views

We often hear stories about how ace investors have made a fortune from the equity market. It is with starry-eyed fascination that many people look up to these titans of the stock market. What is it that makes them succeed, and what is the secret sauce to their success?

In this article I’ll be looking at the portfolio returns of Rakesh Jhunjhunwala, a Mumbai-based stock trader/investor and well-known name in Dalal Street, and that of a layperson’s portfolio if they’d followed the investment principles I’d detailed in a May 7 article in Moneycontrol.

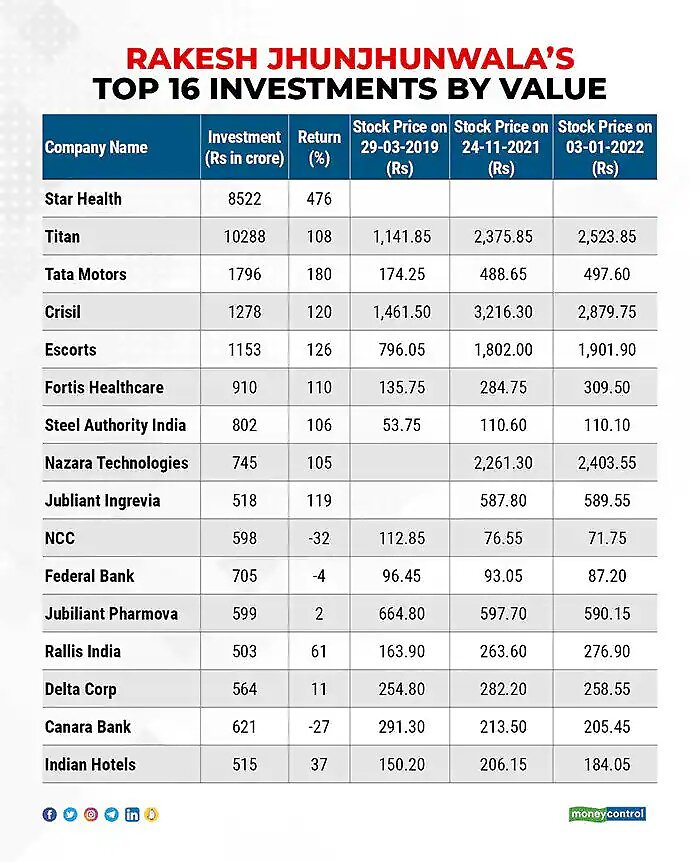

Recently a media article detailed Jhunjhunwala’s key investments. The table below list of his most valuable investments.

A few things stand out from the holdings, which incidentally is also what academics recommend with respect to building an optimal portfolio:

Limited stocks in the portfolio: In terms of value, these select 15-odd stocks form the majority of investments (~60 percent of investments)

Diversification: The portfolio is well-diversified to include companies in IT, FMCG, BFSI, Commodities, Pharma, Auto, etc.

Weightages as per strategy: High conviction ideas have concentrated bets

Minimise losses, maximise gains: There are some loss-making investments, but the high-performing ones outweigh them

Return Calculation And Comparison

As per the table above, Jhunjhunwala’s portfolio (excluding investments in Star Health) has delivered a weighted average absolute return of ~96 percent between March 29, 2019 and November 24, 2021, compared to Nifty’s ~50 percent returns during the same period. This further highlights the benefits of following the tenets of portfolio construction.

In the May 7 article, I had highlighted how a lay person can optimise portfolio returns by tracking the interest rates. Let’s compare the returns of a professional investor (as seen above) and that of a layperson if he/she had adopted the approach as per the article.

According to the article, an individual would have earned more returns through debt between November 2013 and May 2020, and more returns in equity starting June 2020. So with respect to the period under comparison, the lay investor should have focused on debt starting from March 29, 2019 till May 2020, and starting June 1, 2020 he/she should have moved to equity.

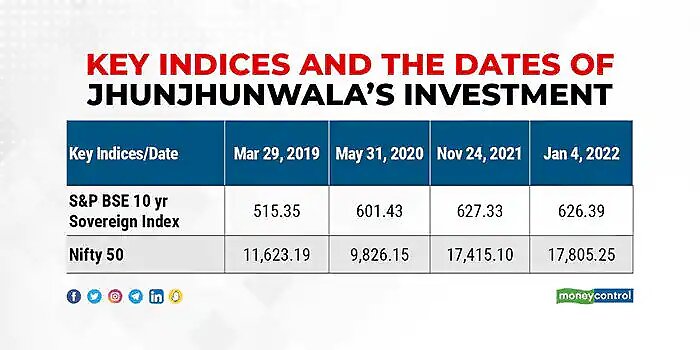

To recalibrate the asset allocation decision as per the investment cycle to the specific dates as mentioned the in the above table, I detail the key indices below to match the dates of Jhunjhunwala’s investment.

The gains in the debt index was ~17 percent between March 29, 2019 and May 31, 2020. Assuming 30 percent taxation (due to STCG), the net return would be ~12 percent. Starting June 2020, the return till November 24, 2021 Nifty yielded 77 percent returns. This translates into a combined returns of 98 percent ((1+12 percent)*77 percent).

The return profile marginally changes if recalibrated to January 4, 2022. As on date, the return of the professional investor would be 104 percent, while that of the individual investor be 102 percent.

I’ve have taken only the index to detail the returns for the layman investor. However, as per www.moneycontrol.com, 17 of the 26 large cap direct investment schemes (above Rs 100 crores AUM) delivered returns higher than 77 percent. Similarly 14 out of 16 schemes’ return profile under the Gilt Fund (direct investment) category were also higher than the debt index between March 29, 2019 and May 31, 2020.

Thus, a layperson can not only outperform the market but also match a professional investor if they follow a process and be patient with their proven investment strategy/decision.

Key Assumptions

The above calculations do not factor in investments made in Star Health in order to make like-for-like comparison. Also, we do not know the returns of the balance 40 percent of the professional investor’s portfolio, and nor about the debt/equity-related asset allocation.

The comparison/conclusion is in no way to belittle the achievement of the professional investor. The objective is to provide encourage the average lay investor to apply investment logic to optimise returns on their portfolio/investments even through traditional investment vehicles such as index funds.

The period considered for comparison is random, and predominantly based to match the article period with respect to the investor’s portfolio.

Shankar K has two decades of experience in equity research. Views are personal and do not represent the stand of this publication.

Read all the Latest Business News here

Comments

0 comment