views

Apple has stopped accepting payments for subscriptions via debit and credits in India. The development essentially means that customers will now need to add money to their Apple funds – similar to a prepaid card – which will deduct money from the account every month when the subscription renews. Apple makes it mandatory for new iPhone or iPad users to create an Apple ID while setting up the device, and they are also required to provide bank details. If customers want to renew or buy a subscription, say, Apple Music or Apple TV, the company offers its own payment gateway for the transaction. The transaction was earlier possible via debit or credit cards, or UPI.

The decision to remove the option of payment via debit and credit cards in India is a result of the auto-debit rules that the Reserve Bank of India (RBI) changed last year. The new RBI mandate indicated that there were to be no more automatic recurring payments for the various services such as utility bills, phone recharge, DTH and OTT payments. It essentially meant that no money would be deducted from the bank account without the customer’s manual approval. The change came into being on October 1.

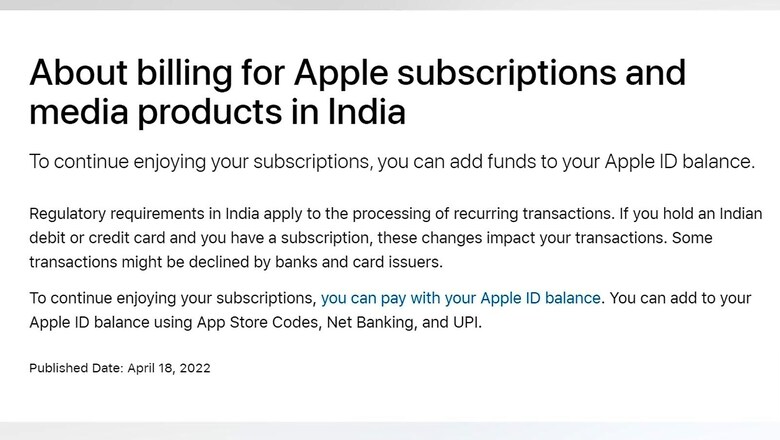

If existing Apple iPhone users have already added their debit or credit details, the ‘Payment and Shipping’ section in the Settings menu shows “[card] not supported”. Through an Apple Support page updated on April 18, the company recommends users add funds to the Apple ID balance to continue enjoying subscriptions. The page notes:

“Regulatory requirements in India apply to the processing of recurring transactions. If you hold an Indian debit or credit card and you have a subscription, these changes impact your transactions. Some transactions might be declined by banks and card issuers. To continue enjoying your subscriptions, you can pay with your Apple ID balance. You can add to your Apple ID balance using App Store Codes, Net Banking, and UPI.”

Users are advised to get an Apple Balance account and link it with UPI to continue subscriptions.

Read all the Latest Tech News here

Comments

0 comment