views

Writing Your Own Promissory Note

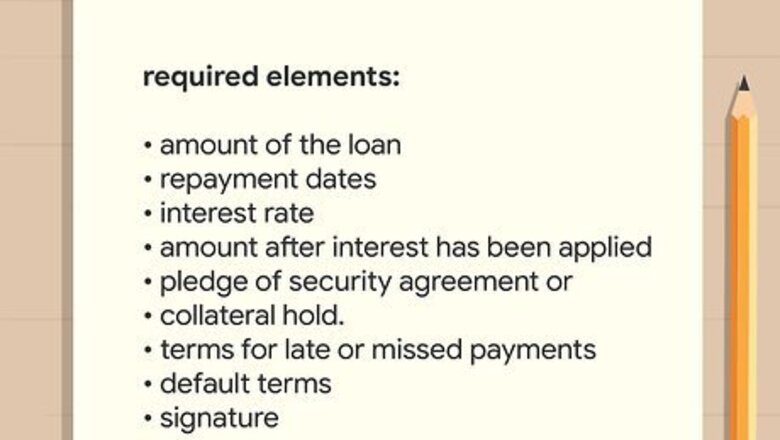

Meet the required elements to create an enforceable promissory note. In order to be enforceable, the note must include certain elements. Without any these you may not be able to collect the money you loaned out. The amount of the loan — the amount that is borrowed and owed. Repayment dates — the date payments are due or the loan must be repaid. Interest rate — the rate charged or paid on borrowed money. Interest rates are calculated in terms of annual percentage rate or APR. Amount after interest has been applied or PI (principle + interest). The Pledge of Security Agreement or Collateral hold. List any goods or services and the value used as a guarantee of the debt to be paid. Terms for late or missed payments, if applicable. Default terms — what will happen if the borrower fails to repay in a timely manner. Signature

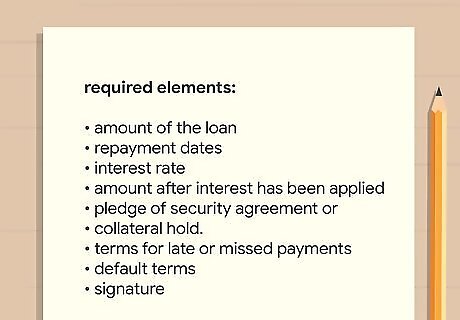

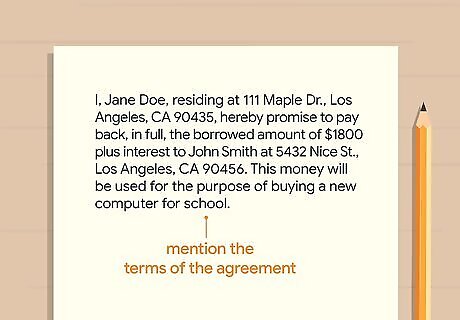

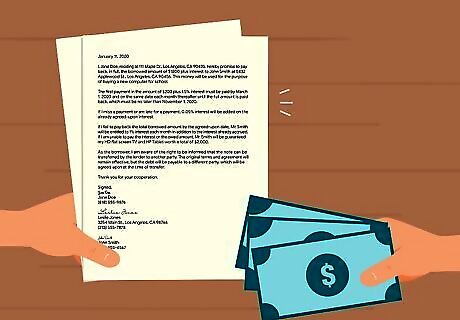

Write down the terms of the agreement. These are the terms that the borrower and lender have agreed upon covering each of the required elements above. You can find free forms to download by doing an Internet search under "promissory note forms." You may want to include a repayment schedule with specific due dates in the note if there are going to be monthly or weekly payments.

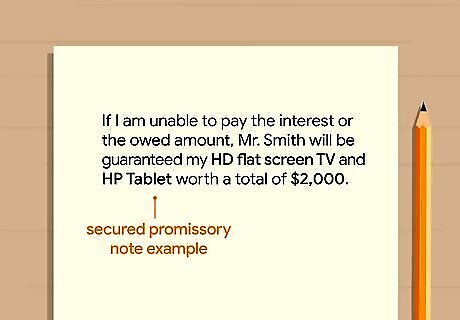

Decide on a secured or unsecured promissory note for repayment. A secured promissory note requires the borrower to provide goods, property, or services as collateral, in the event the borrower defaults on the debt. The value of the collateral should be equal to or greater than the principal of the debt. An unsecured promissory note requires no collateral to borrow. Good to excellent credit is required to get an unsecured loan.

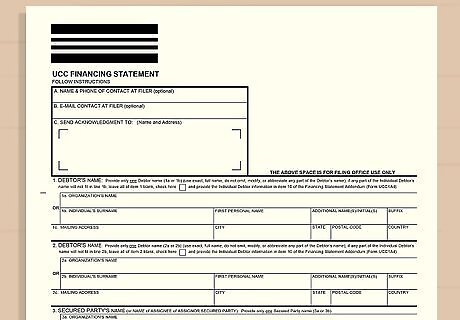

Perfect the security of your loan. If you have a secured promissory note, this means the person borrowing money has agreed that the lender has the right to collateral (such as property) if the borrower defaults. To make sure the lender gets paid, he can file a financing statement (Form UCC1) to "perfect" his interest, meaning he has priority over others (such as those who want to collect on unsecured loans) to collect if the debtor defaults or files for bankruptcy. UCC forms differ by state and must be filed with your state's Secretary of State. The form should include a description of the collateral and its value.

Ensuring the Note is Enforceable

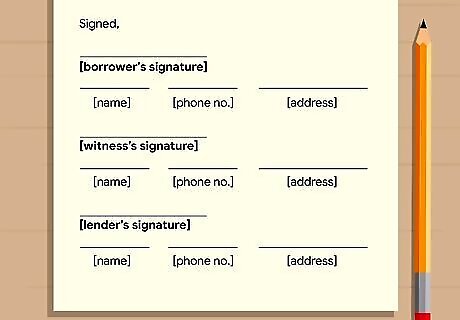

Make the promissory note enforceable. If it is not signed, for example, the note will not hold up in court. The body of the document must include: Legal names of all parties that have a vested interest in the transaction. Address and phone numbers of each party involved, including the lender. The signature of the borrower and a witness. The lender's signature may or may not be required. The requirement varies by state. Purpose — what the money will be used for. This requirement will also vary by state.

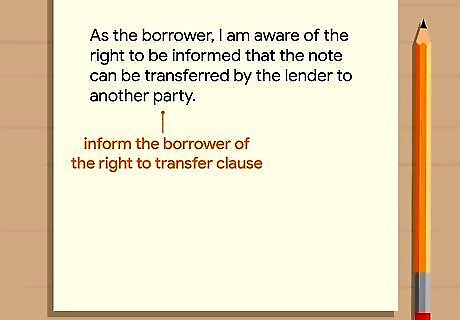

Inform the borrower of the right to transfer clause. The borrower has a right to be informed that the note can be transferred by the lender to another party. The original terms and agreement will remain effective, but the debt will be payable to a different party.

Inform the borrower of the right to cancel. Most states require that a borrower have three days to cancel the note (not take out the loan) after they sign the promissory note. There is a form the borrower signs that informs them of this right.

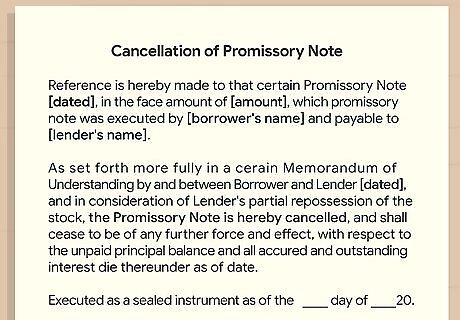

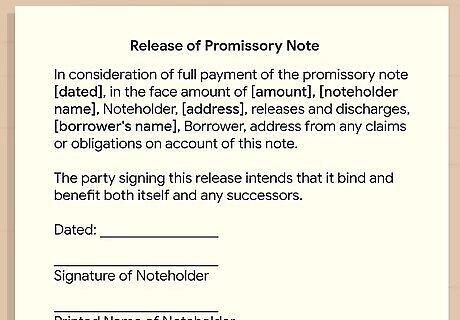

When the loan is paid back, issue a Release of Promissory Note. This signifies the end of both parties’ commitments under the note. A release can help prevent future disputes and lawsuits. If there was collateral that secured the promissory note, make sure that any liens are cancelled or terminated.

Collecting on an Unpaid Note

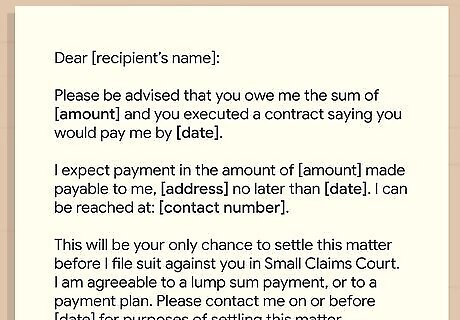

Write demand letters if the note is not paid by the due date. The language in the letter should reference harsh legal action if the borrower does not pay what is owed. Make sure you include a date that the borrower must pay to avoid legal action and loss of collateral if it is a secured note.

Demand the collateral if a secured note is not paid. Default of payments on debts by a secured note requires the borrower to forfeit the items in lieu of payment. You may need to go to court to collect on the loan or the collateral if it is not paid by the due date.

Take the borrower to small claims court. If you are owed a modest sum, such as $5,000 or less, then this is an inexpensive option. You will have a better chance of receiving some of the funds owed on an unsecured note without having to pay high court and attorney fees.

Comments

0 comment