views

Prejudice dies hard. In 1972, Manubhai Madhvani was arrested in Uganda for being of Indian origin and jailed in a dungeon nicknamed the "Singapore Block".

Dictator Idi Amin snatched all his wealth and expelled him from the country. To this day, the 79-year-old businessman counts himself lucky for not having been killed then.

It is events like this — and the all-too-familiar images of disease, poverty and squalor — that have shaped the stereotype of Africa in the minds of Indians. Somehow, we may have been a bit late to note when the continent began to change for the better.

In fact, Madhvani returned to Uganda in 1985 and rebuilt his family business in sugar and hospitality to a $200 million empire. Uganda, and many other African countries, reformed their economies and opened up to foreign investment.

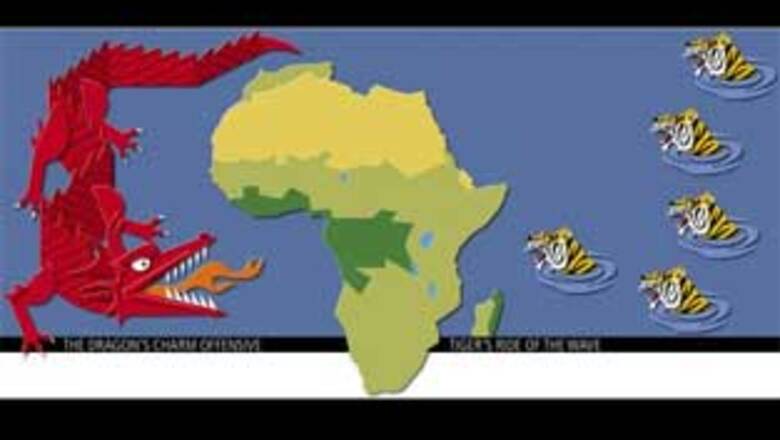

But before we responded to the new Africa, someone else did. In a well-planned and executed strategy, China has been thrusting itself in all spheres of economic activity in the continent.

The Chinese "invasion" of Africa is veritably the biggest state-run investment in the last decade. They are everywhere. State-run Chinese firms are building bridges, roads, telecom networks, airports, and generally boosting the infrastructure all around. In return, they are getting access to natural resources.

China is now Africa’s biggest trading partner, ahead of the US. More than a million Chinese workers are now based there. After the European colonists left Africa, the Chinese have been dubbed the "neo-colonists".

But recently, a new picture is emerging in our image of Africa. And happily, its tone is Indian. Unlike China’s push driven by its government, the Indian march to Africa has been led by the private sector.

After proving themselves in fields as varied as automobiles, telecom and education in recent years, Indian businesses are gradually upping the ante.

Big ticket investments and acquisitions are emerging. In other words, Africa has become the new frontier for Indian companies to break into.

Steadily, the profile and the scale of Indian investments in Africa is going up.

In early August, the Essar group bought a refinery in Mombasa, Kenya. Essar is no stranger there. Its $450 million investment in the country’s mobile telephony market is yielding results — Essar’s brand ‘Yu’ has 400,000 subscribers.

There’s considerable excitement around Bharti group’s on-going talks for a merger with MTN, Africa’s biggest telecom company, which could create the world’s third largest telecom company.

NIIT has grown to be one of the continent’s biggest firms in information technology training, having taught 150,000 students across 55 centres.

The Tata group, the Mahindras and Ashok Leyland have been selling vehicles for more than five years now with increasing success. Indica cars are a common sight in Johannesburg. Sales have moved up from 5,000 to 20,000 a year.

Consumer products company Marico is already in Egypt and South Africa through a carefully orchestrated strategy of buying out local hair care brands. This is just a snapshot of the 42-odd frontline firms from India that have answered the call to Africa.

PAGE_BREAK

Why Africa

What have all these companies sensed in the form of the African opportunity? When asked why Africa, Raman Dhawan, managing director of Tata Africa Holdings, asks why not.

"We are expecting Africa to grow substantially over the next two decades. We are here like any other international company. We are no different from the rest of the world.

They are looking at growth here, so why shouldn’t we? If you can be a good international company, you will find growth in Africa."

After decades of living on the fringes when the West dominated and Asia rose, the African continent is finally coming on its own.

"Since the early 1990s, African countries went through serious structural reforms, improvement of economic management, incentives to develop the private sector, important changes in governance legislation in doing business," says Jose Gijon, head of Africa and Middle East desk, OECD Development Centre.

One slice of the opportunity is a middle class numbering anywhere between 350 million and 500 million, larger than India’s. And per capita income is growing.

The continent clocked an impressive growth rate of 5.2 per cent in 2008. Of course, with recession and a crash in commodity prices, the growth may taper to 2 per cent.

But its trade links with China and India hold out hope that it could recover in tandem with these countries, says a recent article in the Harvard Business Review (HBR).

Besides, as Professor Vijay Mahajan of McCombs School of Business, The University of Texas at Austin and author of the book Africa Rising says, "When you look at (opportunities in) the world, and take out India and China, so where do you go next? The logical answer is Africa."

But it isn’t as if the risks have disappeared. In fact, sudden regime changes, violence and logistical nightmares continue to slow down businesses. But for the most part, it remains a high-risk, high return game.

"In Africa, any country depends on the leadership of the right person. Uganda, for instance, is becoming more open to foreign investment due to President Musevani who is all for an open economy and free trade," says Madhvani.

Today, the global economic crisis has opened up newer opportunities for Asian investors.

"Several big projects in Africa are on hold. Western investors are losing interest in some places," says Andrew Mold, senior economist and head of the Finance for Development Unit, OECD Development Centre. The Chinese and now, the Indian investors, are filling in that breach.

The one advantage Indians can push home is the presence of the diaspora. The ties are age-old. Madhvani’s family migrated to Uganda in 1893. There are several other business families — from the Mehtas to the ComCraft Group — that are particularly active in East Africa.

Keeping Up with the Chinese

As in everything else, the Chinese are playing a game of scale in Africa. The Indian surge may not yet match that.

While India put in $2 billion in the continent last year, the Chinese committed investments of about $8 billion dollars in 2009, according to the HBR article.

PAGE_BREAK

"For one, almost all of China’s investments tend to be state-led, while India’s investment is private," says Mold. Chinese leaders are also engaging with their African counterparts much more than the Indians do.

Indian businessmen agree that reducing the gap with the Chinese will be tough.

"We are nearly five to seven years late," admits Prashant Ruia, group CEO of Essar. Competing with the Chinese is impossible, to be honest. They are building roads, airports and projects as a grant. They are taking a 20 year investment risk — something private companies like us cannot do. We do not have the kind of backing that the Chinese have, they are present on a much larger scale too. They have had a head start and have been there for the past 10 years," adds Ruia.

This state-driven strategy to give infrastructure and take natural resources is the hallmark of China’s African policy. Take the $9-billion deal it struck in Congo.

China will build roads, rail networks, hospitals and schools in return for access to cobalt and copper. (It’s a different matter that the IMF has raised a red flag over Congo’s indebtedness from this deal and threatened to cancel its debt relief to that country.)

Indian businesses that have made a beachhead in South Africa and to an extent Nigeria, are still coming to grips with the rest of Africa. Indians are much more comfortable in the English speaking countries.

They have not yet fully ventured in the French or Portuguese speaking areas.

"But the Chinese do go everywhere – they don’t speak English. Yet they do business everywhere," says Somdeep Banerjee, head of Tata Steel KZN.

Apart from the first wave of companies, much of corporate India is still Africa-shy. The problem is of perceptions, and of lack of information," says Navdeep Suri, Indian consul-general in Johannesburg. "There’s a lot of opportunity, and we have nothing to fear but our ignorance."

It’s not that China’s progress has been without any problems. For instance, in Congo valley, Chinese state-run enterprises had reneged on significant deals to source copper from the mines in Kantago district, after their prices fell.

China has been accused of propping up dictatorships and other repressive regimes with direct military aid and favours.

That has generated considerable ill-will and wariness towards China across Africa. Already, China’s growing presence in Zambia has met with internal resistance.

India is doing better.

"The Indian companies here, from Tata to Mahindra & Mahindra, are doing a phenomenally good job," says Martyn Davies, CEO of South African research group Frontier Advisory and director of the Asia Business Centre at the Gordon Institute of Business Science in Johannesburg.

"They are extremely well accepted in South Africa, running very, very good business. And this is FDI that is welcomed by almost all African countries."

It’s the same story with Indian managers, who are usually at ease with Africans in those clubs where local managers hang out. Indian managers talk to local African managers in ways the Chinese never do.

PAGE_BREAK

Rules of the Game

More than a century ago, Mohandas Gandhi find his calling there and today, many Indian companies find South Africa the perfect gateway to the rest of the continent. The Tatas are present in 11 countries, but the biggest presence is in South Africa.

The Tatas plan a presence in all of Africa, and with all of Tata. Tata investments in Africa are closing in on the half billion dollar mark. The Tatas plan on taking that close to a billion dollars over the next few years, basing themselves in South Africa.

"We do feel that the benchmark will be South Africa for the whole of Africa," says Dhawan. "We can reach the continent much better if we are established in South Africa."

Tatas are also learning the rules of the game along the way. Banerjee of Tata Steel KZN, while trying to set up a ferrochrome plant, realised that environment is a big concern in South Africa, unlike other countries.

The company had to wait for three years to get environmental clearance. Tatas won’t miss this nuance again, he says.

There are other nuances that Indian companies must understand. "In South Africa if you want to expand and do well, you need to have ‘empowerment partners’. The government is ensuring that there are reservations and the black community get jobs now. In mineral resources development… they have to have an equity stake in your business. This might become a norm in manufacturing as well. We have known this for a long time. Zimbabwe and Namibia also have similar laws,"

says Banerjee.

Venturing into a new country requires local knowledge. And NIIT chose to work with local partners in all the eight countries that it operates in.

"This way we will have more access points — somebody who has been in the country, knows the job and skills requirements, and also knows the student’s capabilities," says G. Raghavan, president of global individual learnings solutions at NIIT.

Rather than run smack into Chinese competition in Africa, one tactic to tap Africa is to go to countries where China isn’t as active. That’s what the Essar group did. It focussed on East Africa. It figured that the region was largely English speaking and had lower political risks.

Yet even that proved to be a tough ask. It took Essar Oil nearly two and a half years to negotiate and get a 50 per cent stake in the Mombasa refinery where a set of investors led by Shell were offloading (the other half was owned by the Kenyan government).

In the middle of its negotiations with Kenya, Essar discovered an MoU between the Kenyan and Libyan governments that called for preference to Libyan companies. When the Libyans made an offer for the same stake, Essar was almost out of the reckoning. Essar even tried for a deal with the Libyans but did not succeed.

Only when the Libyans eventually pulled out for their own reasons, did Essar get back in the reckoning. "The feeling was earlier that the Indians have come as opportunists, to take away resources. The Kenyan government had to be convinced that we aren’t traders, but long-term investors," says a senior executive with knowledge of the talks.

PAGE_BREAK

The Healing Opportunity

A bigger Indian presence is in the Africa no one wants to know, the Africa one dreads.

The scourge of HIV is widespread and it is the cheap antiretroviral drugs from Indian companies that are the mainstay of treatment in most parts.

"Sub-Saharan Africa accounts for 10 per cent of the world population but has 75 per cent of the HIV burden," says Skhumbuzo Ngozwana, chairman of South Africa’s National Association of Pharmaceuticals Manufacturers.

The number of people in need of immediate treatment in Sub-Saharan Africa is four million, he says.

While Indian generic drugs are far cheaper than their branded counterparts, many African countries still don’t find them affordable enough. South Africa is rolling out a $500 million plan to provide antiretrovirals to everyone who needs it. Such plans depend on international aid.

And that means business for Indian companies of the likes of Cipla, Ranbaxy, Aurobindo and Dr Reddy’s.

The companies need approval principally by the US Food and Drugs Administration (FDA) or the World Health Organization (WHO). And that comes with its own challenges. Ranbaxy is fighting FDA charges that it falsified vital data.

Aurobindo has gone to court in South Africa over a contract given to another firm when it had offered the lower tender. And many Indian companies have had to fight allegations over sub-standard medicine.

"India is probably where Japan was in the 1960s and 70s, trying to establish itself in the global marketplace," says Vikash Salig, South Africa CEO at Dr. Reddy’s Labs (Pty) Ltd.

"And sadly one of the strategies that we find emanates from vested interests and to some extent from innovator companies is to place concern around quality, safety and efficacy of generic products. And given the momentum India has created, they seem to be facing the brunt of it."

Indian companies produce precisely what Africa needs. "The generic penetration in South Africa is far, far too low," says Salig. "The cost of private healthcare is increasing at a rate that is becoming more and more unaffordable. India offers a wonderful base of high quality low-cost manufacturing operations. The ability to collaborate with a powerhouse like India can only help us in South Africa."

Despite the controversies, Indian companies have managed to build trust in the market.

"If you look at the whole of Indian pharma, the Ciplas of this world, Aurobindo, Matrix, they supply a lot of the treatment programmes on the continent. There is a growing acceptance that drugs from India are of very good quality, they are efficacious, they are safe, and of course they are affordable," says Ngozwana.

Harry Broadman, managing director of Albright Stonebridge Group and the author of Africa’s Silk Road reckons the way India invests in Sub-Saharan Africa is the same as its approach in other parts of the world.

"India’s engagement in Africa is not a political engagement but there’s a role to be played in trade, investment and finance. India’s comparative advantage in Sub-Saharan Africa has been very under-stated. Many people have focussed excessively on China," he says.

Two different countries, two different strategies. One is trying to impress with state-sponsored might, giving away goodies and walking away with plum deals.

The other is sending its private citizens to build trust, radiate through the people and build long-lasting businesses. The battle is intense, the stakes high. The result is in the hands of the African people. At last, power to Africa.

(By Sanjay Suri in South Africa and Neelima Mahajan-Bansal in New Delhi with inputs from Cuckoo Paul, T Surendar and Prince Mathews Thomas)

Comments

0 comment