views

Spotting Indicators of Price Fixing

Compare prices across markets.If you suspect you're paying artificially high prices, find out what the same product costs in another region of the country. If the seller is a large company with a national or global reach, you should even check for price differences within the company. While price fixing is almost always practiced by large companies, it isn't always practiced by the entire company--a regional division might be colluding locally with other "competitors." For example, say the price of 8”x8”x16” concrete blocks averages $1.75 per block in your region, no matter which supplier you go to. This seems high to you, so you call up a friend in another state, who tells you that he pays about $1.25. When you look online, you see a range of prices, but nothing higher than $1.39 per block. Since the same type of concrete blocks should cost about the same wherever you go, this might be a detail worth investigating

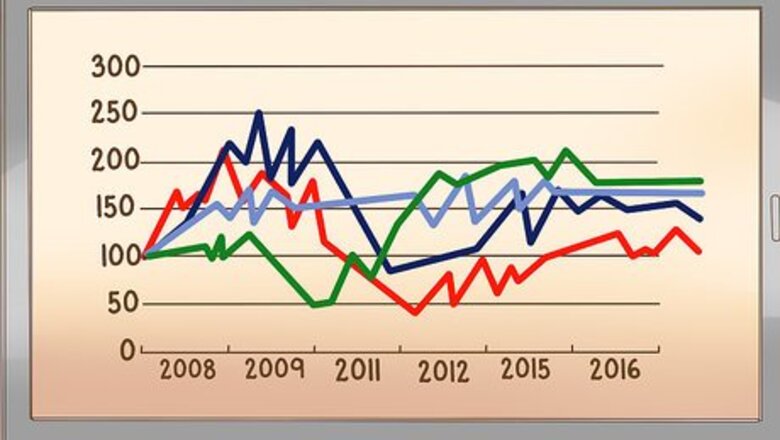

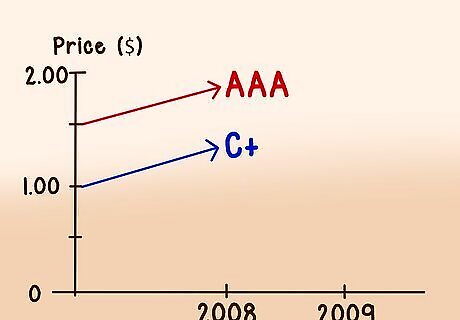

Pay attention to prices that move in tandem. Just because prices aren’t exactly the same at every vendor doesn’t mean price fixing isn’t occurring. In a perfect competitive market, each seller tries to gain advantages over the others. That should mean the sellers' prices rise and fall at different rates as each one tries to sell for less or deliver more. In a fixed market, the prices might rise and fall in tandem with one another, even if they aren’t exactly the same. For instance, AAA Cola caters toward the higher end of the soda market. They sell a bottle of AAA for $1.50. C+ Cola focuses on the bottom end of the market. They sell the same size bottle for $1.00. One day you notice a bottle of AAA now costs $1.75. When you go to pick up a bottle of C+ instead, you realize that it’s $1.25 per bottle. You notice that sugar and gas are the same price as they’ve always been—why the sudden increase in the price of cola? It's tough to say, but it's worth investigating.

Ask sellers why discounts were phased out. It’s much easier to eliminate a discount than it is to raise a price, even if they really amount to the same thing. There’s less record of it, for one. Two, a discount seems more like it's motivated by the seller’s generosity than a built-in part of the price. So when they go away, a lot of buyers are discouraged from asking the sellers why. Don't be that buyer. Imagine that one by one, the bulk discounts on concrete block are dropped by every seller in your area. If discounts were a common practice in your industry, and they all suddenly disappear, it can be a sneaky way to fix prices without looking like it.

Determine the reason for a spike in prices. A market behaving abnormally isn't always the result of collusion, but collusion will always cause a market to behave abnormally. Just because prices all spike at once doesn’t mean there’s price fixing at work. There are plenty of legitimate market forces causing prices to spike. In fact, the cause of a price spike could be virtually anything--a tornado in China, Brexit, a gas pipeline rupturing in Alabama. Just be vigilant. If something seems suspicious, take a closer look. For example, if the price of sugar or gasoline went up dramatically, it would make sense that the price of cola would also rise, as those are two crucial materials for the manufacture and distribution of cola became more expensive.

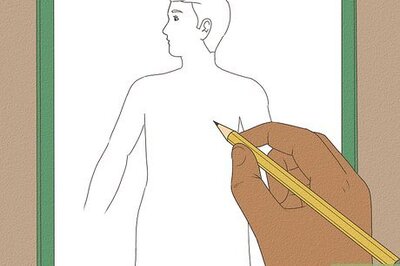

Keep detailed procurement records. It’s not easy to get evidence proving price fixing without the subpoena power of a law enforcement agency. However, if you suspect price fixing, a detailed record of transactions can go a long way toward initiating an investigation. It provides the sort of probable cause that might warrant an investigation.

Reporting Instances of Price Fixing

Consult with an attorney. Speak with a private attorney who has some experience in white collar crime or antitrust laws. If you are a whistleblower, speak with an attorney who has experience protecting whistleblowers. The reasons for this are: You may have a civil lawsuit which could possibly be affected by a criminal case being investigated by the Justice Department. If you are a whistleblower, it’s possible you’re criminally liable along with your co-workers. You should speak with an attorney to advise you of your rights. Find a lawyer who can help through a legal directory like Martindale-Hubble, available at http://www.martindale.com/.

Prepare your complaint. With the assistance of your attorney, you should prepare your complaint to the Antitrust Division. Be sure to include: The names of companies and individuals you believe to be culpable, the laws you believe they violated, and the actions they took which violated the laws. In addition, you should try to explain how the anti competitive practice hurt the consumer, other competitors, and where you fit in.

Submit your complaint to the Antitrust Division of the Department of Justice. The antitrust division makes it easy for you to submit a complaint, offering three ways to report. Submit your complaint via email by sending your complaint to [email protected]. Submit your complaint on the telephone by calling 1-888-647-3258 or 202-307-2040. Mail your complaint to the: Citizen Complaint Center, Antitrust Division; 950 Pennsylvania Ave. NW, Room 3322, Washington, DC 20530.

Familiarizing Yourself with the Conditions Favorable to Price-Fixing

Look for the companies acting behind the scenes. Deliberate price fixing rarely occurs in flashy markets. Flashy markets are typically innovative markets, and innovation gives businesses advantages over other businesses, reinforcing the competition in the market. Price fixing is much more common in “boring industries” like materials suppliers. For example, it would be surprising to find price fixing among several prominent smartphone manufacturers. It would not be surprising to find price fixing among the mining companies mining the rare metals needed for the manufacture of smartphones.

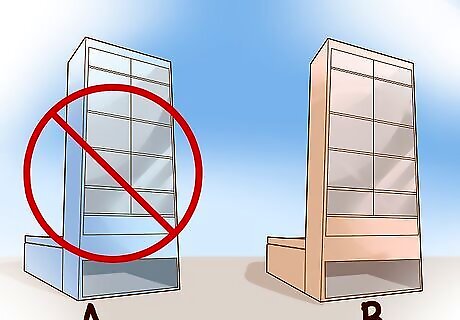

Keep an eye out for companies producing standardized goods across the industry. When new technologies are being invented and applied in different ways, companies compete intensely against one another. When the pace of change and innovation slows, offerings across that industry become more similar to one another. It becomes more difficult to gain an advantage over the other companies through competition, so the impulse is to cooperate with them in order for all the parties in the market to make money. For example, manufacturers of copper wire, nails, concrete block, and drywall are all manufacturing products which are fairly standardized across the industry. While there might be slight variation in the quality of different brands of copper wire, it’s nothing like the difference between the Nintendo DS and the Gizmondo.

Be wary of markets with few players. Pay special attention to markets with just a few large players. These are called oligopolies, and there’s a natural tendency towards collusion (cartelization) in such circumstances. When a market consolidates into just a few players, it becomes more and more expensive for one company to best the others through competition—they can make more money by cooperating with one another than they can through competing with one another. By way of example, the Organization of Petroleum Exporting Countries, OPEC, is an oligopoly opening colluding with one another to set limits on the production of oil, which controls the price. Since so few countries are oil exporters (a natural oligopoly) and no one has the authority to stop them, they naturally gravitated towards collusion and price fixing.

Comments

0 comment