views

"You must be mad," thundered 82-year-old Catherine Paver when her son Stuart broached the idea of selling shoes in India in 2007. "Why can't you concentrate on what we know works?," she asked.

Catherine was referring to the £100 million shoe retail business she had built since 1971. With a £ 200 bank loan, she had begun by throwing shoe parties and then moved to selling them in huge warehouses before setting up 160 retail stores in the UK and Ireland. Forty years on, the business, Pavers Shoes, was growing at 25 percent, far in excess of market growth, and she couldn't see any reason for them to take a risk half way across the world.

On the other hand Stuart, it seemed, wanted to throw it all away. After all, theirs was a small business that gave the family about £10 million in profit every year. All of that money is ploughed back into the business.

A Maze Called India

It's not that her fears were not well founded. In 2002, Stuart's brother Ian, who handles buying for the company, impressed with the enthusiasm of Indian suppliers, started sourcing materials for Pavers Shoes from India. The suppliers would say ‘yes' to every order for insoles, toe caps and mid-soles, but would rarely deliver on time and in the desired quantity. After three frustrating years, the company stopped doing business with them, with Ian vowed never to come back.

But Stuart, acutely aware that the company had missed out on the China opportunity, didn't want to give India a miss. So, on a whim, he winged his way here and decided to see things for himself. While strolling down Linking Road in Mumbai, he saw how disorganised shoe retailing was. Retailers would often do stock checks once a season and had no clear record of what was selling.

Stuart realised that in this market Pavers does not have to be perfect to succeed. "All we had to be was better than the others," he says. "The market was at a place that would give us enough time to understand and learn from our mistakes."

Four years on, the company has 12 exclusive franchisee stores and 65 points of sale in India. Pavers plans to add another 20 franchisee stores this year. Revenue from sales has been doubling every year, and now stands at Rs 38.5 crore. If things go according to plan, Pavers India says it should close the decade with a billion dollars (Rs 4,500 crore) in sales. That figure - Rs 4,500 crore - is what analysts say India's entire footwear market is approximately worth right now. Of that, the organised shoe market is 20 percent.

One company, Bata India, accounts for a third of all shoes sold in India. Last year, its sales stood at Rs 1,277 crore. It also had the country's largest network of 1,250 retail stores spread across 400 cities. India's second largest listed footwear company Mirza International, the makers of Red Tape shoes, had revenues of Rs. 472 crore last year.

Growing Step by Step

Pavers has grown in excess of 100 percent every year in India, with the market for premium shoes growing at 40 percent. By contrast, Bata, which sells mainly mass market shoes, saw sales rise 15 percent. Pavers' growth rates indicate that it is beginning to attract the Indian consumer.

In 2007, Stuart knew India could allow the company to grow a lot quicker. But he needed to test his hypothesis. That's when he turned to Belle International, which had been set up in 1991 in Guangzhou, China. In 20 years, Belle has built a network of 12,000 stores and makes 50 million pairs of shoes every year. Pavers represents Belle's Staccato brand in the UK. Stuart Paver knew if anyone could help him understand scale and high growth rates, it would be the head of Belle.

He brought Belle Senior Vice President Hu Bing to India for a market visit and to help set up operations and strategy. After a week, his message was unequivocal: "The Indian market is where the Chinese market was 15 years ago. Start operations in India and then ride the consumption wave."

Thereafter things moved swiftly. Stuart reckons Clarks Shoes, Pavers' main UK competitor, was 20 times as large as Pavers 10 years ago. Now they'd managed to narrow the gap to 10 times. If Pavers was to surpass the company in Catherine Paver's lifetime, they had to get to India. Moreover, he reasoned that even if the India bet went wrong, an initial investment of £ 5 million wouldn't kill the company. (Pavers, which has entered India in partnership with the $ 500 million Foresight Group, has committed a total investment of £ 60 million, according to Utsav Seth, managing director, Pavers India.) So far, the company has invested $ 27 million.

Pavers identified some key strategies for India. First off, Stuart kept his brand price positioning slightly above Indian brands like Lee Cooper and Woodland but lower than the available international brands like Gioxx and Ecco. According to Jagdeep Kapoor of Samsika Consultants, a brand consultancy, the decision to buy shoes is largely based on aspiration and the company has done a good job by positioning itself between Indian and foreign shoe companies.

Another key insight: Sell what the market already buys and don't try and change a habit as that takes a long time. In India, lace-up brogue-style formal shoes are the most popular and the company found that this is a particular favourite among bankers. It's no surprise that Pavers' top selling shoes in India are black formal shoes priced between Rs 4,000-6,000. Akash Sehgal, who heads Landmark Group's Shoe Mart, says Pavers' shoes are selling as well as brands like Lee Cooper, which have been around for a decade.

Third, the fragmented and the underdeveloped nature of the shoe supply-chain in India posed a huge potential problem. Belle, with its two decades of experience in the rapidly growing Chinese market, advised Pavers against entering the Indian market with a large stock. According to Shirley Shan, head of international business at Belle, a company must always start small and then replenish quickly.

But knowing what sells is only half the battle won. Replenishing stores is another key challenge. This was one area where Pavers thought it better to over-invest. It spent $ 6 million in setting up a research and development facility in Ambur, a town known for its leather factories in Tamil Nadu. Two-thirds of India's leather exports came from Ambur. Here, the company has its own computer-aided design system in place. At the facility, Pavers has also set aside one production line to work as a quick repeat line allowing it to make fast selling shoes in 28 days. For traditional shoe companies, this response time is usually three months.

Getting shoes to stores in time presented another challenge for Pavers. "Our challenge was to manage growth with the investment in the back-end infrastructure," says Seth. Shoes are a complex retail business due to the number of stock keeping units a store has to keep. Each shoe comes in 10 different sizes and different colours. Ideally, a store must keep at least two pairs of each. This results in 3,000-4,000 shoe boxes in the average shoe store. Managing inventory is what often sinks shoe companies.

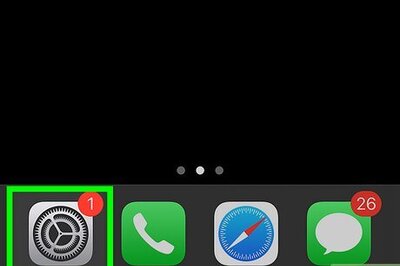

According to Stuart, when consumers don't find their size, they rarely come back; it is usually a lost sale. The company invested in an enterprise resource planning (ERP) system that, by their own account, took 14-15 months to get working. It leased space in a warehouse in Bhiwandi, on the outskirts of Mumbai, where most of its stocks are kept. And to make sure goods reach stores on time, it also leased space in the city at Andheri. Now, the moment a sale is made, the ERP system gets updated and shoes are picked from the warehouse at night to be replenished in the store the next morning.

Next, Pavers realised that functioning from multi-brand stores was not a strategy that would work in the long-term as they were not able to get their brand sufficiently noticed in the clutter. But Stuart has now managed to get into leading malls in the country as well as high street locations like Khan Market in New Delhi. The company plans to more than double its number of stores to 40 this year. It has also set up airport stores in Mumbai and Bangalore to cater to business travellers who are hard-pressed for time.

One issue that Pavers still faces is with advertising. At Rs. 38 crore, the company is still too small and thinly spread to have a significant advertising budget. As a thumb rule in India, unless a national brand spends Rs. 10 crore in advertising, it is rarely noticed by consumers. In its first year, the company spent Rs 1.5 crore in advertising and got nothing in return. The per shoe cost worked out to more than Rs. 22,000. "I would have been better giving cash with the shoes," jokes Seth. Pavers has tied up with Jet Airways and Cathay Pacific to offer discounts to buyers.

For now, Stuart knows he's had a successful start to the India business. As for Catherine Paver, she can see the India opportunity, but still says, "Why not concentrate on the UK?"

Comments

0 comment