views

The government is battling COVID-19 as best as it can, plugging gaps as it fights a foe that is mutating and changing all the time. It is not as if the fight will be over soon. Every war saps resources and the government has to plan ahead for it too. While the total vaccination was budgeted at Rs 35,000 crore, several heads of expenditure have not been accounted for. Current expenditure is a given, but capital expenditure will soon be required as well to reboot the economy. Hence, new forms of revenue generation have to be identified. Without further taxing a population that is reeling or recovering from the second wave.

There are two kinds of expenditure, which are going to emerge in this fiscal—one is to repair the existing healthcare infrastructure in states, second is to provide stimulus or support to the organised and informal sector. Several industrial sectors will soon start making demands for relief and stimulus, especially the ones that have been ignored like tourism, hospitality and restaurants. The informal sector, which includes migrant workers, street vendors, construction workers and even farmers, will also need support over the next two years. As a result of the lockdown enforced during the first wave, some estimates suggest that up to 100 million informal workers lost their livelihoods. Several of them have not been able to find their way back into jobs even after the second wave. Those who have found their way back into cities have suffered from loss in income or wages as they are doing the same job for a smaller income.

As per a report by the Azim Premji University, “Due to the employment and income losses, the labour share of GDP fell by over 5 percentage points from 32.5% in the second quarter of 2019-20 to 27% in the second quarter of 2020-21. Of the decline in aggregate income, 90% was due to reduction in earnings, while 10% was due to loss of employment. This means that even though most workers were able to go back to work they had to settle for lower earnings.”

Where Will the Money Come from?

The budget for supporting these informal workers will not come from deficit funding; new options will have to be considered. Moreover, the state and Union governments will have to incur capital and operating expenditure towards improving their healthcare services infrastructure. Doctors, nurses and anesthesiologists are in short supply across government hospitals, especially in primary healthcare centres (PHC) and community healthcare centres (CHC) in rural districts. These centres are poorly staffed with zero equipment, and have been exposed as the Achilles’ heel of the public sector healthcare services.

Governments will have to create new ways of generating revenues and think of reforms that can help spur this investment. Every war has been funded through bonds; it is time India floated healthcare bonds. These should not be called COVID bonds as that will be perceived negatively by investors. Second, a subcategory—rural healthcare bonds—should be created where the funds are sent to state government health departments. Investment by banks in these bonds should be classified as priority sector lending (PSL) and repayment of interest on these bonds should be better than the Rural Infrastructure Development Fund (RIDF).

Citizens are willing to pay for healthcare services, shown by the success of the private sector. Government should charge a nominal amount for its services and not give it away as free. This is because anything given for free, even medical advice, is not taken seriously. Second, medicines, if charged, create a paper trail and set a base price that avoids pilferage and destruction. To protect the poor, these charges can be reimbursed under Ayushman Bharat. But the funds created in this manner can be used for repayment of the interest on healthcare bonds.

Dismal Record on Priority Sector Lending

The Venkatappaiah Committee, 1969, had said that the central bank should increasingly come forward to finance activities in rural areas. A study group (Gadgil Committee, 1969) had recommended the adoption of the ‘Area Approach’ for bridging the spatial and structural credit gaps. Based on these recommendations a ‘Lead Bank Scheme’ was adopted. Priority sector lending was formalised in 1972 with the recommendations of the Informal Study Group on Statistics relating to the advances to the priority sectors. Since then, there have been many committees—the Krishnaswamy Committee of 1980; the Sivaram Committee that helped set up NABARD; the Ghosh Committee in 1982 with its 20-point programme; the Narasimham Committee in 1991 that wanted to restrict PSL targets; the Rajagopalan Committee that wanted to restrict concessional credit only to the poorest of the poor. The second Narasimham Committee in 1998 pointed out that 47 per cent of NPAs came from priority sector lending and opened up the debt securitization route for banks to park their PSL funds. The Verma Committee, 1999, reduced the PSL target as a percentage of net bank credit by taking out FCNR (foreign currency non-resident) deposits. The Vyas Committee in 2004 and the C.S. Murthy Committee in 2005 exhorted the banks to meet their PSL targets. Many more committees after that have improved and changed the PSL’s working.

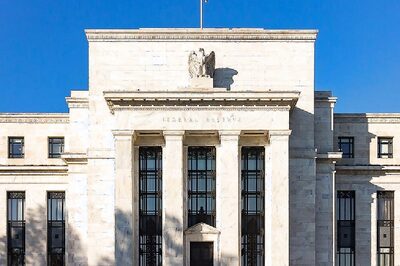

Priority sector lending over the years has become a drain on banks, adversely affecting their efficiency and utilization. Small borrowers have not benefited from this policy. It is time the Reserve Bank of India looks at other ways, including vertically differentiated banking licenses to direct credit to the needy sector. Forcing universal banks to lend to small borrowers does not work as these banks do not have the capability to handle the mandated low cost of lending and small loans.

Even small finance banks have failed to meet priority sector lending requirements; RBI is including their lending to the micro finance institutions as priority sector lending. This is sheer hypocrisy: instead of ensuring a serious implementation of PSL, the regulator allows banks the leeway to meet their priority sector lending targets under blatantly dubious heads. Since 1968, when the priority sector lending targets were instituted, not a single bank has been penalised for not meeting them. Instead they have been allowed to park their PSL funds in RIDF bonds or other instruments.

To direct credit to the agriculture sector, banks with expertise in agriculture are needed. These banks cannot be burdened with the requirements of branches. A physical rural branch network is a relic of the past in the current world of digital banking and mobiles. Similarly, entrepreneurs would like to lend to the healthcare sector and specialize in that sector. Currently, RBI does not allow the flexibility of specialization and creating a bank business model based on a vertical. This has now become the economy’s crying need—more important than ever. In the mid-term, a reform in the banking licenses allowing vertically differentiated banking licenses, and in the short-term healthcare bonds, will serve the immediate needs for expenditure in the healthcare sector.

Read all the Latest News, Breaking News and Coronavirus News here.

Comments

0 comment