views

- Purchasing an ATM is a high cost upfront that pays for itself over time. Leasing an ATM is less expensive upfront but brings in smaller profits.

- Purchase a machine that meets your needs from a reputable retailer. You’ll also need insurance, a business checking account, and an ATM processor.

- Register your ATM as a business entity and invest in branding if you wish to expand into a multi-ATM business.

How profitable is an ATM?

On average, a single ATM generates about $540 per month. ATM profits come from the surcharge fees that users pay to make withdrawals at the machine. The average surcharge is $3 and the average number of transactions per machine per month is 180. Assuming you receive 100% of the fees, this comes out to $6,480 per year. The exact profit depends on the dollar amount of the surcharge fee, the percentage of the fee you get to keep, and the number of withdrawals.

Owning is more profitable than leasing in the long run. When you purchase an ATM, you’re on the hook for the cost of the machine itself, plus installation, maintenance, and repairs. This makes for big out-of-pocket expenses, especially upfront. However, you get to keep all of the surcharge fees. Assuming your ATM gets an average number of visits, it will pay for itself after just a few months. Leasing reduces the cost upfront—many companies will transport and install the machine cheaply or for free. They'll handle maintenance and repairs, too. When you lease, you split the surcharge fees with the service company. Depending on your ATM traffic, this could reduce your long-term profits. If you don’t mind handling maintenance, buy an ATM for bigger income. Lease if you want to take a hands-off approach for a smaller income.

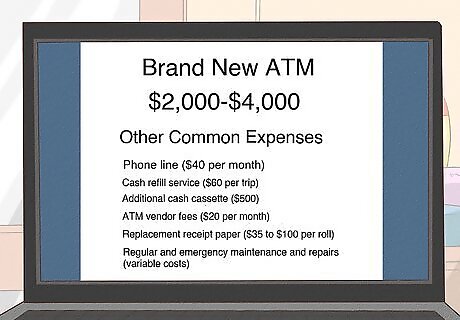

What does it cost to own and maintain an ATM?

An ATM costs a few hundred dollars per month, plus the purchase cost. Most new ATMs cost between $2,000 and $4,000 to buy upfront, but the exact price may be lower or higher depending on the model and whether it’s used. On top of that, there are regular maintenance tasks an ATM owner is financially responsible for. Here are estimates for the most common expenses: Dedicated phone line for dial-up machines ($40 per month). Cash refill service ($60 per trip). Additional cash cassette to hold more bills (up to $500 for a one-time purchase). ATM vendor fees ($20 per month). Replacement receipt paper ($35 to $100 per roll). Regular and emergency maintenance and repairs (variable costs).

If you’re a small business owner, an ATM may be worth the expenses. After weighing the potential profits and costs of an ATM, consider how it would impact the day-to-day functioning of your business. If you’re cash-only, for example, an ATM would bring you surcharge fee income and facilitate more purchases from customers. Here are a few more signs that an ATM could benefit your business: You regularly have customers that ask where the nearest ATM is. Hundreds of people walk by your business and could easily see an ATM or sign. Your business makes lots of credit card transactions for small amounts.

What kind of ATM should I purchase?

Buy an ATM within your budget that fits in your desired location. New machines are typically between $2,000 and $4,000, but can go as high as $10,000 depending on how many features it offers. Consider a used or refurbished machine to save some money—they cost as little as $500 to $1,200 but might lack the modern security features of new ATMs. The main machine types are freestanding, countertop, and through-the-wall (TTW) machines: Freestanding machines ($3,500-7,000): Purchase for gas stations, drug stores, or restaurants with floor space for the machine plus a customer. Countertop machines: Choose one of these if you don't have floor space for a freestanding ATM (they're less expensive, too). Through-the-wall (TTW) machines ($5,000 to $10,000): These cost more since they require construction to install. Opt for one if you have heavy after-hours foot traffic. They're more prone to theft and weather damage.

Consider a wireless machine, safety features, and other options. ATMs need to connect to the internet to process transactions. If you have high speed internet and WiFi at your business or desired location, buy a wireless machine. Transactions will be faster and you’ll have more flexibility with where you place it compared to older dial-up machines, which need a dedicated landline to function. If your ATM is going outside or in a rough area, consider extra user safety features like mirrors, covered keypads, or video surveillance. A simple withdrawal-only machine could be perfect for small businesses. Consider machines with additional user options like adding money to a card or checking account balances.

Buying Your First ATM

Buy a machine from a reputable local retailer that fits your needs. Consider a company’s location, reputation, and product offerings. Choose a retailer that’s based or has personnel in your geographic area and can get to you quickly for repairs. Look at their Better Business Bureau rating and ask others in your field whether they’d recommend that company or not. Select a company that offers insurance and a simple, fair agreement or contract in addition to fair pricing and competitive features. Some prominent ATM sellers include ATM Money Machine, ATM Brokerage, Mobile Money, and ATM Mega Store.

Install your ATM in a high-traffic location to get the most transactions. If you’re purchasing a machine for your business, place it near an entryway, cash register, or restroom to grab attention. If you’re purchasing an ATM independently, negotiate a contract with a convenience store or drug store location (these are the most popular spots for ATMs). Other popular locations could be gas stations, clubs and bars, hotels, office buildings, and cash-only businesses. Consider wiring needs, accessibility, outlets, and door clearance when choosing the exact spot where your ATM will stand. Test your location for 3 months and relocate the ATM if its performance is low. If you’re placing an ATM at another business, be upfront about your intentions and keep your initial contract flexible in case the location isn’t profitable. Most ATM retailers will install the ATM for you (for free or for a cost, depending on your agreement). Self-installation isn't recommended unless you have training as an ATM technician.

Connect your machine to an ATM processor. Processors facilitate transactions between the ATM and payment networks. Some also provide other services like repairs, software updates, and cash refills. Consider pricing, support, and services offered before settling on a processor. Choose a full-service processor that offers installation, maintenance, and refills if you prefer a one-stop-shop for all your ATM needs. Some processors take a cut of your surcharge fees for their services, while others do not. Reputable ATM processors include Prineta, ATMs America, ATM Depot, and Cord Financial. Payment networks are associations of member banks that facilitate transactions between merchants and issuers (for example, VISA, Mastercard, or NYCE).

Open a business checking account to receive the surcharge fees. Opening an account for an ATM business is a rigorous process—independent ATM ownership is viewed as a possible risk for money laundering, so prepare to be highly scrutinized by the bank you apply to. Consult a legal advisor about federal, state, and local regulations surrounding ATM ownership, such as the federal Regulation E or the Bank Secrecy Act. The Bank Secrecy Act (BSA) requires banks to monitor your ATM account activity to identify and halt suspected money laundering acts.

Get ATM insurance to protect your expensive equipment and cash. ATM insurance covers damage to the machine and loss of the cash inside due to theft, malfunctions, and other causes. Reach out to companies directly for pricing, since few list their rates on their websites. Some prominent ATM insurance providers include American Special Risk, Marshall & Sterling, and Marsh. Additionally, consider general liability coverage for your ATM. It runs up to $700 per year for $1 million in coverage.

Update your business listing or website to show you host an ATM. Mention your ATM on your website and edit your Google Business Profile to take advantage of searches like “ATM near me.” With an up-to-date listing, you can potentially increase traffic to your ATM (and raise your profits).

Expanding Your ATM Business

Form a legal business entity and brand. Decide on a name for your business—you can use your own name or create an original one. Then register your business name and entity with your state to ensure you follow the proper legal and tax obligations of an ATM business. Consult a legal expert for assistance, especially if you’re forming a corporation or starting an LLC. Invest in an original logo and website to identify your business. Branding will help third party businesses recognize and reach out to you to install machines at their locations.

Purchase additional machines to grow your business. Buy machines one by one to gradually expand, or purchase an existing network of ATMs (a route). Research routes with good locations that turn a profit—online business listings will provide the price, income, and other metrics to help you determine whether you want to make the purchase or not. Some platforms offering ATM routes for sale include Bizbuysell, Dealstream, ATM Brokerage, and Vending Connection.

Hire a cash refill company to load up your machines for you. Refilling the ATM is the most labor-intensive aspect of ownership—servicing 1 or 2 machines in safe locations is not very draining, but if you expand your business, it will become a harder task. Thankfully there are plenty of companies that will do this for you, from ATM processors or retailers to armored truck services. Most independent ATM operators refill their machine once a week. The frequency depends on the machine’s capacity and the number of withdrawals. Hiring a refill service also eliminates the safety risk that’s posed when you’re transporting large quantities of cash yourself. The cost depends on your purchase or leasing agreement, but often outweighs the burden of doing it yourself.

Comments

0 comment