views

New Delhi: As countdown for the most ambitious tax reform, Goods and Services Tax (GST), nears its culmination point, Delhi’s biggest wholesale consumer goods market, Sadar Bazaar witnessed a bandh by traders who blamed the government for not bothering to create awareness about the “complex” compliance norms, rendering them “clueless” about its feasibility.

When one thinks of Sadar Bazaar, image of porters jostling with carts full of goods and a sea of customers tending to their wholesale needs comes to one’s mind. But on Friday, the market wore a deserted look.

N Kumar, owner of ML Plastics, said he and dozens of other wholesalers he knows are still waiting for their GSTIN. GSTIN is a unique 15 digit GST Identification Number issued to each ‘taxable person’ to make the tracking of transactions transparent.

“My business comes under the 18% GST rate. Apart from this, there is nothing that is clear or confirmed. We should have been explained the procedure of implementation at least 15 days before imposing the law. There is no definite format of billing and all the information that we are banking on is from random WhatsApp forwards. It’s a situation of chaos and confusion,” said Kumar who has now hired a CA to sort out his finances.

“If not anything else, I have additional burden of paying the Chartered Account,” he said.

Friday’s strike was called by the Federation of Sadar Bazaar Trade Association. Speaking to News18, RK Gupta, general secretary of Qutab Traders Association, a unit of the larger federation, said the one of the key demands of the protest is that the government should lower the top tax slab of 28%.

Sadar Bazaar wears a deserted look (PC: Debayan Roy)

“The government has failed in creating a basic platform to roll out GST. Let us not talk about the big business conglomerates. It’s the small traders, wholesalers and suppliers who are suffering the wrath. We were left to arrange for CAs to hold workshops for us. But even then there is a lot of confusion. Hence, we demand that the tax slab of 28% should be reduced, all the creases in GST implementation should be ironed out and the government should stop these divisive taxation slabs. For example, loose wheat will not be taxed but once it is packed, it attracts a 5% tax, loose nuts attract 5% tax whereas packaged ones would attract 15%. This is ridiculous,” rued Gupta.

The products which come under the tax slab of 28% are lubricating oils and preparations which include oils and preparations of the kind used for oil or grease treatment of textile materials. However, it excludes oils that contain 70% or more by weight of petroleum oils, or oils obtained from bituminous materials.

Toy wholesalers complain of "absurd tax rates" which has different tax slabs for normal toys, electronic toys and board games. (PC : Debayan Roy)

Apart from the oils, all ready-to-use products made from textiles come under this bracket. This includes products like travel cases, holsters and similar containers; travelling bags, insulated food or beverages bags, toilet bags, rucksacks, handbags, shopping bags, wallets, purses, map cases, cigarette cases, tobacco pouches, tool bags, sports bags, bottle- cases, jewellery boxes, powder boxes, cutlery cases and similar containers made of textile materials.

This tax reform also requires each business to update the buyer’s GST registration number in the GST database; hence each sale and purchase is tracked. But most of the wholesale shop owners complained of still not having the required GSTIN.

Mohammad Azam, owner of Fitting Mart, a fixtures wholesale shop, is still hoping that he would receive GSTIN by tomorrow morning to issue proper invoices from July 1.

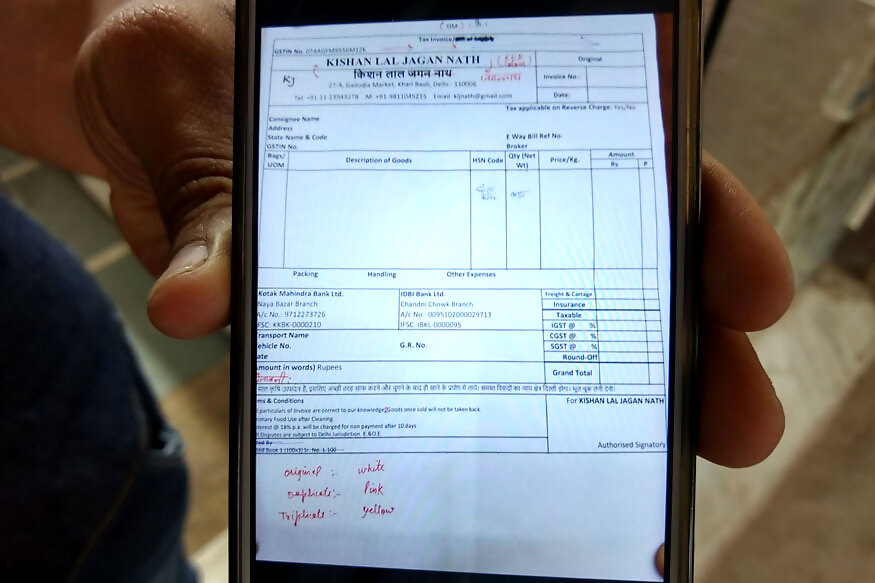

“I had to hire a Chartered Accountant for my business. We are completely clueless about how this will roll out. I am still waiting for my GSTIN. We need to incorporate the number on our stamp and ensure that stamp print is there on all invoices. If it is not there, then what should I do from tomorrow? For now I am depending on the invoice format received on a WhatsApp group,” Azam told News18.

Mohd Azam showing the GST Invoices most of the shopkeepers have received over WhatsApp messages and not from the government (PC: Debayan Roy)

Complaints of confusion also came from toy makers as different kind of toys will be taxed differently. “With GST in place from tomorrow, the complete tax structure will double for some categories like board games which somehow fall under the higher tax bracket as there is vagueness around the definitions. For example, a toy rifle will attract a tax of 12% but a game of chess or monopoly would attract 28% tax. This is absurd. Why is the government even charging tax for educational games?” said the owner of the biggest toy wholesale store in Sadar Bazaar. Under the new regime, there are three tax slabs for toys, which is 12% for normal toys, 18% for electronic ones and 28% for board games.

Similar worries plagued the electronic wholesalers.

Even though many food items sold at kirana stores are exempted, wholesalers said “GST will make their life difficult.”

A member of one of the busiest Kirana stores in Sadar Bazaar, Aligarh Kirane Wale, said, “I am a 70 years old semi-illiterate man. How will I retain these invoices and file monthly returns. It is a hassle for me. I am hiring a chartered accountant,” said Rupendra Sharma.

Another section hit by confusion around GST is thousands of daily wage labourers. Close to 3000 daily wage workers toil hard at this market, carrying goods from shops. But on Friday they wandered in front of closed shops, wondering the reason behind the shutdown.

Manoj Kumar, one of the daily wage labourers who are without work today as the market witnesses a complete shutdown (PC: Debayan Roy)

“I earn around Rs 300 to 400 per day. But there is no business today. I do not know anything about GST but I know that I would surely return empty handed to my family today,” said Manoj Kumar, a daily wager.

A few wholesalers defied the ban and kept their shops open. Chandra Mohan Kapoor, chairman of Vyapar Sangh Green Market, said, “Majority of these protesters do not understand GST. They are only looking at the 28% tax slab. What they are not looking at is that they will have input credits. All forms like H form, I form and statutory forms have been abolished. This has made business easy for us. I attended workshops, have the GSTIN and the invoices. The government has even given us the benefit that in the next two months if we make mistakes in invoices, or accounts, we would not be penalized.”

Comments

0 comment