views

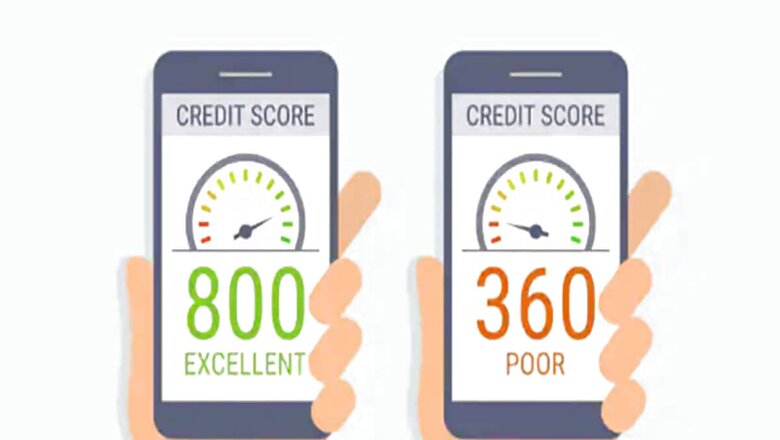

Your credit score is a numerical representation of your financial trustworthiness, influencing everything from loan approvals to interest rates. A good credit score opens doors to a world of financial opportunities, while a poor one can be a major hurdle.

Understanding how credit works and taking proactive steps to improve your score is crucial for financial well-being. This guide provides essential tips to help you build and maintain a strong credit profile in India.

Here are five tips to boost your credit score:

1. Pay Your Bills on Time:

Timely payment of your credit card bills, loan EMIs, and other dues is crucial for a good credit score. Late payments can have a significant negative impact on your score.

2. Keep Your Credit Utilisation Low:

Aim to use less than 30% of your available credit limit. High credit utilisation can indicate financial distress and lower your credit score.

3. Maintain a Mix of Credit:

A healthy mix of secured (like home loans) and unsecured credit (like credit cards) can positively impact your credit score. However, avoid taking on too much credit at once.

4. Avoid Multiple Loan/Credit Applications:

Every time you apply for a loan or a credit card, the lender checks your credit score, which results in a hard inquiry. Multiple hard inquiries in a short period can reduce your score.

5. Regularly Check Your Credit Report:

Review your credit report periodically to ensure there are no errors or unauthorised transactions. If you find any discrepancies, report them immediately to get them corrected.

Consistently following these practices will help you build and maintain a good credit score over time.

Comments

0 comment