views

Finance Minister Nirmala Sitharaman has announced that earnings from virtual digital assets will be taxed at 30 per cent; any capital losses on such assets cannot be settled against other capital gains.

Virtual digital asset is the official nomenclature that will be used from now on for crypto assets, or any other digital tokens like non-fungible tokens (NFT). I have said several times that these digital tokens need to be controlled, the so-called exchanges selling them need to be monitored and regulated. In the Wild West World of these assets, there are no rules and players brazenly advertise and even promise gains. And, they even “advice” that the RBI needs to issue CBDCs (Central Bank Digital Currency) or Digital Rupee.

These exchanges keep changing the location of their permanent establishment to avoid scrutiny and taxation. While all the time acting as holier-than-the-world and saying they want to be regulated, globally. Yes, they seek “global regulations” for the local mischief they are doing. They want the governments of the whole world to come together before acting towards controlling these exchanges or forcing them to meet a nation’s regulatory requirement.

It is like a pharmaceutical company selling opioids and saying we won’t be classified as a narcotic-class addictive drug by any country till such time ALL the countries do not classify opioids as such.

The FM in her budget speech reiterated most of my suggestions.

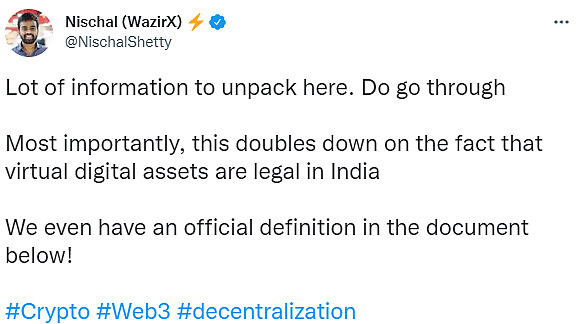

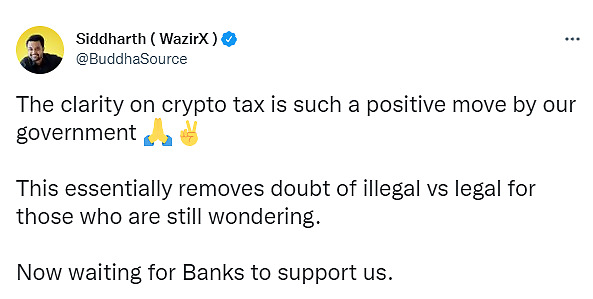

But now that the government has decided to tax these tokens, founders of the so-called crypto exchanges are again going to the market, falsely claiming their tokens have been recognised, legitimised. The founders and CEOs of these exchanges have been issuing misleading communication, fooling investors about these assets.

Let me give another analogy to make it clear. Can a cocaine seller who pays tax on his earning from selling a banned product like cocaine claim legitimacy for cocaine? Can he claim legitimacy because he is paying taxes on his earnings? His earnings are being recognised, not the product he is selling. He is still liable for action and arrest under the IPC code for selling narcotics. While a lot of investors may call this analogy with cocaine or opiates wrong, but it is important to note the similarities.

As a matter of fact, when Al Capone, the Chicago Mafia head, was arrested in 1931 for tax evasion, his defence was, “They can’t collect legal taxes from illegal money.” He was arrested and sent to jail for 11 years for tax evasion. This is because earnings from illicit trade are also subject to taxation.

Even opiate makers managed to fool the US FDA for a long time by refusing to be classified as narcotics addictive drugs. They kept talking about the ability of their drugs to ease pain for their users, hence demanding exemption from narcotic classification. Similar to crypto exchanges, who keep talking about blockchain, decentralised finance and lately Web 3.0 and its ability to ease transaction costs and reliability. All this ability, they argue, is in the interest of greater good, rather only for the public good. This is a fast one and they are succeeding in pulling this farce as they are buying out media and influencers to promote it.

The new definition will even cover non fungible tokens (NFTs) as they are also digital assets. Several people have got on to the bandwagon of NFTs, using it to convert black money into white.

The process is very simple, an NFT is created around some meaningless item, and sold to a compromised buyer for an enormous amount of money. As of now such token transactions were not taxed, and it was the easiest way to convert your income from black to white. Even store it in the form of crypto assets outside the country through dubious exchanges.

This is similar to ‘Art scam’ practised by a section of the bureaucracy in the ‘90s. A bureaucrats’ wife would make and sell a painting for an unheard of price to a buyer who’s seeking favours from the officer. Nobody could object to the transaction or the value as it was considered art whose value was indeterminate. This is what is happening in the NFT space too, a digital asset with uncertain value is being sold at a huge price, nobody knows whether the value is real or fictional. Once the transaction is taxed, the tax paid will be in real currency, forcing the real value to be revealed.

Which is why the proposal to impose a TDS on digital tokens’ transactions will help the Income Tax department identify the buyer and seller. And the market places which are conducting these transactions will be responsible for ensuring that this TDS is collected and paid. This would ensure that the uncertain tax status of these exchanges and their earnings would also come under the ambit of the taxman.

The central bank digital currency or the Digital Rupee will ensure that global wholesale transaction costs come down. One of the first adopters of the Digital Rupee should be exporters, importers and e-commerce companies. This will help them carry out their transactions faster with customers globally, reducing the cost of transactions.

If the RBI makes it mandatory that Digital Rupee has to be used for all foreign transactions, the money laundering currently happening through foreign banks will also stop. There is another very important and significant shift that may happen if these transactions become mandatory, which is the need for localisation. RBI may not go heavy on localisation of data if compulsory CBDCs become a success in the system. These are early days, but there is more to come in this space.

The author is CEO, Center for Innovation in Public Policy. The views expressed in this article are those of the author and do not represent the stand of this publication.

Read all the Latest Opinions here

Comments

0 comment