views

Taiwanese company Foxconn has promised to double employment as well as its current investment in India by 2024. This assertion — made by the India representative of Foxconn while wishing Prime Minister Narendra Modi on his 73rd birthday on Sunday — has again brought into focus the shift in the global electronics manufacturing order, away from China and towards India, Vietnam and other emerging hubs.

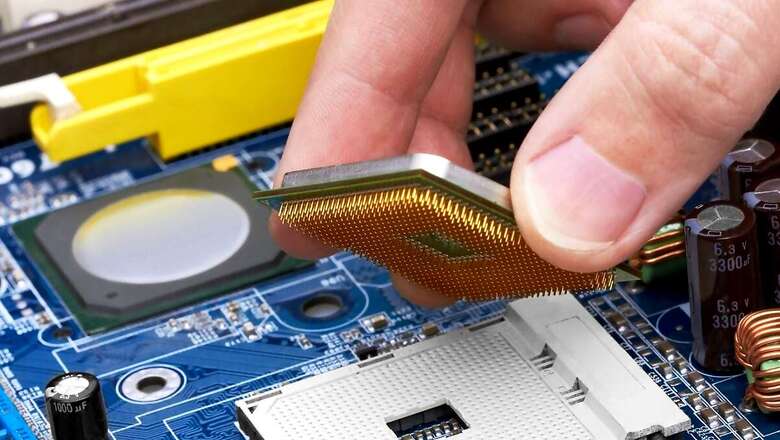

Before Foxconn raised the bar, US chip maker Micron had similarly placed a large bet on India by announcing a $2.75 billion semiconductor facility in Gujarat in June this year.

China has traditionally been the world’s electronics manufacturing hub, with an enviable network of suppliers and the resultant ecosystem being big attractions for global brands such as Apple (Foxconn is one of the biggest assemblers of Apple iPhone). But this Chinese dominance in global electronics is being challenged now, largely because of supply chain disruptions seen during the Covid-19 years.

In any case, large American manufacturers and others, including companies from Taiwan, have now realised that the ‘China Plus One’ strategy is the only sensible way to move forward in a world disrupted not just by the pandemic but also by the prolonged Ukraine-Russia war.

In this changed world order, manufacturers do not want to carry on with the earlier model, where they set up mega factories in China that were supported by a local supply chain developed over decades. Instead, manufacturing is now being divided, with facilities coming up in countries such as India and Vietnam, to de-risk operations.

In this scenario, India offers several significant advantages. Under the country’s Semiconductor Policy, for example, Micron will get up to half its project cost as investment from the Centre and further incentives from the Gujarat government (where the facility will come up). This means an overwhelming investment for the company’s manufacturing facility will actually come from Indian authorities.

Besides, India also offers a rather large domestic market for the company’s products. It is pertinent to remember that Micron’s India trajectory was probably accelerated by China’s decision earlier this year to bar the company from supplying its products to key local manufacturers, citing national security concerns.

As for Foxconn and its failed partnership bid with Indian company Vedanta to make chips in India — this joint venture would have been the first one to get approval under India’s Semiconductor Policy had it not broken up — the Taiwanese company has already said it is looking for other Indian companies for partnership. Vedanta is also scouting for technology partnerships instead of abandoning its chip manufacturing plans.

Also, news reports suggest that a Tata group company could soon become an assembler of iPhones in India by acquiring the facility of another Taiwan based company in Karnataka. So all in all, it is Advantage India.

Comments

0 comment