views

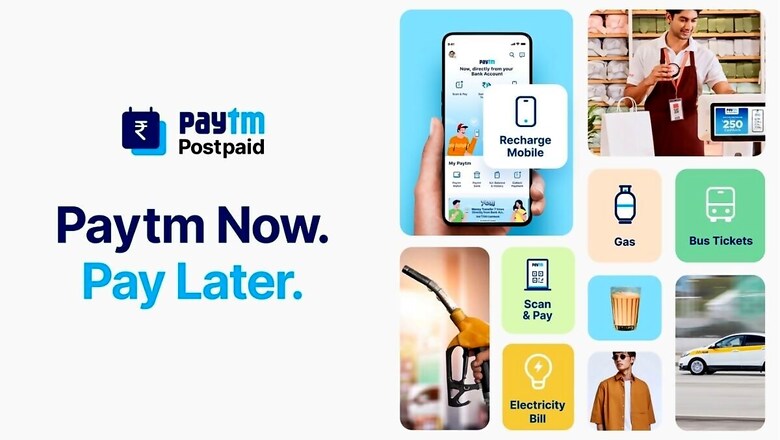

Paytm has announced the launch of Paytm Postpaid Mini, an extension of its Buy Now, Pay Later service. The company says that these “small ticket instant loans” would give customers flexibility and manage household expenses to maintain liquidity during the ongoing COVID-19 pandemic. The Paytm Postpaid Mini service has been launched in partnership with Aditya Birla Finance. The digital payments company is giving access to loans ranging from Rs 250 to Rs 1000, in addition to Paytm Postpaid’s instant credit of up to Rs 60,000. It is said to help users pay monthly bills such as mobile and DTH recharges, gas cylinder booking, electricity and water bills. Customers can also shop on Paytm Mall with Paytm Postpaid Mini.

In a blog post, Paytm explains that the Paytm Postpaid service is offering a period of up to 30-days for repayment of loans at 0 percent interest. There are no annual fees or activation charges, only a “minimal” convenience fee. Speaking more over the development, Bhavesh Gupta, CEO at Paytm Lending said that the company wants to help customers develop a “financial discipline” with their service. “Through Postpaid we are also making sincere attempts to help drive consumption in the economy. Our new Postpaid Mini service helps users manage their liquidity by clearing their bills or payments on time,” he said in the blog post.

Through Paytm Postpaid, users can pay at online and offline merchant stores across the country. The postpaid service is currently accepted at thousands of petrol pumps, neighbourhood Kirana stores or pharmacy shops, popular chain outlets (such Reliance Fresh and Apollo Pharmacy), internet apps (such as Myntra, Firstcry, Uber, Dominos, Ajio and Pharmeasy) and popular retail destinations (such as Shoppers Stop and Croma) among others. Paytm Postpaid is available in over 550 cities in India, the company notes.

Read all the Latest News, Breaking News and Coronavirus News here.

Comments

0 comment