views

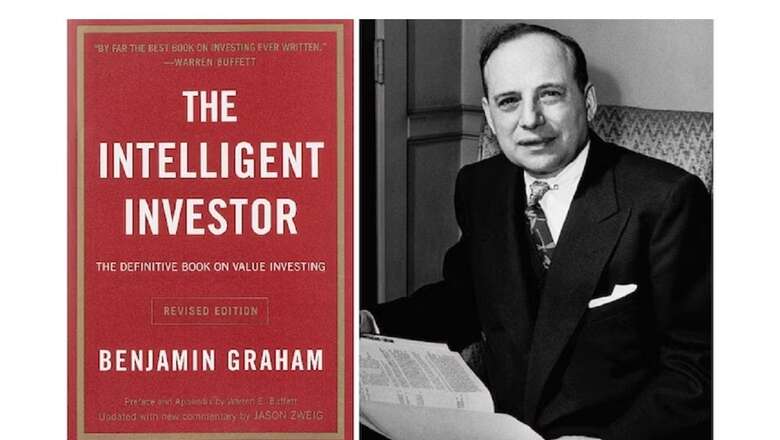

Stock Market Investing Tips For Retail Investors: As shown in the recent growth in new demat accounts, retail investors’ participation is increasing in the Indian stock market. Online brokerages like Zerodha and Groww have made it easier for retail investors to buy and sell shares and track them in a hassle-free manner. Here are 10 lessons from the stock market classic book ‘The Intelligent Investor‘ by Benjamin Graham for stock market investing.

Investing Vs Speculation

The Intelligent Investor emphasises on the difference between investing and speculation. It says speculators focus on short-term price trends, while investors aim to achieve long-term, stable returns after a fundamental analysis of a company. Fundamental analysis includes evaluating a company’s business, its net profit, revenue, prospects, business foundation, debt, etc.

When To Buy Shares

Benjamin Graham in The Intelligent Investor advises investors to buy shares when their prices are below their intrinsic value. This ‘margin of safety’ will minimise the risk of loss due to unforeseen events or market fluctuations.

Calculate Intrinsic Value

The book advises investors to evaluate the shares’ intrinsic value based on the company’s fundamentals, rather than market sentiments about the shares.

‘Mr Market’

Graham introduces the concept of ‘Mr Market’. Mr Market is an imaginary investor who is driven by panic, euphoria, and apathy. Graham said investors should use Mr Market’s mood swings to their advantage, rather than being swayed by them.

Long-Term Investment

Graham advises investors for a long-term perspective in investing. Long-term investment can lead to better results over time.

Diversification

The Intelligent Investor advises investors to diversify their investment portfolio. It means rather than investing the whole money into one stock or one sector or one asset class, investors should divide the investment amount into various companies, sectors and asset classes (like gold, real estate, debt, and equity).

Bonds Vs Shares

The book distinguishes the difference between shares and bonds. It highlights that stocks have the potential for higher returns but greater risk, while bonds offer stable returns but lower growth potential.

Emotional Discipline

The Intelligent Investors advises investors to be rational while investing, rather than emotional. It says emotional decisions often lead to poor investment outcomes.

Active Vs Passive Investing

Graham says active investors seek to outperform the market through careful stock selection, while passive investors invest in funds linked to indices.

The decision between active and passive investing depends upon investors’ individual preferences, knowledge and time horizon.

Conduct Research

The book encourages investors to conduct thorough research before making investment decisions, including analysing the company’s financial statements, competition position, and long-term prospects.

Comments

0 comment