views

The Apple iPhone 12 series is proving to be incredibly popular with buyers globally and have clocked the highest volume share as well as revenue share for Q1 2021. In terms of revenue share, Samsung follows in a distant second place while Xiaomi’s Redmi phones are behind the Apple iPhone 12 series and indeed the iPhone 11 in the volume stakes. This is according to the latest numbers from the Counterpoint Research Global Handset Model Tracker, Q1 2021. The global smartphones revenues crossed $100 billion in Q1 2021, and flagship phones clocked the maximum share. Apple and Samsung dominate the top 10 list of highest revenue grossing phones, with Huawei also making a lone appearance. The volume numbers, which indicate popular phones, are dominated by Apple, Xiaomi and Samsung.

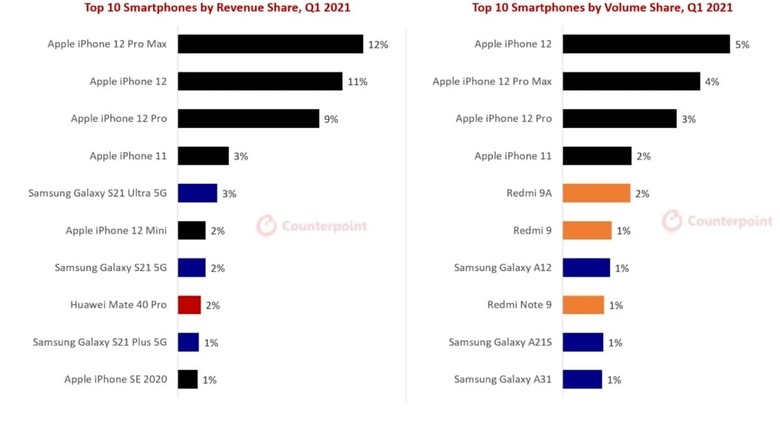

The popular phones, indicated by the volume share list for Q1 2021 has the Apple iPhone 12 leading the way with 5% share, followed by the iPhone 12 Pro Max (4%), iPhone 12 Pro (3%) and the iPhone 12 (2%). The Redmi 9A (2%), Redmi 9 (1%) follow, with Samsung making its first appearance with the Galaxy A12 at number seven on the list. This is followed by the Redmi Note 9, Samsung Galaxy A21S and the Galaxy A31, all with 1% share. “Strong 5G upgrades within the iOS base, pent-up demand and the spillover of Apple’s demand due to the late launch were some of the factors driving the volumes for Apple. The iPhone 11 captured the fourth spot as it remains a popular choice for users looking for lower-cost Apple devices and in markets like India where 5G services are still elusive,” says Counterpoint.

In term of revenue from smartphone sales, flagship phones unsurprisingly led the way. The Apple iPhone 12 Pro Max with 12% share of the revenue sits at the top of the list, followed by the Apple iPhone 12 in second place with 11% share. Tie this in with the numbers on the volume share list, and the sales vs revenue relations become clear. The iPhone 12 Pro (9%) and iPhone 11 (3%) follow, with the Samsung Galaxy S21 Ultra 5G (3%) making up the top five. The iPhone 12 Mini (2%), Samsung Galaxy S21 5G ( 2%), Huawei Mate 40 Pro (2%), Samsung Galaxy S21 Plus 5G (1%) and the Apple iPhone SE 2020 (1%) make up the rest of the revenue list. This list also indicates that volumes for expensive flagship phones, be it the top-of-the-line Apple iPhone 12 Pro Max or the Samsung Galaxy S21 series, are much higher and therefore indicate strong demand for these phones. “In some regions, consumers preferred to buy higher variants of the devices. The iPhone 12 Pro Max was the best-selling model in the US. The S21 Ultra 5G also sold more than the lower variants in the US and Europe. The S21 series, which was launched at cheaper prices than the S20 series, was also supported by strong carrier promotions,” says Counterpoint.

The preference towards flagship phones could also be the reason why we are seeing a concerted push from brands including Xiaomi and Realme, towards the Android flagship phone space. Xiaomi has recently added the Mi 11 series to its product line-up in India, which includes the Android superphone, the Mi 11 Ultra. Realme is expected to introduce the Realme X7 Max 5G in India, soon.

Read all the Latest News, Breaking News and Coronavirus News here. Follow us on Facebook, Twitter and Telegram.

Comments

0 comment