views

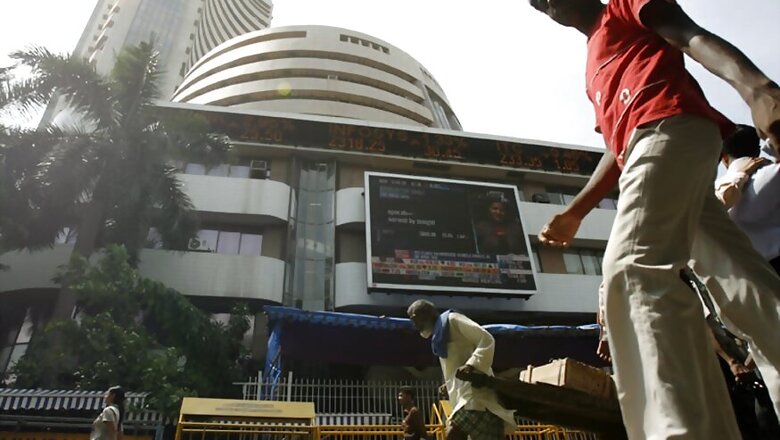

Mumbai: Investors went on bargain hunting on Monday that helped the benchmark Sensex stage a modest recovery at 27,117 at the close as hopes grew that the upcoming Budget on February 1 would contain steps that can ease the impact of the cash ban.

Market, which remained range-bound for the better part of the session, turned better towards the end after the Supreme Court dismissed a petition seeking postponement of the Union budget on the ground of forthcoming Assembly polls in 5 states.

Metal and mining stocks were in demand as base metal prices rose at the London Metal Exchange (LME) on expectations that demand might pick up as the US President Donald Trump reiterated plans to spend on infrastructure amid weakness in the dollar.

The 30-share Sensex moved both ways before settling at 27,117.34, up 82.84 points, or 0.31 percent. Intra-day, it moved between 26,963.58 and 27,167.79.

The gauge had lost 274.10 points in the previous session on Friday as investors tried to look for clarity from the initial days of the Trump administration.

The broad-based NSE Nifty recovered 42.15 points, or 0.50 percent, to 8,391.50 after hitting a high of 8,404.15 and a low of 8,327.20.

The optimism ensured banking stocks kept aside their asset quality worries while IT companies that were on the backfoot last week ahead of Trump's inaugural speech gave up the cautionary stance.

The rupee supported the recovery as it appreciated 17 paise to 68.01 intra-day against the dollar.

A mixed trend in Asia and a lower opening in Europe pulled back participants here as Trump's economic policy details gradually emerge, traders said.

The recently battered blue-chips turned attractive amid encouraging earnings by some companies.

In the metal space, Tata Steel, Hindalco, National Aluminium, JSW Steel, Jindal Steel, Hindustan Zinc, Vedanta Ltd and NMDC caught buyers' attention and climbed by upto 5.75 percent.

Foreign portfolio investors (FPIs) sold shares worth a net of Rs 26.34 crore last Friday, as per provisional data released by the stock exchanges. Domestic institutional investors (DIIs) also offloaded shares worth a net of Rs 175.48 crore on Friday.

GAIL surged the most, rising 2.41 per cent, followed by HDFC Ltd (1.77 per cent) and Tata Motors (1.72 percent).

Hero MotoCorp, Lupin, ITC Ltd, SBI, ONGC, TCS, HDFC Bank, Adani Ports, Maruti Suzuki and Power Grid ended in the green.

In the 30-share Sensex space, 19 ended in the positive zone while 11 led by ICICI Bank, L&T, Axis Bank, Sun Pharma, Dr Reddy's, RIL, Bharti Airtel, NTPC, M&M, Asian Paints and Cipla closed with losses.

Sectorally, the metal index gained the most by rising 2.61 per cent, followed by PSU (1.26 per cent), oil and gas (1.15 percent) and IT (0.63 percent).

The broader markets rose, with the mid-cap and small-cap indices ending higher by 0.48 per cent and 0.47 percent, respectively.

Indices in other Asian markets, including those in Shanghai, Hong Kong and Singapore, ended higher by up to 0.44 per cent while Japan's Nikkei declined 1.29 per cent. European market was trading in the negative zone in the early trade.

Comments

0 comment