require that a manager uses a key to put the register in a different mode to access the NO SALE function.

Close the till drawer. Always close the cash drawer immediately after you use it so that it is not left hanging open. This could put you at risk for theft. Always empty out or remove the till drawer at the end of the business day and store it in a secure place.

Correcting Mistakes

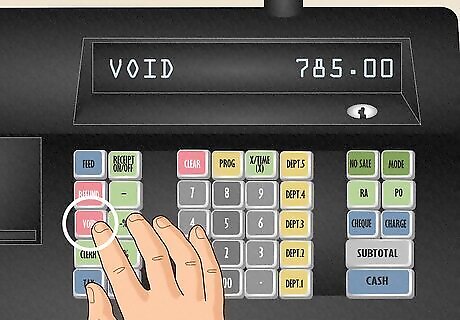

Void a sale. If you have mistakenly entered in the wrong price for an item, or a customer decides they do not want to purchase an item after you entered it in, you may need to void the item or sale. This will remove it from the subtotal. Type in an amount, press department key, press VOID (sometimes VD) button to remove it from the total. You must void an item before entering in a new item. Otherwise, you will need to subtotal the items, then press VOID, then press the exact amount you'd entered by mistake, and press the department key. This will subtract the incorrect amount from the subtotal. If you need to void the entire sale with multiple items, go through each item and void each one.

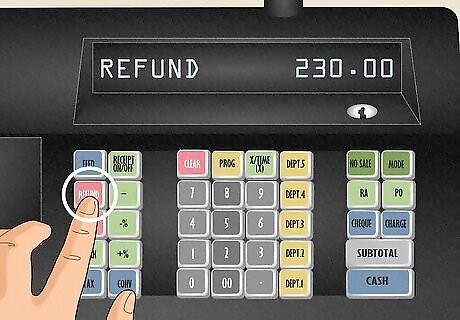

Refund a sale. If a customer wants to return an item, you need to account for that in the day's cash totals before handing back money to the customer. To refund a sale, press the REF key, type in the exact amount of the item, and press the corresponding department key. Hit the subtotal button and then hit the CASH/AMT TND button. The till drawer will open and you can issue a refund to the customer. Certain buttons and functions such as refunding money can be protected for manager use only. These might require that a manager uses a key to put the register in a different mode to use void or refund. Check with your supervisor regarding the correct policy for handling returns and refunds.

Stop the error sound. Some registers will beep or emit an error sound if keys are pressed in the wrong order or wrong combination. To stop the error sound, press the CLEAR or C key.

Clear numbers that were entered incorrectly. If you have pressed the wrong numbers and have not hit the department button yet, press the CLEAR or C key to clear the numbers you've entered. If you already hit the department button, you will need to void the transaction.

Running Sales Reports and Balancing the Register

Read running totals for the day. Some managers may want to check the sales totals periodically throughout the day. To read the running totals, turn the register key to X or press the mode button and scroll to the X option. Press the CASH/AMT TND button. Your daily sales totals thus far will print out on a receipt. It is important to remember that X will read running totals, while Z will reset the daily totals.

Run an end-of-day sales report. At minimum, this report will tell you the sales totals for the day. Many cash registers will also report hourly sales, sales by clerk number, sales by department, and other reports. To run these reports, press MODE key and scroll to the Z mode function or turn the key to Z to run report. Remember that running the Z report will reset the cash register's totals for the day.

Balance the cash register. After running the sales report for the day, count out the money in the cash drawer. If you have checks or credit card receipts, add these into the total. Most credit card processing machines will also run daily total sales reports, so that you can easily reconcile your daily sales totals. Subtract your overall total from the amount of money that you started with before your first transaction of the day. Put all your cash, credit card receipts and checks into a deposit bag and take them to the bank. Keep a written ledger of the currency, credit card transactions and checks. This will help with your overall accounting. Replace a base amount of money to the drawer for the start of the next business day. Be sure to store the money in a safe, secure location when your business is not open.

Comments

0 comment