views

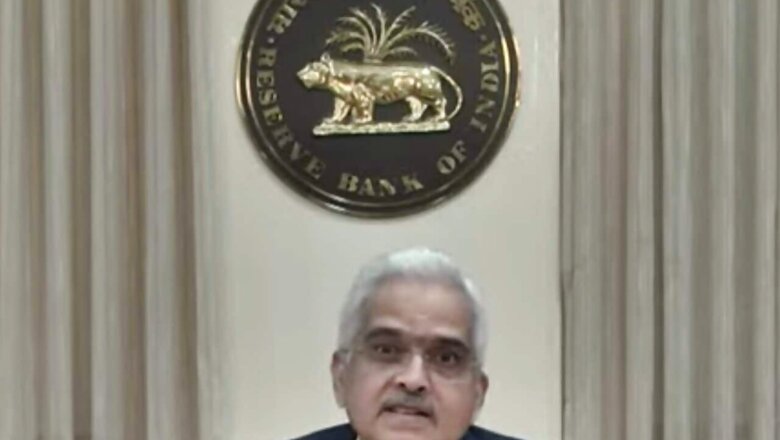

RBI Governor Shaktikanta Das during the last monetary policy review meeting said a premature pause in monetary policy action would be a costly policy error at this juncture, given the “uncertain outlook”. He also said it is essential to persist with the stance of withdrawal of accommodation.

“I am…of the view that a premature pause in monetary policy action would be a costly policy error at this juncture. Given the uncertain outlook, it may engender a situation where we may find ourselves striving to do a catch-up through stronger policy actions in the subsequent meetings to ward-off accentuated inflationary pressures. I, therefore, vote for an increase of 35 basis points in the repo rate – a departure from 50 bps on three previous occasions – which itself conveys the signal of an improvement in the inflation outlook,” Das said during the meeting earlier this month, according to the MPC minutes.

In the consecutive fifth hike this year, the RBI’s Monetary Policy Committee on Decemeber 7 raised the repo rate by 35 basis points (bps) to 6.25 per cent with immediate effect, making loans expensive. The policy rate is now at the highest level since August 2018. The RBI has maintained policy stance at ‘withdrawal of accommodation’.

With this latest hike, the RBI’s rate-setting panel has raised the key policy rate by 225 basis points this year in total, in order to control inflation. The repo rate is the interest rate at which the RBI lends to the commercial bank.

During the MPC meeting, the RBI governor said that considering the prevailing policy repo rate, liquidity conditions and the expected trajectory of inflation over the next several months, it is essential to persist with the stance of withdrawal of accommodation. “Hence, I vote for the same.”

Four other MPC members Shashanka Bhide, Ashima Goyal, Rajiv Ranjan and Michael Patra had also voted for a 35 bps hike. Jayanth R Varma, however, voted against the repo rate hike.

Shaktikanta Das said, “In a tightening cycle, especially in a world of high uncertainty, giving out explicit forward guidance on the future path of monetary policy would be counterproductive. This may result in the market and its participants overshooting the actual play out of real conditions. In such circumstances, it would be prudent to keep Arjuna’s eye on the evolving inflation dynamics and be ready to act as may be necessary. Monetary policy has to be nimble to address any emerging risk to the price stability, while keeping in mind the objective of growth.”

“Global growth is set to lose momentum as monetary policy actions tighten financial conditions and as consumer confidence weakens with the rising cost of livelihood. Inflation remains elevated and persistent across countries as they grapple with food and energy price shocks and shortages,” the RBI’s assessment of the global economy read.

However, according to the latest data, the retail inflation in India in November eased to an 11-month low of 5.88 per cent with food prices seeing sharp cooling. Inflation in the food basket, or the Consumer Food Price Index, decelerated to 4.67 per cent in November this year, compared with 7.01 per cent in October.

To rein in prices further, markets regulator Sebi has extended the suspension of derivatives trading of paddy (non-basmati), wheat, chana, mustard seeds and its derivatives, soybean and its derivatives, crude palm oil and moong, for one more year till December 20, 2023.

“The suspension of trading in the above contracts has been extended for one more year beyond December 20, 2022, i.e. till December 20, 2023,” the Securities and Exchange Board of India (Sebi) said in a late-night order passed on Tuesday.

Read all the Latest Business News here

Comments

0 comment