views

Pulling Together Financial Information

Find proof of your business income. You must accurately report your small business income, so diligently find all proof of income. Hopefully, you are organized and have this information in an Excel sheet. If not, then look for the following: Bank statements Gross receipts for sales of goods and services Sales records Proof of returns and allowances Interest for business checking and savings accounts Any other small business income

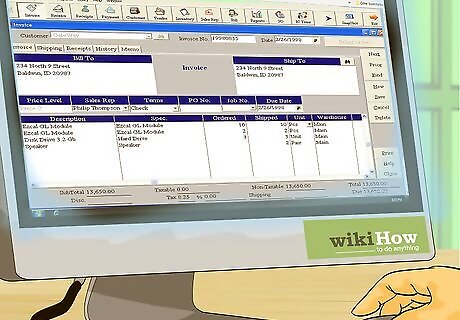

Match purchase orders with invoices. Go through your paperwork and find all the invoices you sent out for the year. Then find the purchase orders you received. Match them together. Also remember to find the shipping notices. Reconcile the purchase orders with the invoices. If they don’t match, then go through and find out why.

Calculate money spent on labor. You must meet reporting requirements if you hired employees or used independent contractors. Go through your records and calculate how much you spent on salary and commissions. You can also claim these amounts as a business expense. Don’t forget benefits paid. For example, you might have paid health insurance, short-term disability, etc. You should also have withholding records for taxes on your employees and the quarterly reports of their taxes. You should have had independent contractors complete a W-9, Request for Taxpayer Identification Number and Certification form from the IRS. If you paid them more than $600 in the year, then you need to report these payments to the IRS using form 1099-MISC. Remember that February 1 is the deadline for sending your employees their W-2 and independent contractors their 1099-MISC.

Gather information about the cost of goods sold. You may deduct the cost of goods sold from your gross receipts on Schedule C. To determine this amount, you need to calculate the cost of your inventory at the start and end of the year. Gather the following information: value of inventory at the start of the year cost of labor cost of materials and supplies purchases (less items withdrawn for personal use) inventory at the end of the year

Identify your business expenses. You can deduct any expense that is “ordinary” and “necessary” for your business. (However, you can’t deduct if you include this amount in the costs of your goods sold). If you want to claim business deductions, then pull together proof of all business expenses. Find receipts, which are required by the IRS. You should look for the following business expenses: advertising phones computer expenses, including Internet transportation and travel expenses business insurance professional fees, such as money paid to lawyers, accountants, and consultants office supplies office rent For more assistance determining what business expenses you can deduct, visit https://www.irs.gov/businesses/small-businesses-self-employed/deducting-business-expenses.

Find your quarterly payments. You might have made estimated quarterly payments to the IRS. Find the payment information and compare your estimated tax for the year with the amount you paid in the first 3 quarters. You'll need to pay the difference in your fourth quarterly payment in January.

Review your financial reports. If you have an accountant, then you’ll want to thoroughly review your financial reports before handing them over to your accountant. Double check that all information is accurate.

Commit to starting early next year. Tax preparation is easiest when you start early. Ideally, you should carefully track your expenses and your sales throughout the year. You’ll make fewer errors that way and also maximize your business tax deductions. If you feel overwhelmed, then you should purchase accounting software, which will allow you to automate the process next year.

Using an Accountant

Identify if you need an accountant. If you have a small sole proprietorship, then you might be able to do your own taxes. However, you should consider hiring an accountant as your business grows. That way, you’ll free up your time to invest in your work instead of preparing to do your taxes. Accountants are also trusted financial advisors who can help you even when it isn’t tax season. For example, an accountant can audit your operations to find inefficiencies. One can also advise you about how best to fund a business expansion.

Find an accountant. The easiest way to find an accountant is to ask another small business owner. Ask someone who runs a business like yours, so that the accountant will be familiar with the business. Once you have the name of someone, call them up and schedule an appointment. You might also contact your state’s Society of Certified Public Accounts and request a referral. Try to avoid simply searching online. It is hard to judge someone’s reputation that way.

Ask your accountant questions. You want an accountant to handle your tax return. However, you should also tap their expertise on other issues. Schedule an appointment and ask for their advice about the following: Can you really take a business deduction for your car expense or for a home office? These are confusing areas of tax law. You’ll want to run it by your accountant. Should you invest in equipment before the tax year ends? If you do, then you’ll probably be able to take a business deduction. Nevertheless, you might want to wait until next year. Talk this over with your accountant. Should you start a retirement plan? If you make contributions before December 31, then you can reduce your annual income. Are tax laws changing? Depending on how the law changes, you might need to change your business strategy. Your accountant can fill you in on any changes.

Provide all requested information. Make sure to get your accountant everything they request, and do so in a timely manner. Your accountant is probably very busy, so you don’t want to delay. If your accountant requests information in a certain format (such as electronically), try to comply.

Review your tax return. Before filing the return, review it carefully with your accountant. You are certifying that the return is accurate, so be comfortable with all reported information. If you fail to report something, then the IRS can hit you with penalties and fees. They won’t come after your accountant. Accordingly, it is key that you confirm the accuracy of all information. Always keep a copy of the return and accompanying schedules for your records.

Automating the Process

Identify the benefits of accounting software. If you aren’t using accounting software, you’re probably using a few Excel spreadsheets and have invoices stuffed in a shoe box or file folder. With accounting software, you can do the following: Maintain a database of customers. In one convenient place, you can maintain contact information, credit card numbers, and details about the customer. Keep track of inventory. If you sell goods, then you’ll be able to check on your inventory levels with a click of the mouse. Organizes transactions. You can create an invoice, purchase order, and sales receipt. Track income and expenses. You’ll be able to see if you are hitting your annual goals in terms of profit and sales. Give your accountant access. This can speed up tax preparation at the end of the year.

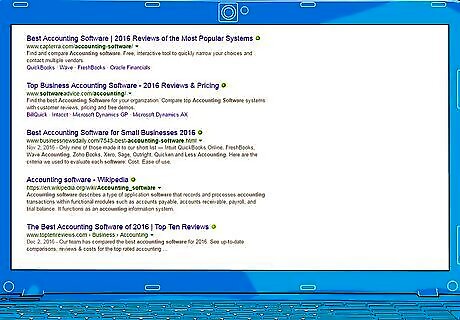

Research accounting software. You should choose an accounting software based on your needs and your ability to pay. Paid packages range from $10-40 a month. You can look online or talk to your accountant. Consider your needs. You probably need basic accounting capabilities, such as income and expense tracking, as well as automatic billing. You can also get tax preparation, which will automatically calculate taxes. Quickbooks Online and Xero are both reputable accounting softwares.

Ask software providers questions. Before buying the software, you need to fully understand what you’re getting into. Talk to a sales rep and ask the following questions: Is the software designed for small businesses? You don’t want to overpay for something designed for large corporations. How does the software back up data? You don’t want to lose everything when the software crashes. What is the total cost? Sometimes, you might be charged setup or storage costs. You want the “all in” number that you will pay to use the software. What kind of tech support is available, and when is it available? When something goes wrong, you want immediate help. Are there security measures in place to protect your data? There’s no point using accounting software if it makes your business vulnerable.

Outsource your payroll. Payroll is particularly complicated, so you should consider outsourcing to a company. On average, about 40% of small businesses incur penalties for not handling payroll properly. Some accounting software also provides payroll services, so you should consider getting it as part of a package. You can find a provider by asking another business owner or your accountant. Some of the largest payroll service providers include ADP, Paycheck , and Intuit Online Payroll. However, they may try to sell you services you aren’t looking for, such as human resource services. Always ask questions before buying. For example, check the speed of turnaround and whether annual fees stay the same or increase after one year. Generally, payroll services charge $20-80 per month, depending on your number of employees. Shop around for the best deal.

Comments

0 comment