views

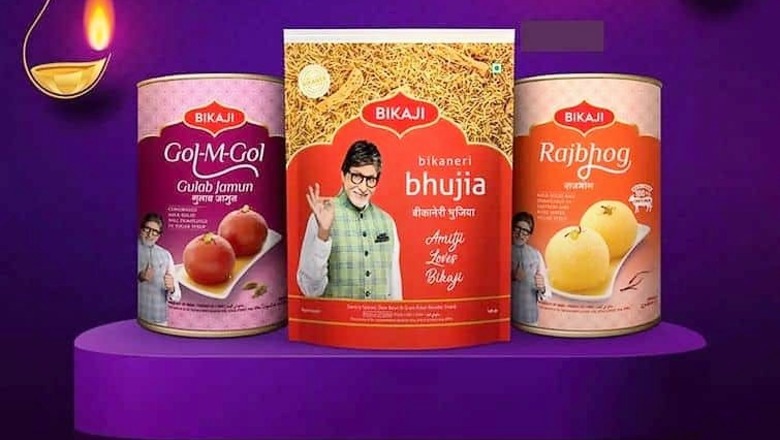

Bikaji Foods IPO Last Day: The Rs 881 crore initial public offering (IPO) of Bikaji Foods International sailed through on the second day of the bidding process on Friday. As per the tentative schedule of Bikaji Foods IPO, allotment date is most likely on November 11 whereas Bikaji Foods IPO listing date is likely to happen on November 16, 2022. Bikaji Foods is India’s third-largest ethnic snack company. The company’s product range includes six principal categories: bhujia, namkeen, packaged sweets, papad, and western snacks among others.

Bikaji Foods IPO: Subscription Status

After two days of bidding, Bikaji Foods IPO subscription status suggests that the public issue worth Rs 881.22 crore has been subscribed 1.48 times whereas its retail portion got subscribed 2.33 times.

Bikaji Foods IPO: Issue Price

Potential investors will be able to bid for Bikaji Foods shares in a price band of Rs 285-300 apiece under the IPO.

Bikaji Foods IPO: Lot size

Bidding will be possible in multiples of 50 shares — which translates to Rs 14,250-15,000 per lot.

Bikaji Foods IPO Financial performance

Bikaji Foods recorded a compound annual growth rate of 22.44 per cent in revenue from operations during FY20-FY22, coming in at Rs 1,610.96 crore for FY22. Profit and EBITDA (earnings before interest, taxes, depreciation and amortisation) in the same period grew at a CAGR of 16.13 per cent and 21.45 per cent (at Rs 76 crore and Rs 139.5 crore in FY22, respectively), but the EBITDA margin contracted to 8.66 per cent in FY22 against 11.04 per cent in FY21 and 8.8 per cent in FY20.

There was volatility in return on equity (RoE) and return on capital employed (RoCE). RoE stood at 9.5 per cent in FY22 against 14.89 percent in FY21 and 10.65 per cent in FY20, while RoCE was 13.89 per cent against 20.88 per cent and 12.79 per cent in the same period.

Most of the company’s business contribution comes from two segments, bhujia and namkeen which accounted for around 70 per cent of revenue, followed by packaged sweets with nearly 13 per cent of total sales.

Bikaji Foods IPO: GMP Today

According to market observers, shares of Bikaji Foods International Ltd are steady at a premium of Rs 40 in the grey market today. On Friday, Bikaji Foods IPO GMP was Rs 27 per equity share.

After two days of successive losses, the Indian secondary market witnessed a trend reversal as key benchmark indices ended higher on the weekend session.

What Should Investors Do Now?

The majority of the brokerages remain positive on the issue but a few have flagged pricey valuations and a complete OFS issue as areas of concern.

We believe the current valuation of 95.2x is reasonable considering the average industry P/E of 204.4x as per the company’s RHP, said KR Choksey Research in its IPO note.

“Given the market positioning, brand equity and improving penetration of the packaged food products, we are optimistic about the company’s outlook,” it added with a subscribe rating for the issue.

“Due to shifting lifestyles, rising incomes and urbanisation, India’s packaged food industry has experienced tremendous growth over the past five years. Pan-Indian demand for regional snacks is booming,” said Swastika Investmart.

The company’s margins are on the declining side and a P/E valuation of 95.2 looks expensive, it said, adding that it is a complete offer for sale, thus we recommend a Subscribe rating, but only for high-risk investors.

Read all the Latest Business News here

Comments

0 comment