views

X

Research source

Calculating your APR on your credit cards takes only a few minutes if you know some key factors and a little algebra. The APR on mortgage loans, however, is different from the simple interest rate because of additional charges or fees to you for securing your loan. Learn how to do both here.

APR Basics

Understand that it costs money to borrow money. If you're using a credit card or taking out a mortgage on a home, you may need to use more money than you currently have. If you're given credit, the lenders who give you that credit expect you to pay the premium back, in addition to a finance charge for the luxury of being given money. This finance charge is called APR.

Compare different APRs based on the total loan, interest, and finance charges. The following graph should help you compare different APRs. Use this information as a guidepost when shopping for a mortgage. However, you should always use an online APR calculator to check your exact APR before signing on a loan. The directions to do so follow this graph. Note how,in most cases, the APR is almost identical to the interest rate, but changes depending on the amount of finance charges. This difference is why you must compare APR when shopping for a loan. APR For Different Loans and How it Affects Total Cost Total Loan Interest Finance Charges APR Total Amount Paid $100,000 3.50% $1,000 3.5804% $163,272.65 $100,000 3.75% $1,500 3.8720% $169,222.44 $100,000 4.00% $5,000 4.4089% $180,462.98 $100,000 5.00% $10,000 5.8612% $212,581.36

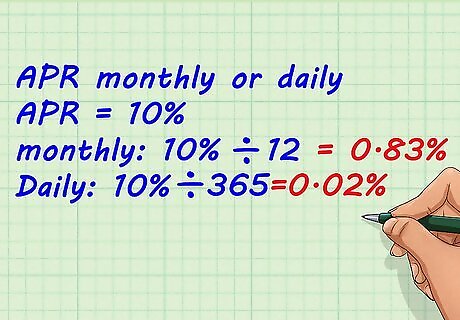

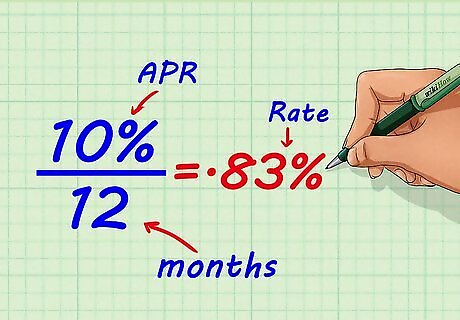

Know that APR can be broken down into monthly or daily interest payments. APR is the annual rate you pay on credit or loans. For example, if you take a $1,000 loan, and your APR is 10%, at the end of the year you'll owe $100 (10%) of your $1,000 premium. If you want to know the monthly periodic rate, just divide your APR by twelve, 10 % 12 = .83 % {\displaystyle {\frac {10\%}{12}}=.83\%} {\frac {10\%}{12}}=.83\%, to find out what your APR is for every month. You can also divide it by 365 to find you daily APR. Different banks will calculate APR over different times, and this affects how much they charge you. Note how a yearly APR is higher than monthly or daily, but is ultimately cheaper: Monthly, Yearly, and Daily APR and the Effect on Total Cost for a $100,000 Loan Compound Type Interest Finance Charges APR Total Amount Paid Yearly 4.00% $5,000 8.1021% $110,412.17 Monthly 4.00% $5,000 7.8888% $110,512.24 Daily 4.00% $5,000 7.8704% $110,521.28

Know the three types of APR. APR comes in three flavors. There's fixed, variable, and tiered. This simply means that the interest rate you pay can be changed depending on your current debts or the bank's whims. As such, fixed are usually the safest bets, since you will always know what you're paying. Fixed APRs remain constant for the life of the loan or the credit card. Variable APRs can fluctuate daily, leaving the debtor in the dark about how much interest she's paying. Be very careful with variable APR. Tiered APRs depend on what tier the debt falls into, raising and lowering depending on your current debt. For example, your APR might be 4% for debts below $1,000, but raise to 7% if you cross $1,000. For stability, choose a fixed APR. For potentially lower rates, consider a variable APR—just be prepared for fluctuations.

Understand that the average APR is about 14%. That's not an insignificant sum, especially if you're unable to pay off the principal quickly. Average fixed rates hover slightly below 14%, while average variable rates hover slightly above 14%.

Know that you will not be charged APR if you pay off your monthly credit card balance in full. If you spend $500 on your credit card but pay off the entire balance by the due date, APR is not calculated on your money. To avoid paying interest and to better your overall FICO credit score, make monthly payments on time and in full.

Calculating APR for Credit Cards

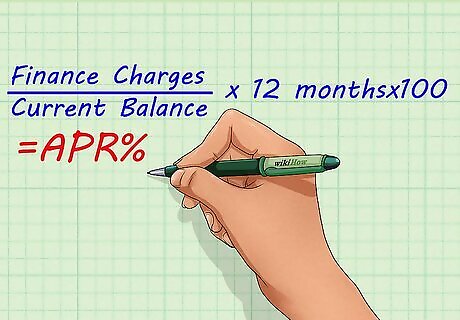

Divide your finance charges by the total balance, then multiply by 1200 to get your APR. APR, or annual percentage rate, is the amount of money your bank charges you when it lends you money. Unless your APR is 0%, you're actually paying extra money every time you leave a balance on your credit card. Finding out your APR is simple if you follow this formula: F i n a n c e C h a r g e s C u r r e n t B a l a n c e ∗ 12 m o n t h s ∗ 100 = A P R % {\displaystyle {\frac {FinanceCharges}{CurrentBalance}}*12months*100=APR\%} {\frac {FinanceCharges}{CurrentBalance}}*12months*100=APR\% You should end up with a decimal before multiplying by 100. This final step converts the decimal into a percentage, making it easier to read.

Find the current balance on your card using the most recent statement. If your card statement does not tell you your APR, you can calculate it right off your statement sheet. For an example, assume your current balance is $2,500. This does not have be the current month's charges only. APR is calculated on your entire balance, so just use that number.

Find the finance charge on your card using the most recent statement. For this example, assume that your hypothetical credit statement says that your finance charge is $25 on the $2,500 debt. This charge will change from month to month.

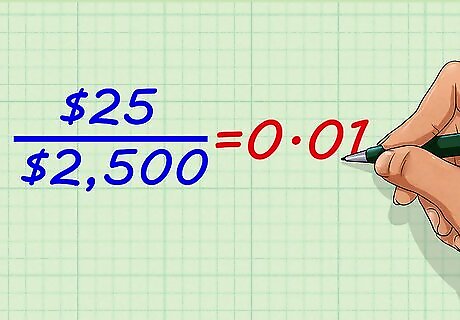

Divide your finance charge by the amount owed. The finance charge is leveraged against you depending on your total debt. $ 25 $ 2 , 500 = 0.01 {\displaystyle {\frac {\$25}{\$2,500}}=0.01} {\frac {\$25}{\$2,500}}=0.01

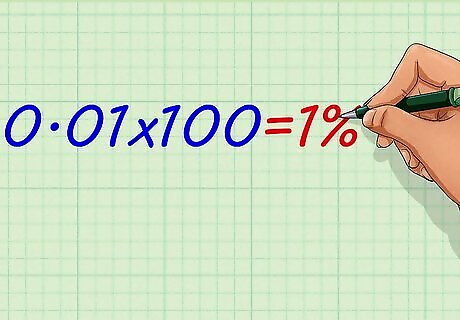

Multiply the answer by 100 to get a percent. This is your finance charge, or interest charged monthly. 0.01 ∗ 100 = 1 % {\displaystyle 0.01*100=1\%} 0.01*100=1\%

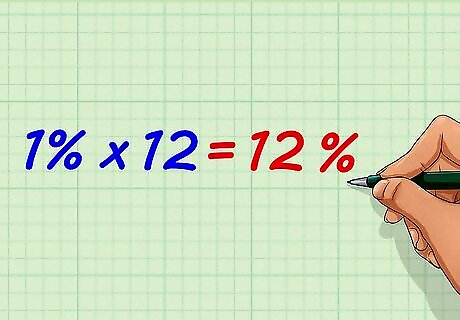

Multiply the monthly charge by 12. The answer is your annual interest (percentage) rate, also known as "APR." You can do this with every single bill if you have a variable APR, meaning your bank has the ability to change your interest rates on the fly. 1 % ∗ 12 = {\displaystyle 1\%*12=} 1\%*12= 12 % {\displaystyle 12\%} 12\%

Calculating APR for Mortgage Loans

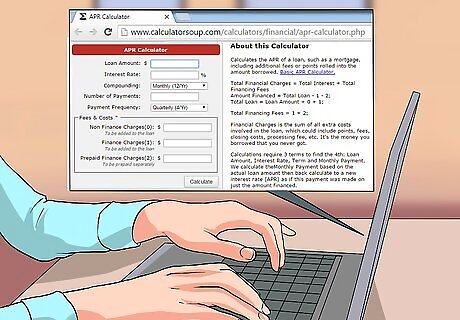

Locate an APR calculator online. Type is "APR mortgage calculator" in a search engine and click on a result. This is a very complicated equation, and it is difficult to find by hand. You are much better off using a specialized computer algorithm, and there are plenty of free ones available. You should see boxes for the following: Principal, or Loan Term or Length Interest Fees (Optional)

Enter the loan amount where indicated on the calculator. For this example, assume you are taking out a $300,000 mortgage loan. Mortgages are simply specific loans on houses.

Enter the extra costs of securing the loan (fees) where indicated on the calculator. For this example, assume it costs $750 extra in fees. If you're just planning potential mortgages, you might not have fee information yet. This is fine to leave out -- it won't make an enormous difference on the final calculation.

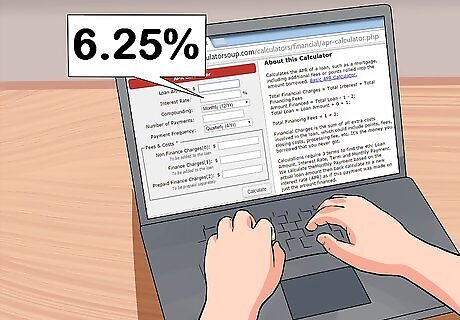

Enter the given interest rate, which represents the interest rate per year without the additional fees. For this example, calculate based on a 6.25% interest rate.

Enter the life, or term, of the loan. Most mortgages are based on the 30-year fixed. You may have to convert this to months, however. This is easily done by multiplying the number of years by twelve.

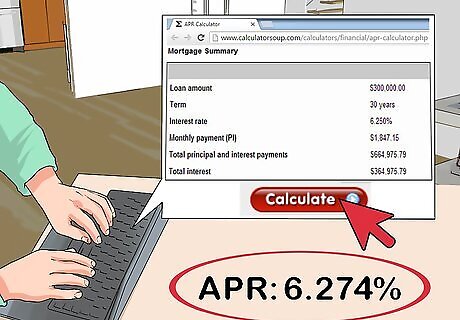

Hit the "calculate" button to get the APR. This is different from the interest rate, as APR represents the real cost of the loan based on the total amount borrowed, not just the current interest rate. For the hypothetical mortgage provided ($300,000, $750 in fees, 6.25% interest, 360-month term), you should get: The APR of our hypothetical mortgage would be 6.37%. The monthly principal and interest payment would be $1,847. The total cost of the interest on the mortgage would add up to $364,975, making the total cost of the mortgage a whopping $664,920.

Comments

0 comment