views

X

Research source

Registering Your Company as a PLC

Choose a name for your company. When you incorporate your company, it must have a unique name that sufficiently identifies the products your company sells or the services it provides to consumers. Use the UK's WebCHeck service to make sure the name you've chosen is unique and hasn't already been registered by another company. You can access the service by going to http://wck2.companieshouse.gov.uk/ Check registered trade marks as well to make sure your chosen name won't infringe on anyone's registered trade mark. You can search the UK's Trade Marks Register by visiting https://www.gov.uk/search-for-trademark.

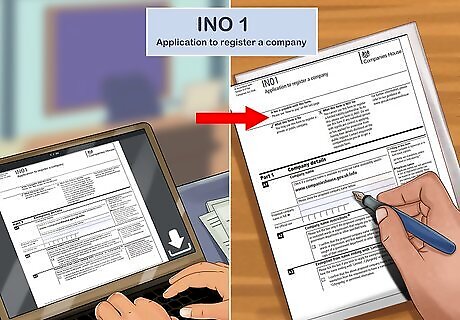

Complete an application to register your company. Your application provides basic information about your company, including the name of your company, the location of your company's registered office, and the type of company you want to register. You can view and download the application form at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/534915/IN01_V7.pdf. However, it's easier to complete the application online than to fill out and deliver paper forms. For a public company, you must have at least 2 directors and a qualified secretary. Qualified secretaries typically are chartered accountants or lawyers who have previously served as secretary for a public company.

Draft your memorandum and articles of association. You can draft your own articles or use the standard model articles provided in the Companies House regulations. If you use the model articles, you aren't required to adopt every single provision. Rather, you can adapt the articles to best suit the needs of your company and its members. Your articles of association are the governing document for your company. They set forth how the company is structured and provide rules for operation and procedures for making ownership and management changes. You may want to speak to a lawyer or accountant for advice on the drafting of your articles, particularly if you've decided to draft your own rather than using the model articles.

File your incorporation documents with Companies House. Once your articles and application are complete, you can submit them to Companies House either online or through the mail. If you deliver paper documents, they should be on white, A4 sized paper. The fee for incorporation is £10 for software filing, £12 for web-based filing, or £40 for paper filing. You may expedite service by paying £30 for software filing or £100 for paper filing. There is no expedited service for web-based filing. If you adopted the model articles in their entirety, you don't have to include a copy of your articles with your incorporation documents. When your application and documents are received and approved, you will receive a certificate of incorporation. This certificate proves that your company is duly registered and complies with UK corporations law.

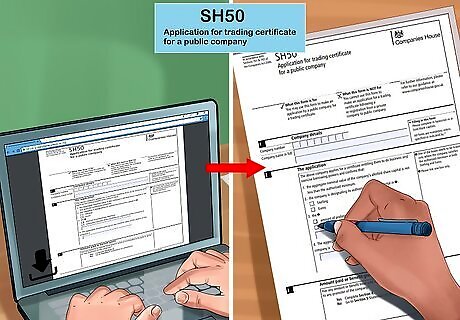

Apply for a trading certificate. Before you can start doing business as a PLC, you must have a trading certificate issued by Companies House that confirms you've met the minimum statutory requirements for share capital. PLCs must have at least £50,000 in allotted share capital, at least 25 percent of which is paid in full, before they can begin trading. Download the trading certificate application form at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/533451/SH50_v5.pdf.

Maintaining Records and Accounts

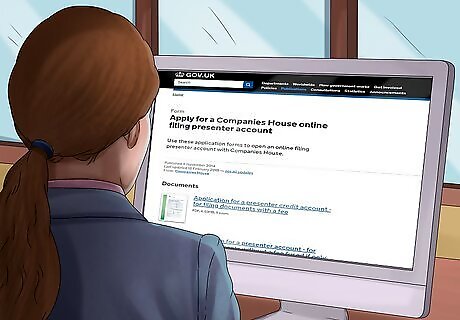

Use approved software to manage your accounts. If you manage your accounts and payroll with software approved by Companies House, you can use the same software to submit accounts and tax returns easily. When shopping for accounting software, look for a statement from the software provider or manufacturer that the software has been approved by Companies House. You can also used web-based filing with Companies House for free. Go to https://www.gov.uk/government/publications/apply-for-a-companies-house-online-filing-presenter-account to fill out an application.

Audit your accounts at least once a year. PLC accounts must be audited by a qualified independent accountant every year. The accountant must have an audit-practicing certificate issued by a supervisory body recognized by Companies House. If you already have an accountant who is not an officer or employee of your company, they may be able to perform your annual audits. Ask them if they have a current audit-practicing certificate. If they don't, they may be able to recommend someone who does. The auditor will produce a report, which must be filed with Companies House.

Submit your accounts and tax returns to Companies House each year. Tax return and account documents must be submitted to Companies House every year, even if your company is dormant or did not earn any income. Your accounting records must include entries for any and all money flowing into and out of your company, as well as a statement of your company's assets and liabilities. If you sell goods, your accounting records also must include information about your inventory and goods sold and purchased wholesale.

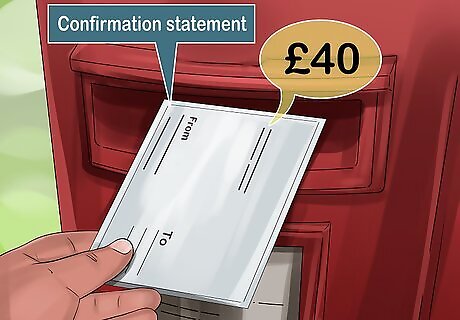

File your confirmation statement annually. The confirmation statement is used to verify that the information Companies House has in its records about your company is correct. Details include your registered office, directors, secretary, and the location where your business records are kept. As a PLC, you also must confirm capital and shareholder information. You can mail in a paper confirmation statement, or file it online. If you mail a paper statement, include payment of the £40 filing fee. The fee is only £13 if you file online.

Notify Companies House of structural or managerial changes. If any directors resign, or new directors are appointed, provide their names and contact information to Companies House as soon as possible. You should also notify Companies House if you change the company's registered office. If you amend your articles, you must file a copy of the special resolution of amendment along with a copy of the amended articles. These documents must be filed within 15 days after the date the resolution passed.

Paying Taxes and National Insurance

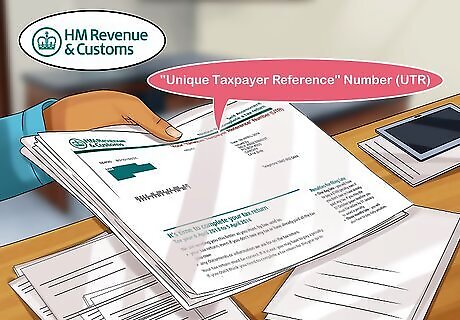

Receive your company's Unique Taxpayer Reference (UTR). Within a few days after your company is registered with Companies House, HM Revenue and Customs (HMRC) will mail your company's UTR to the address of your company's registered office. If you don't receive your UTR within 5 to 10 business days after registration, call the HMRC helpline at 0 300 200 3410. The number operates Monday through Friday from 8:00 a.m. until 6 p.m. Lines may be less busy first thing in the morning.

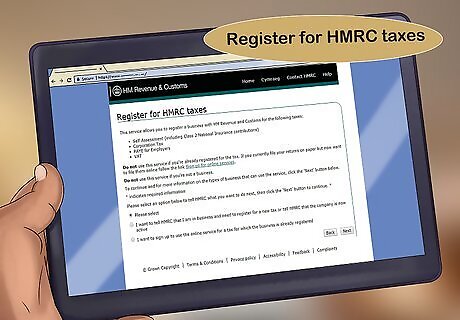

Register for Corporation tax. You must register for Corporation tax within 3 months of the date you start doing business, or you may have to pay penalties. Simply advertising or hiring employees counts as "doing business" for these purposes. You can register for Corporation taxes online at https://online.hmrc.gov.uk/registration/newbusiness/introduction. When you register, you'll need to provide HMRC with your company's UTR, the date you started doing business, and the date your annual accounts are made up to (your accounting period).

Register for PAYE. If your PLC has employees, you must operate PAYE and deduct taxes and national insurance from your employees' paychecks each period. It can take up to 5 days to get your employer PAYE reference number, so plan ahead. To register with PAYE as an employer, go to https://www.gov.uk/register-employer and follow the instructions. You can either use a payroll provider, such as a payroll agency or an accountant, or you can buy payroll software and do it yourself.

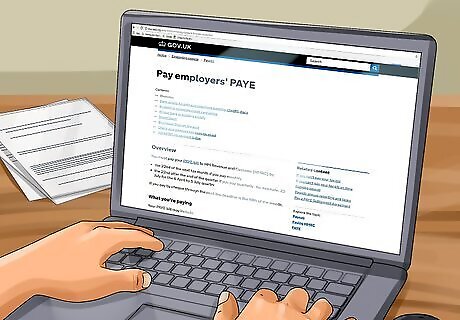

Report and pay employee payroll taxes each month. Employees' payments deducted from their paychecks must be reported to HMRC on or before each payday. Your payroll software (or your payroll service provider) will work out how much you're supposed to deduct from paychecks using the information you and your employees provide. Payroll taxes must be paid by the 22nd of each month. If you find that your payments are typically less than £1,500 each month, you may be eligible to make quarterly payments instead of monthly payments. Call the payment helpline at 0 300 200 3401. There are a number of different methods you can use to pay payroll taxes. To choose the one that works best for you, visit https://www.gov.uk/pay-paye-tax.

File company tax returns. When you register to pay Corporation tax, HMRC will provide you with the deadline for filing your company tax returns. You will also receive a notice before your returns are due. You can hire an accountant to prepare and file your tax return for you if you're not comfortable doing it yourself. Generally, tax returns must be filed within 12 months of the end of the accounting period covered by the tax return. Any taxes owed must be paid within 9 months and 1 day of the end of the same accounting period. You must file a tax return even if you didn't earn any profits, or don't have to pay any taxes for that tax period.

Comments

0 comment