A post shared by Hood Rich n wealthy (@hoodrichsuperstars)

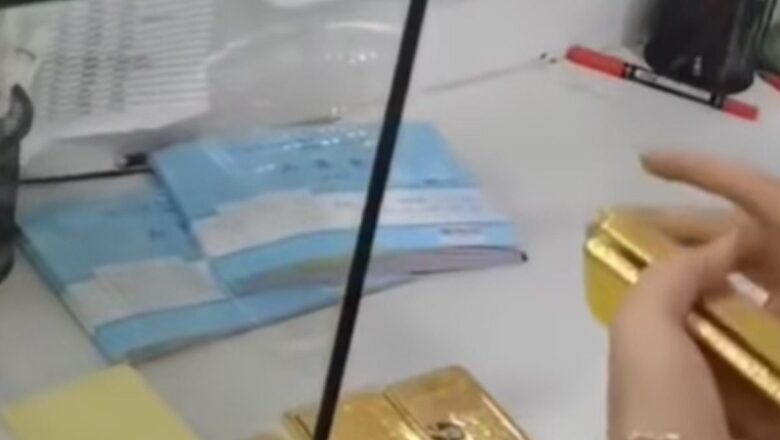

The golden spectacle not only caught the attention of the parties involved in the transaction but also left social media users stunned. Videos of the gold-laden buyer and his glistening bricks flooded the internet, sparking a frenzy of reactions from them.

One amused user took to social media to express their awe, saying, “To say you pay for your mansion with gold is a high flex. Man pulling out bricks like a rabbit in a hat.”

Another user, seemingly awestruck by the sheer magnitude of the gold involved, humorously questioned, “What is he buying, Shanghai?”

And then there was the voice of financial wisdom chiming in, stating, “That’s REAL money that never suffers from inflation.”

Now, you might find yourself pondering a timeless conundrum: Is it wiser to invest in gold or maintain a stash of cash? This age-old debate has haunted investors throughout history, and in today’s economic climate, it’s more captivating than ever. Think of your savings as an army of soldiers. Should you station them safely as cash reserves in banks, or should you lead them boldly into the golden battlefield, rife with risks and rewards?

The allure of investing in gold holds merit for many individuals. It serves as a shield for investors seeking to diversify and safeguard their assets during economic downturns. However, it’s crucial to recognise that choosing gold can impact your earnings differently than anticipated and may entail certain risks.

Before you leap into the golden fray, take a moment to weigh your options. If the prospect of investing in gold beckons you today, ensure that you comprehend how it seamlessly integrates into your overarching investment strategy and financial plan. Gold may be a precious asset, but like any investment, its role should align with your long-term goals and risk tolerance. So, whether you’re considering cash or gold, arm yourself with knowledge and make a strategic decision that suits your financial objectives.

Comments

0 comment