views

Purse your career goals starting now.

If there are ways to improve your future earning power, pursue them. Don’t put off college, grad school, or that certification course you’ve been meaning to take to get that big promotion at work. It’s hard to save enough money to retire comfortably if you never make enough money to save, so do whatever you need to do to improve your earning potential in the future, now. Network early and often. You never know how an acquaintance or new friend will be able to help you out in the future when it comes to the scoop on big clients or openings at new jobs. Learn some new skills that you could parlay into a raise or promotion in your field. For example, if you’re a graphic designer, learning how to code will make you marketable as an “all in one” website builder! If you’re not in your “forever” field, it’s time to set up that job alert and revising your resume. Don’t waste your time doing something you can’t grow in. If you are working in your field of choice, talk to your boss about what you’d need to do to earn a promotion.

Create multiple sources of income.

Turn your downtime into some spare cash with a side gig. Weekends and weeknights can be great opportunities to make some money. Whether it’s driving for a rideshare service, or delivering pizzas for a local pizza joint late at night, find a way to make some extra dough! If you have a hobby or passion you can use to get paid, do that. Selling things you create (or buy cheaply) on Etsy or eBay can give you easy additional money. Alternatively, if you have a goal of starting your own business, you can invest your spare time now to begin developing it.

Pay off any high-interest or unsecured debt ASAP.

Before you start preparing for retirement, clear any nasty debts. All debts are not created equal. A student loan should pay for itself over time, and a mortgage is certainly a productive way to buy a home. But you should clear any high-interest debt fast, since carrying the balance over time will make it harder and harder to clear. Basically, if the interest rate is over 5%, get it off of your books fast. Unsecured debt refers to debt that isn’t tied to any collateral. This applies to things like personal loans and credit cards. These are nefarious because the debt just snowballs out of control, so don’t hold these balances for very long if you can avoid it. Interest rates are relative depending on the market environment, but these days, a high interest rate is generally considered to be >4%.

Hold off on the credit cards if you can’t pay them off.

Credit card debt is the fastest way to fall behind. The interest rates are typically very bad for you on credit cards, so do not use them unless you can pay the balance off in full every month. If you can pay the balance in full every month, credit cards can be a great way to earn free travel points and things of that nature. They’re also a great way to build your credit score. But you have to be disciplined about using them responsibly. Minimum payments are absolutely awful. You might feel like you’re making progress paying down debt on a minimum payment, but you’re usually just barely scratching the surface. It can take years to pay off a simple $100 or $200 charge if you just make minimum payments.

Build the habit of saving early on.

Saving money is a lot easier if you can turn it into a habit. For a lot of folks in their 20s, saving is tough. Maybe you aren’t making enough money to save yet, or maybe it’s hard because you’ve never really saved before. However, the earlier you start getting ready for your retirement, the easier it will be. Hold yourself to the goal of saving a certain percentage of every single paycheck. Eventually, it will just become muscle memory and saving will be a breeze. You can always set up automatic transfers at your bank to move a percentage of each paycheck into a savings account. The more you can save the better, but aim to save at least 15% a year for retirement. Pretend you make $60,000 a year and start saving at 20. That’s $9,000 a year. If you retire at 66, you’ll have amassed nearly half a million dollars for retirement! If you can’t save 15%, at least save 5-10%. Some savings are better than no savings at all!

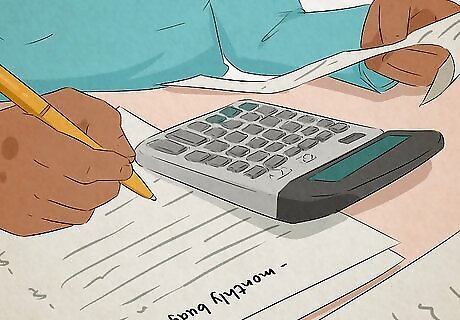

Keep yourself accountable by budgeting.

Set a budget and stick to it unless there’s an emergency. The simplest way to do this is in a spreadsheet, but there are all kinds of fancy apps out there to help you with this. Basically, you track all of your income and expenses every month to ensure that you aren’t going into debt, chewing into your savings, or spending unnecessarily on things you don’t need. The other goal here is to never ever touch your savings unless there’s some kind of serious emergency. If you don’t budget, you may lose track of how much you have saved, or overspend to the point that you have to dip into your savings. Mint, YNAB, and Goodbudget are all popular apps that will track your spending habits and alert you when you’re coming dangerously close to overspending. Monitor your spending habits. If you notice that you’re overspending in one area, you can adjust your budget expectations or your behavior to maintain more control over your finances.

Live well below your means.

Maybe you can afford something, but do you really need it? When you’re just getting started in your career, it’s tempting to spend all of this money you never had when you were in college or high school. Just because you can afford that sick car or sweet apartment in the hippest neighborhood doesn’t mean that you should get it. The less you spend early on, the more room you have to grow that money into something much better later on! Don’t save your credit card information on online shopping sites. This will force you to rethink each purchase before you make it. Get a bike or take public transit. Between insurance, repairs, and gas, vehicles are expensive! Avoid eating out as much as possible. It’s much cheaper (and healthier) to cook at home than it is to go to a restaurant.

Begin investing once debts are paid and you’ve saved a bit.

Start investing in the market once you have 3-9 months of living expenses saved. The earlier you invest, the faster you can start taking advantage of compounding interest. As you receive dividends and experience growth, you can reinvest that money to continue growing it at an exponential rate! Start funding some brokerage accounts (401(k), IRA, and/or taxable) to invest it. You won’t earn very much in interest with a savings account, so you don’t want everything sitting in there if you’re going to keep up with inflation. You know how you’ll hear about $100 in 1920 being the equivalent of $1,500 or something today? That’s inflation. Basically, as the government prints more money, the value of all other money diminishes a little bit. On average, inflation increases roughly 2% a year. With 2% inflation, that means that if you save $10,000 today, it will be worth roughly $9,800 next year. Unfortunately, a savings account only pays out roughly 0.3-0.5% (as of 2021). How can you make the rest of that up? Investing! The average yearly return on the US stock market is roughly 10%. If it’s 10% why not invest everything, you ask? Well, savings accounts are liquid. If you have to dip into invested funds, you’ll need to pay taxes on them, and it takes longer to get that money anyway. When it comes to investing, everyone's situation is different, but generally, it's a good idea to invest in index mutual funds like the S&P500.

Max out your 401(k) plan if you have one.

The 401(k) is one of the best retirement vehicles available. Unfortunately, you have to work somewhere that offers a 401(k). If you do though, talk to your HR and set your paychecks up so that a percentage of your pay goes automatically to your 401(k) up to the company’s matching percentage. Basically, every time you put aside money for retirement, your company will match your contribution. It’s free money! If you ever find yourself self-employed or opening a small business, talk to your brokerage or bank about opening a self-directed 401(k). If your job doesn’t offer a 401(k), that’s okay. You still have other options at your disposal to save for retirement! You can go beyond whatever your company’s match is if you’d like. It’s not always advisable though, since you don’t get any “free” money matching your contributions and you don’t get to choose what that money is invested in.

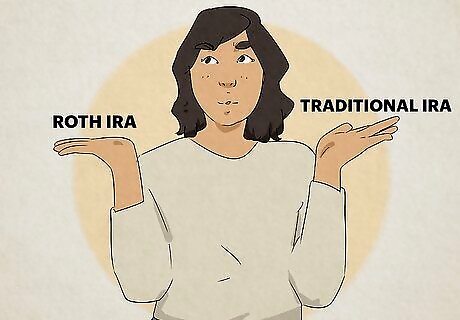

Choose between a ROTH and traditional IRA.

After a 401(k), the IRA is a cornerstone of any retirement plan. IRA stands for Individual Retirement Account. They’re tax-free retirement vehicles, and you must open one if you want to retire in comfort. You can’t have more than one IRA, so you’ll need to choose between a ROTH or a traditional IRA. The difference is that with a ROTH, you pay taxes now, but don’t owe any later. With a traditional, your funds are taxed when you withdraw them, but not when you deposit them. They’re both great though, so you can’t go wrong here. Anyone can have a traditional IRA, but you can’t use a ROTH if you make over $120,000-135,000 a year or more. A ROTH is probably ideal for you if you aren’t making a ton of money. You can withdraw your underlying contributions without penalty under certain conditions with a ROTH, while you’ll pay a fee with a traditional. If you’re worried about the tax rates when you’re retiring, a ROTH is likely better for you. If you think future taxes may be lower or you won’t need to worry about the taxes eating into your retirement, you might prefer a traditional IRA. Both of these IRA options are good. Even if you “pick the wrong one,” you’ll be fine!

Open an IRA and max it out every year.

Contribute the maximum yearly amount to your IRA. Find a reputable brokerage you’d like to work with (Schwab, Fidelity, and Vanguard are popular in the US), and max out the contribution every year. As of 2021, you can only contribute $6,000 a year, but the tax advantages are so great that it’s still worth doing. Once your account is funded, select your investments! Just to point out how key these accounts are, pretend you invest in the S&P 500—the 500 biggest companies in the United States. Historically speaking, you’ll get about 10% a year. If you max the IRA every year from 20 to 65, you’ll retire with somewhere between 3.5 and 4 million dollars. Seriously. That’s the power of compounding interest!

Put your leftover capital in a taxable brokerage account.

With the IRA and 401(k) maxed, you may have money left over. Open a taxable brokerage account and invest the remainder of your savings there. Taxable accounts aren’t sheltered from taxes, but you only pay capital gains taxes when you sell anyway. Since you’re going to be holding your investments for decades to come, you don’t need to worry about this. It’s still preferable to invest the funds for later, even if they’ll be taxed. Do not start actively trading with your leftover funds. It can be tempting if you hear stories of people making it rich in the stock market, but 97% of traders lose more money than they start with!

Prioritize growth funds, ETFs, and stocks.

Time is on your side, so invest in securities that have a lot of potential. “Growth” stocks refer to companies and funds that have a lot of upside. The opposite of growth is “value.” Value stocks are low-risk, safer investments. However, they probably won’t appreciate as much as growth stocks over the course of your lifetime. There will be a place for these investments later as you get older, but in your 20s, growth is probably better. ETF stands for exchange-traded fund. They’re basically baskets of dozens (sometimes hundreds) of individual stocks, and they’re perfect if you don’t want to risk gambling on individual companies. You can even buy ETFs that track the entire US market to lock in that average yearly return of 10%. Don’t bother with bonds just yet. Bonds are safer than stocks, but the volatility shouldn’t be an issue when you’re in your 20s and the riskier growth in stocks should eventually pay off. You shouldn’t be touching this money for years to come, so don’t worry if you see some red days in your portfolio.

Adopt a “set it and forget it” attitude.

Don’t fixate on your investments and just keep contributing. It’s easy to see the money growing and get fixated on tinkering with your investments, but that’s usually a bad idea. So long as you’re making sound investments, just keep buying in regular intervals and leave it alone. It will take decades for this money to grow, and you don’t need it now, so forget about it! If you’ve had a red year and you’re behind in the market, which will happen every now and then, just keep buying and dollar cost average (or DCA). Think of it this way. If you buy a thing for $10, then buy it later once it falls to $5, what did each item cost you? Only $7.5! By averaging down, you lower your risk over time.

Take calculated risks with a small portion of your portfolio.

It’s better to take risky investments when you’re young. That way, if you’re wrong, you have time to make the ground you lost back up. Risk can be your friend if the returns are solid and you can stomach the volatility. If you want to invest in cryptocurrency, tech startups, or speculative companies, you can. Just don’t overdo it and make sure you aren’t making these investments more than 5% of your overall portfolio. There’s a phrase, “Never invest more than you’re willing to lose.” Remember, risky investments are risky. This is why you keep it small and always do your due diligence so that you understand what you’re investing in.

Consider FIRE if you want to retire early.

If you want to potentially retire by 40 or 50, look into FIRE. FIRE stands for financial independence, retire early. It’s a kind of intense way to go about living your life when you’re in your 20s and 30s, but it can pay off big in the end. The premise is that since compounding growth and interest are so valuable, you should sacrifice as much as you possibly can to invest and save as much as humanly possible today. Here’s what you might do: Aim to save 70% (yes, 70%) of your yearly income. If you make $80,000 a year, live on $24,000. Never eat out, don’t drink, find free hobbies you enjoy, and live in the cheapest acceptable housing possible to curb costs everywhere. Invest at least half of your annual income in aggressive growth stocks. Transition more to a dividend-style portfolio as you get older. FIRE is not for the faint of heart. You’ll sacrifice a lot of the traditional stuff that people often get out of bed for, but if you can amass a large enough portfolio, you may be able to retire very early.

Comments

0 comment