views

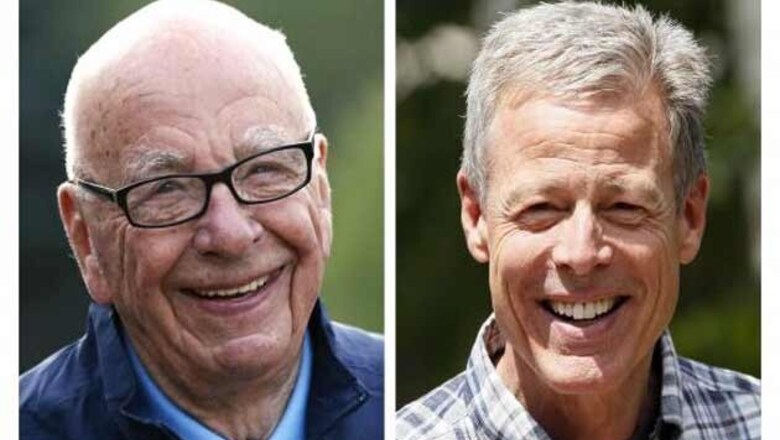

New York: Rupert Murdoch's 21st Century Fox Inc said on Wednesday that it had offered to buy Time Warner Inc, a move that would unite two of the world's most powerful media conglomerates, but Time Warner rebuffed its offer.

Time Warner's stock jumped 17.3 per cent to $83.33 on the New York Stock Exchange after news that Murdoch had his sights on Time Warner, the owner of the Warner Bros. movie studio and cable channels such as HBO and CNN, among other media properties.

Murdoch's cash-and-stock bid was worth about $80 billion, or $85 per share, people familiar with the matter told Reuters earlier on Wednesday. The offer, first reported by The New York Times, consisted of 60 percent in stock and the rest in cash.

Twenty-First Century Fox later confirmed it had made a formal takeover proposal in June but said there were no talks currently under way. Even so, Murdoch and his advisers are unlikely to abandon his ambition to put Time Warner in his empire so easily, one of the people said, pointing out that he has the "disciplined determination" to get a deal done.

Fox's overtures to Time Warner could accelerate a wave of consolidation that is already reshaping the US media landscape. Reuters reported this month that Murdoch was in the midst of a deal that would give Fox the firepower to buy a content company.

Fox, which owns cable news channel Fox News as well as movie studio 20th Century Fox, has indicated it would sell CNN as part of its proposal to buy Time Warner to clear any regulatory hurdles, according to the people familiar with the matter.

"(It) would be good deal for Fox if it goes through Washington (regulators) with CNN sales," Wunderlich Securities analyst Matthew Harrigan told Reuters in an email. He said that the "fair public value" for Time Warner was $82 a share.

Fox currently estimates that a combined company would save $1 billion in costs and possibly more, primarily by cutting sales staff and back-office functions, the people familiar with the matter said.

It believes that detailed negotiations with Time Warner could reveal much higher synergies than $1 billion, which may justify Fox sweetening its offer, the people said. The combined company's revenue would be more than $60 billion.

Twenty-First Century Fox is in the middle of a reorganization of its television business as the network seeks to lift itself out of last place among the big US broadcasters.

The shakeup of Rupert Murdoch's Twenty-First Century Fox's TV units comes a year after the film and TV company was spun off from Murdoch's News Corp, which now operates publishing assets, including the Wall Street Journal.

Twenty-First Century Fox is being advised by Goldman Sachs and Centerview Partners, while Time Warner is working with Citigroup.

Comments

0 comment