views

Identifying the Executor or Personal Representative

Locate the will and identify named executor. When a loved one dies, it is important to determine if there was last will and testament and locate that will. Below are some ways to determine if there was a will and how to find it: Ask the decedent’s family. Always asking any surviving spouse or children whether there was a will and if they know where the decedent kept it. Check in the decedent’s files. If family members are unsure if there was a will or where it was a kept, ask them to show you where the decedent kept his/her “important papers.” You should also check the decedent’s home for filing cabinets, file folders or lock boxes/safes that may contain the will. Safety Deposit Box. Some people keep their important papers, including a last will and testament at a bank in a safety deposit box. A living spouse with a death certificate or a person listed as a joint beneficiary of the safety deposit box can gain access to the box for you. You should also check with the bank to see whether the decedent granted any other individuals the right to access the safety deposit box. Check with the decedent’s attorney. If the decedent had an estate attorney they may know where the decedent kept his/her will, have the original will, or have a copy of the will. While a copy cannot be submitted for probate, the copy may have notes about the location of the original will. Check with the probate court. Some probate courts allow people to file their last will and testament with the court prior to their death. You should call the county clerk in the location where the decedent lived and ask whether they maintain copies of wills.

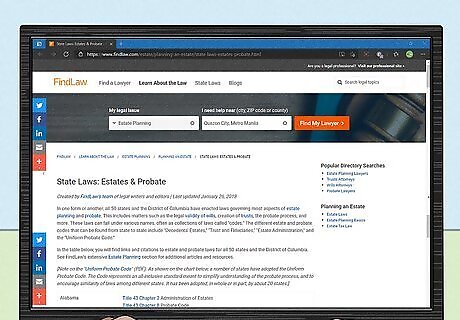

Determine who will act as personal representative (PR). A probate court may appoint a PR if there is no will or the executor named in the will refuses to serve. Before the court appoints a PR, family members may try to decide who they want to act as the personal representative. Generally, a spouse, child, parent, or sibling is chosen as PR. Some things to keep in mind when choosing a PR include: People convicted of a felony my not be legally allowed to serve as PR. You can check your state’s probate laws for any restrictions on PRs at http://estate.findlaw.com/planning-an-estate/state-laws-estates-probate.html. On the website, select your state and read through the relevant probate laws. Choose a PR who has enough to time to focus on the demands of the estate. More than one PR may be appointed, and the Co-Personal Representatives, as they are called, may be required to act together or each allowed to act on his or her own. A bank or financial institution may be appointed as PR or Co-Personal Representative. You can contact local banks to see whether they provide this service.

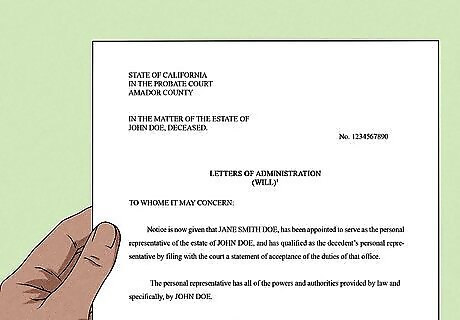

Have the court appoint a personal representative. The county probate court where the decedent lived can appoint a personal representative if the family is unable to decide who should act as PR or multiple parties want to act as PR. Contact the local probate court clerk and ask what steps you need to take in order for the court to appoint a personal representative. Courts will look at state law for guidance on who to appoint but typically the law will provide for the following people: surviving spouse, children, parents of the decedent, the decedent’s siblings, or the decedent’s grandchildren. Courts have final authority to name and approve a personal representative and issue “letters of administration,” which grants legal authority to control the decedent’s assets.

Evaluating the Estate

Determine if an asset is subject to probate. The only assets that are subject to probate are property that was owned solely in the name of the decedent at the time of death, such as a car or house, or property owned as “tenants in common.” “Tenants in common” is a legal relationship in which people share ownership in real property. There are a number of assets that are part of an estate but are not subject to probate, such as Assets owned jointly with a surviving spouse. Retirement accounts that have a named beneficiary. Life insurance proceeds that have a named beneficiary. Property held in a living trust. Co-owned savings bond. Pension distributions. Certain household goods designated under state law.

Inventory the estate. As PR you are required to identify all of the decedent’s assets. You should document the following: All real property, i.e. land and buildings that the decedent owned. Personal bank accounts. Personal investments, including retirement accounts, stocks, or bonds. Ownership interests in businesses. All other items owned solely by the decedent.

Calculate the value of the estate. Probate forms may require that you provide the value of the estate. In certain states, the law allows for a simplified probate process depending on how much the estate is worth. The higher the value of the estate, the more complicated and detailed the forms may be. To calculate the value of an estate documented in your inventory, follow these steps: Calculate the value of all of the decedent’s property identified in inventory. You may be required to use an expert or licensed appraiser for unique items or real property, as well as antique cars. For a standard car, you can assess the value of the car using Kelly Blue Book, located at http://www.kbb.com/. Calculate the value of all of the decedent’s debt. This includes all loans, mortgages, and debts that became due on or before the date of death. You may be able to identify the decedents debt by running a credit report. Subtract the value of the debts from the value of the estate. For example, if the value of the decedent’s property is $100,000 and the value of debt $40,000, you would subtract $40,000 from $100,000, so the value of the estate would be $60,000.

Determine whether the estate qualifies for a simplified probate process. Most states have a simplified process for small estates. Each state defines “small estate” differently so you should check your state’s probate laws for the definition of a small estate. You can find state probate laws at http://estate.findlaw.com/planning-an-estate/state-laws-estates-probate.html.

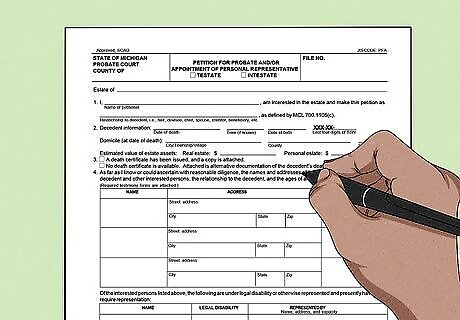

Filling Out Probate Forms

Locate relevant probate forms. Every county has slightly different forms or legal document formats that the PR or executor must use. There are several ways for you to locate the correct forms: Conduct an internet search. Search the internet for the name of the county where they decedent resided and the words “probate forms.” Most county courts have websites that will provide these forms for download, provide information on how to locate the forms, or contact information for the probate court. Check with the County Clerk or the Court. To get contact information for a county clerk’s office, search the internet for the name of the county where they decedent resided and the words “probate court clerk.” After locating the court’s website or address, you can call the probate court clerk and ask him or her what forms you need and where you can get them.

Provide the requested information. Typically, the first forms that an executor or PR will file with the court is a Petition for Probate/Appointment of a Personal Representative and Letters Testamentary/Letters of Administration. These forms begin the probate process and grant the PR legal authority to act on behalf of the decedent’s estate. The forms may require the following information: Decedent’s full name. If the decedent used any names other than his or her legal name, be sure to include this information in your Petition. Decedent’s address. Decedent’s date of birth. Decedent’s date of death. Personal Representative(s)’ names. Personal Representative(s)’ addresses. Personal Representative(s)’ telephone number. Number and names of heirs. If the decedent did not leave a Will, heirs can be determined by checking the decedent’s state’s intestate inheritance laws located at http://estate.findlaw.com/planning-an-estate/state-laws-estates-probate.html The value of the estate. The amount of each heir’s expected inheritance. An inventory of all personal and real property of the decedent. The inventory may or may not need to be filed with the Court. In all cases, you will need to provide a copy to the heirs. Signatures of the PR and/or the decedent’s heirs. If the forms require that a signature be notarized, have the person who is signing do so in front of a notary public.

Contact the Court Clerk. You should contact the probate court clerk if you have any questions about the paperwork or how to file your probate documents. These clerks work with the public regularly to ensure that their probate paperwork meets all of the necessary legal requirements.

Comments

0 comment