views

New Delhi: As part of the many firsts on this Republic Day parade, the Income Tax Department of India had its tableau showcasing a common man's fight against black money bringing back memories of 8 November 2016, when Prime Minister Narendra Modi banned the previously circulated Rs 500 and Rs 1000 notes from the economy.

The parade which has traditionally been a display of the country's military might and cultural diversity took cognizance of the government's effort in flushing out non-taxed currency.

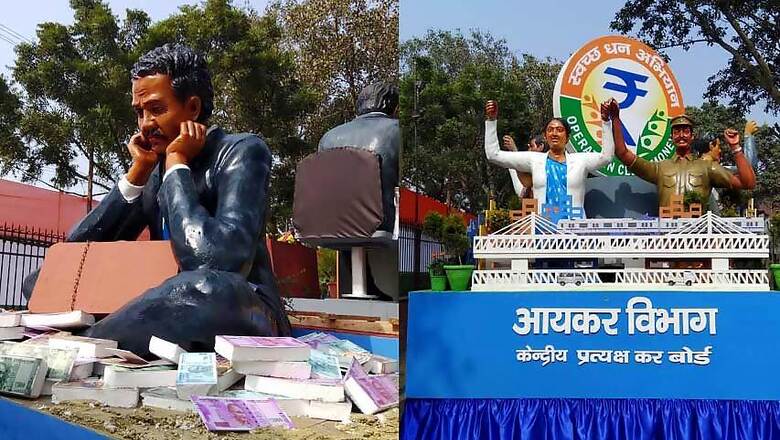

Showcasing a man sitting with a stash of cash, looking worried following by the Income Tax Department's float of operation clean money (OCM) recollected finance minister Arun Jaitley's Budget 2017 speech where he talked about "the need to infuse the habit of tax paying in the common mass of the nation."

The float depicted how clean money is required for the nation’s development and how it is important for the citizens to join hands in this ambitious drive. The words ‘OCM- Festival of Honesty’ were displayed on the float.

According to a brief on the tableau provided by the Income Tax department prior to the celebrations, "the tableau will showcase the collective support of the people of the country to the clean money drive while also depicting how unaccounted wealth brings stress and anxiety."

"The rear part of the tableau will showcase how income tax payment contributes to the nation-building process," said the brief.

The tableau also highlighted the "taxpayer-friendly approach" of the IT department for honest taxpayers.

Last Republic Day witnessed the tableau of the Goods and Services Tax (GST), touted as India’s biggest tax reform since Independence.

OCM was launched by the Centre and Central Board of Direct Tax (CBDT) in order to check black money generation and tax evasion.

The I-T department claims to have conducted 900 searches between November 9, 2016, and March 2017, leading to the seizure of assets worth Rs 900 crore including Rs 636 crore in cash. According to official sources, the searches had led to the disclosure of Rs 7,961 crore undisclosed income.

The government's efforts to associate tax-paying with a sense of pride for the nation is clear.

Comments

0 comment