views

X

Research source

Negotiating

Meet in person. If possible, meet face to face with your friend to discuss the loan, rather than relying on a phone conversation. Meeting in person allows you both to observe each other's body language and tone of voice as you discuss various aspects of the loan. If your friend lives far away from you, or a face-to-face agreement isn't possible for some other reason, discussing the matter over email is preferable to a phone conversation, because you have a written record of the negotiations. When you meet with your friend, take notes on the things you discuss so you have something you can refer to as you write up the agreement.

Discuss your friend's financial history and her needs. Before you agree to loan your friend money, make sure you understand why your friend needs the loan, and why she's asking you. Your friend should bring any relevant documents or information along with her, so you can get a sense both of her financial situation and the options available to her. Find out if she contacted banks or other traditional lenders seeking a loan for the same purpose. If she did, find out what she was offered and why. If none of the banks were willing to finance her, you might question why you should be willing to take that step. If you're going to loan money to a friend – whether it's $500 or $50,000 – you must have transparency. Getting information about your friend's finances and the purpose for the loan makes the process more objective and less personal. Consider how much you can afford to lend, and how it would affect you if your friend didn't pay you back. You shouldn't stretch yourself too thin simply to accommodate your friend's needs.

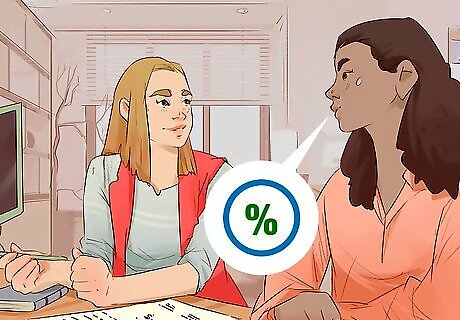

Set an interest rate. Not charging your friend interest on the loan could have tax consequences, depending on the amount you lend. To prove to the IRS that the money is a loan and not a gift, you must charge and collect interest as well as having a formal loan agreement in writing. If you don't charge interest, you run the risk that the IRS decides you've made a gift to your friend in the amount of interest you would have collected. This amount may be subject to the gift tax. You can charge a rate as low as the minimum applicable federal rate. If the loan will be paid back in less than three years, the minimum rate is 0.55 percent as of October 2015. You probably don't want to charge an exorbitant interest rate anyway, but if you're planning on charging over 10 percent, check your state law first. Most states have usury laws that set a limit on the amount of interest you can charge. In a few states such as Michigan, it may be as low as 7 percent – but typically it is between 10 and 20 percent. Also keep in mind that if you deposited the money you're lending to your friend in a savings account or certificate of deposit, you would earn interest on the money during the same time period. This means by lending interest-free, it's actually costing you money to lend the money to your friend – even if she pays it all back. Up to $14,000 in gifts can be excluded from gift tax, so if you're only loaning your friend a few hundred, or even a few thousand dollars, the gift tax shouldn't be any concern. However, if you're loaning your friend more than $10,000, charging at least the minimum interest rate is in everybody's best interest.

Decide on a repayment schedule. A solid understanding of your friend's financial situation will enable both of you to set up a reasonable payment plan that won't cause a strain. If your friend has had difficulty managing her money in the past, you might consider working with her to develop a budget she can use to control her spending and pay off the loan. You have several different repayment options you can evaluate before selecting the one that best fulfills everyone's needs. For example, many loans to friends simply require a single lump-sum payment of the entire amount borrowed, including interest if applicable, on a certain date in the future. You also may structure the repayment as installment payments on a weekly, monthly, or yearly basis for a set period of time, or lower installment payments coupled with a balloon payment at the end to the repayment term.

Iron out any other issues or conditions. When you make a loan agreement, you want to plan for as many possible outcomes as you can, so brainstorm issues that might come up with you're friend and come to an agreement on how that issue will be handled. For example, suppose your friend has five years to pay off the loan. For two years she pays on time as agreed; however, something comes up and you need the money immediately. Assuming she can't pay the balance of the loan in full, you might want to include a term in the loan that gives you the ability to essentially sell the obligation to someone else. You could then take out a loan for the money you need, which would be satisfied by collecting her payments. You should anticipate whether your friend would be able to transfer the loan as well. Suppose your friend becomes severely ill, and her mother offers to take over the payments for her? It probably wouldn't matter to you who was making the payments, as long as payments were being made, but such a contingency should be spelled out in your agreement. To keep the lines of communication open, you may want to set up a monthly or quarterly meeting just to chat about the loan and make sure everything is proceeding according to plan. If you agree to such an arrangement, put it in your written agreement. Especially if your friend has a history of financial trouble, you may want to include a clause in your agreement stating what will happen to the loan if your friend declares bankruptcy.

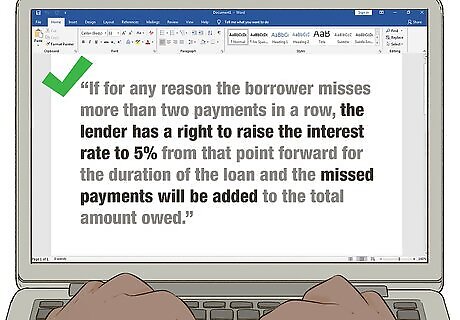

Talk about penalties for late payments. If your friend isn't able to make payments on time, you may want to include additional fees. Be sensitive to the fact that if your friend later has problems making payments, your personal relationship could deteriorate as a result. Having a system in place ahead of time for dealing with the possibility of nonpayment can alleviate some of that stress if issues arise. However, when deciding on penalties, don't insist on anything you don't believe you'd have the nerve to follow through with. For example, don't include the ability to sue your friend or garnish her wages if you don't believe you would ever actually do that. You might consider including a procedure by which the agreement can be modified if something happens to prevent your friend from making payments as agreed. For example, your friend might be out of work for several weeks because of an injury or illness. If you include loan modification as an option when your friend gets behind on payments, make sure you also set parameters for that process, including advance notice requirements if necessary. For example, if you have a late fee, the modification option may be available provided your friend tells you she needs her payment modified at least two weeks before the payment is due – otherwise the late fee still will be assessed. Keep in mind that if your friend does have problems making payments later on, the situation can become heated fairly quickly. Creating a plan from the outset when you're both relatively calm can help you avoid arguments that could happen later if your friend stops paying you and you panic.

Consider using a loan administration company. For a fee, you can set up your loan through an intermediary, which allows for automatic payments and credit reporting. Particularly if your friend is seeking a loan from you because she has a low credit score, using a third-party intermediary can benefit her by reporting her payment history to the credit bureaus. Even if you decide not to go with a loan administration company, your friend may be able to have her good payment history added to her credit report by sending a letter to the credit bureaus along with copies of any receipts and a copy of your written agreement.

Writing the Agreement

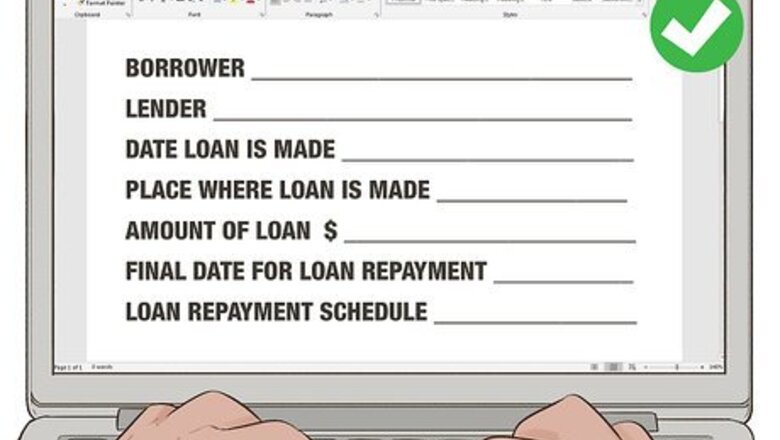

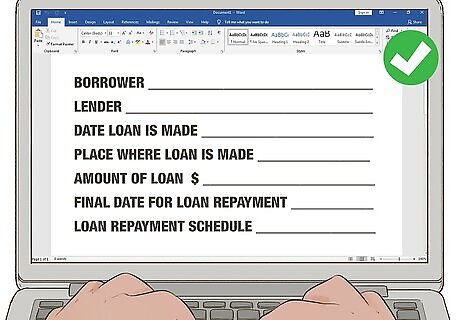

Search for forms. If you don't want to draft an agreement by yourself from scratch – or if you're afraid you'll leave something important out – you can search online for free contract templates. You also could use an old promissory note or finance agreement as a guide. For example, if you have the promissory note for your car, much of the finance terminology may be similar to what you need for your loan agreement. If you're drafting your agreement yourself, keep in mind that you don't have to use a lot of legalese or banking terminology for your agreement to be valid and enforceable. You can write it in plain language. If you're loaning a relatively small amount, your agreement doesn't need to be complicated. For example, if you're loaning your friend $400 for car repairs, and she plans to pay you back $100 a week for a month, you probably don't need to worry about extensive terms and conditions.

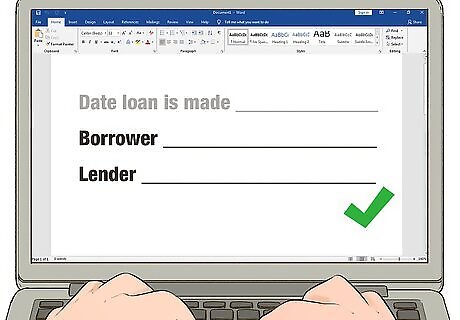

Date the agreement. Start drafting your agreement by putting the date at the top of the page. If you plan to give your friend the money at a later date, you might want to use that date as the date of the agreement itself, rather than the date you're writing it.

Identify the parties. Your agreement should include full legal names and contact information, as well as the role of each party. A full name and address serves to further identify each of you, which could avoid confusion or mistakes later on. You can provide an alternate identification for each party throughout the agreement, such as by saying "Jane Smith, hereinafter 'Lender'." However, if your agreement is short and relatively simple, you can feel free to simply stick to names and pronouns.

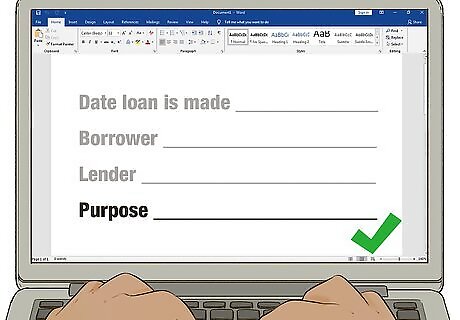

State the purpose for the loan. If your friend needs money for something specific, include that information from the outset. If the loan is conditional on your friend achieving the purpose you specified, you should state that up front in your agreement. For example, if your friend wants to borrow money so she can make a down payment on a new car, and you don't want to loan her the money if she isn't able to obtain financing, make it clear that if her deal with the car falls through, she must give you back the money – she can't spend it on anything else. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back. For tax purposes, you must include the interest rate, all terms and conditions, the length of the repayment period, and whether the loan (or debt) can be transferred to another party.

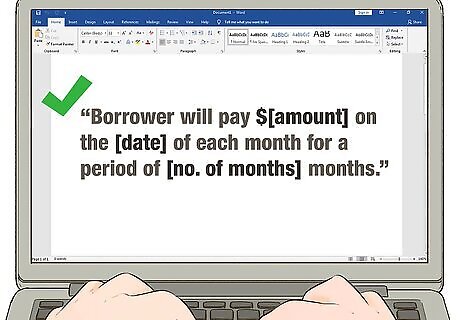

Include a repayment schedule. Make the schedule as specific as possible, with details such as precise dates, total number of payments, and length of the loan. If you're charging interest, you should include an amortization table for tax purposes. This table clearly shows the amount of principal and interest paid and the balance due each month for the entire loan period. If the payment will be made on the same date each month, this can be as simple as saying "Borrower will pay $100 on the third of each month for a period of 14 months." However, in some circumstances the payment schedule might be more complex, such as if the payments are tied to the dates your friend gets paid. If the schedule is more complex, you might consider including a calendar as an exhibit, with payment dates marked.

Set forth the consequences of nonpayment. Your agreement must provide methods for you to enforce the agreement if your friend makes late payments or defaults. Use the notes you made when you were negotiating with your friend to structure your agreement, and make sure you're not adding anything that you and your friend didn't discuss. If you agreed on a plan to modify payments, include the entire plan along with any notification requirements. If you're using a third-party intermediary to service the loan, identify that company in your conditions and disclose the fees you must pay to them and whether those fees are being added to the loan or paid separately.

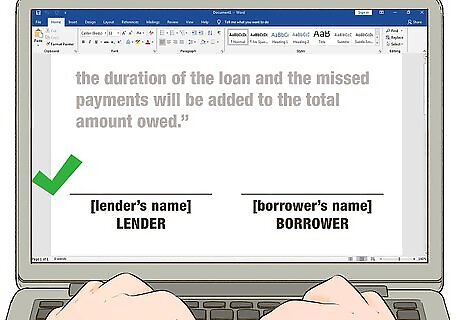

Write your closing. End your agreement with a sentence or two indicating that you both are bound by the agreement, and leave space for signatures. Type your name and your friend's names under blank lines, and indicate the roles of each person by adding "Lender" or "Borrower" after the appropriate name. You also might want to include contact information for each of you, such as street addresses, phone numbers, or email addresses.

Signing

Review the agreement with your friend. Both of you should read the agreement and make sure you have the same understanding of the terms. Once you've proofread your agreement and made any necessary changes, you're ready to print the agreement for both of you to sign.

Sign your agreement. To enhance your agreement's enforceability, you can sign it together in front of a notary public. Typically you can find a notary at your bank, the courthouse, or at many shipping companies such as UPS. If you don't know where to find a notary near you, visit an online directory such as http://www.notaryrotary.com/agent/find_a_notary.asp and perform a search. The notary will pay a small fee for his services, usually less than $10. Each state has a law that sets the maximum fees a notary can charge for various notarial services. Both you and your friend must sign the agreement for it to be legally binding. If you live far apart, this may mean you have to sign the agreement yourself, then mail it to your friend to sign. If you have to mail the agreement to your friend to sign, use certified mail returned receipt requested, or a private delivery service that will require a signature for acceptance of the document. After your friend has signed, make sure you get the original with both signatures back. To ensure this happens, you might consider including a postage-paid envelope. Regardless, don't send any money to your friend until you have the original contract back.

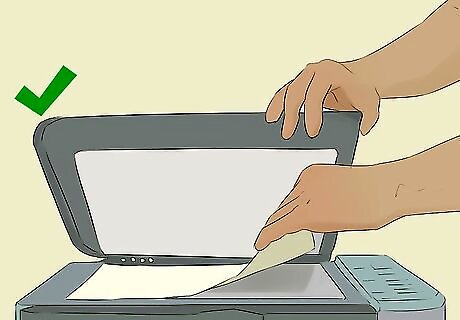

Make copies of the signed agreement. After you've both signed the agreement, make copies of the original agreement for each of you. In case of a disagreement or problems later on, the signed agreement protects both of you.

Consider having the agreement recorded. To make the agreement even more official, you can take it to your county recorder's office and have it recorded. If you have the document recorded at the county recorder's office, your agreement is protected in the event either or both of you happened to lose it.

Comments

0 comment