views

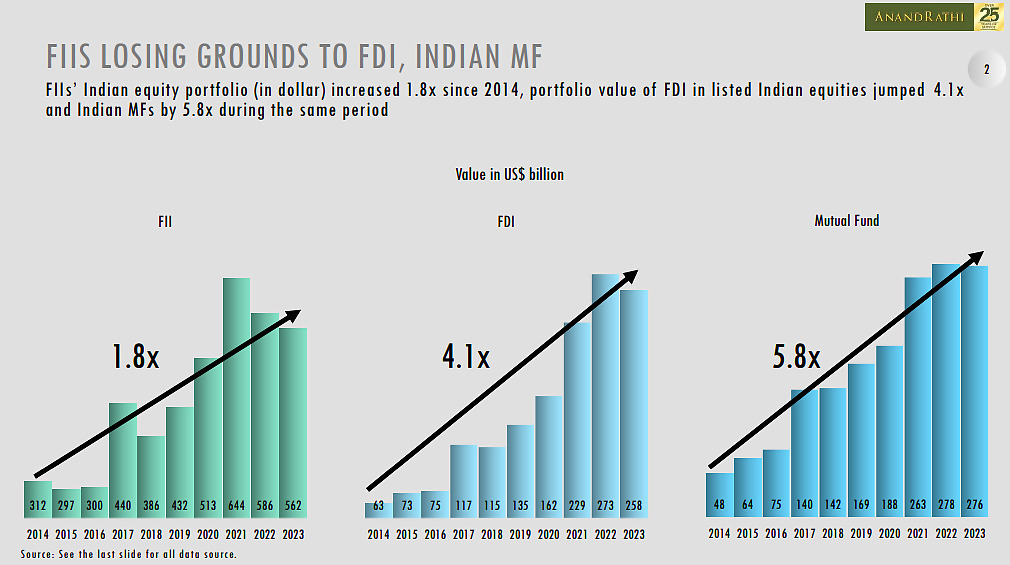

Foreign Institutional Investors (FIIs) seem to be losing ground to Foreign Direct Investment (FDI) and Indian mutual funds.

According to a report by Anand Rathi Shares and Stock Brokers, FIIs’ Indian equity portfolio (in dollar) increased 1.8x since 2014 and portfolio value of FDI in listed Indian equities jumped 4.1x and Indian MFs by 5.8x during the same period.

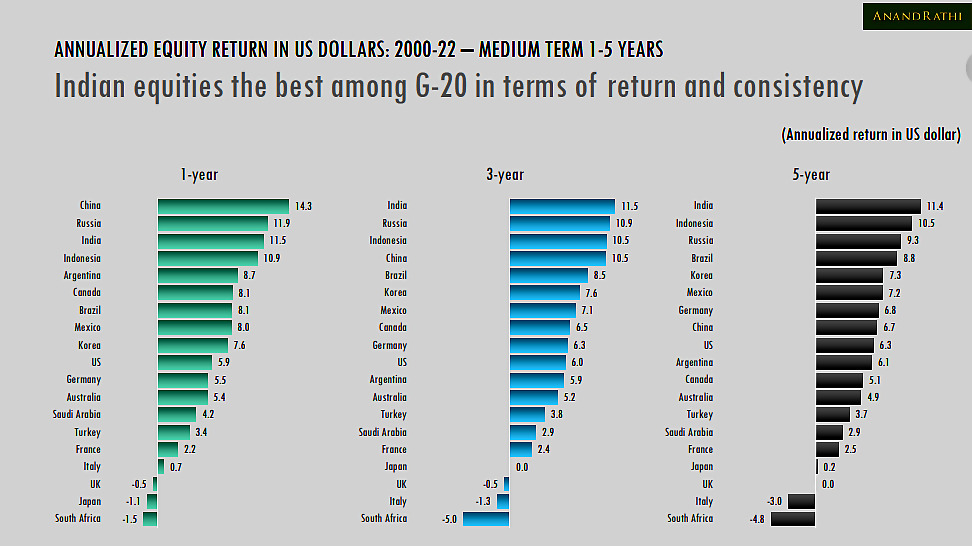

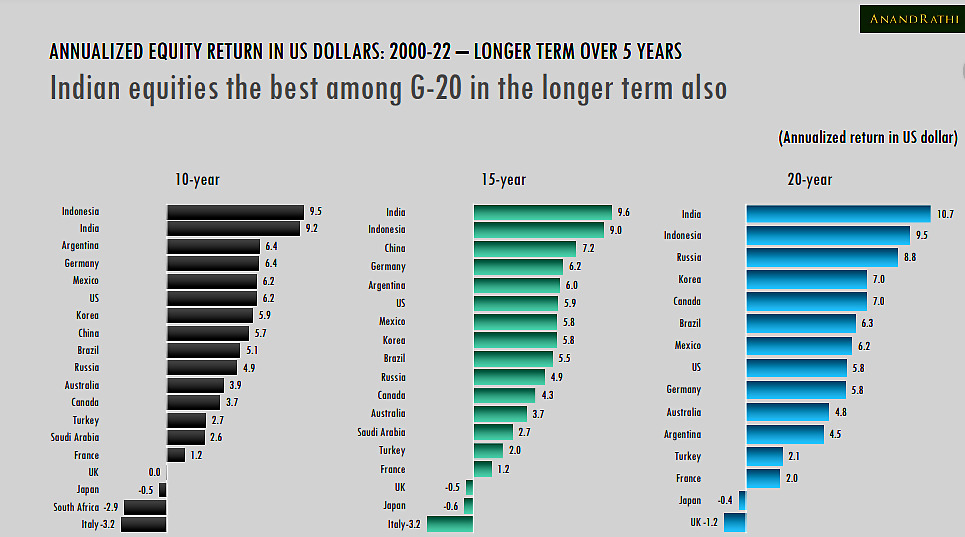

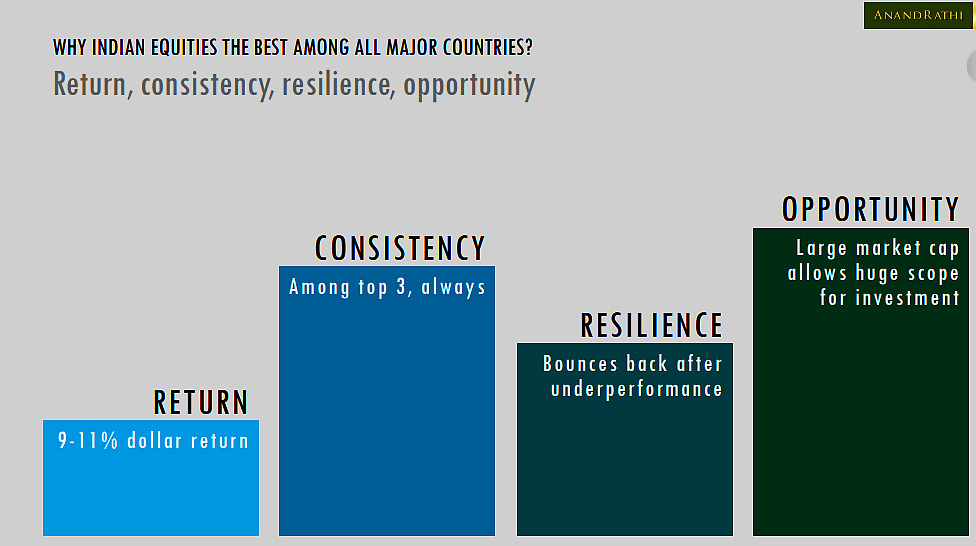

Indian equities are best among G 20 in terms of return and consistency, it added.

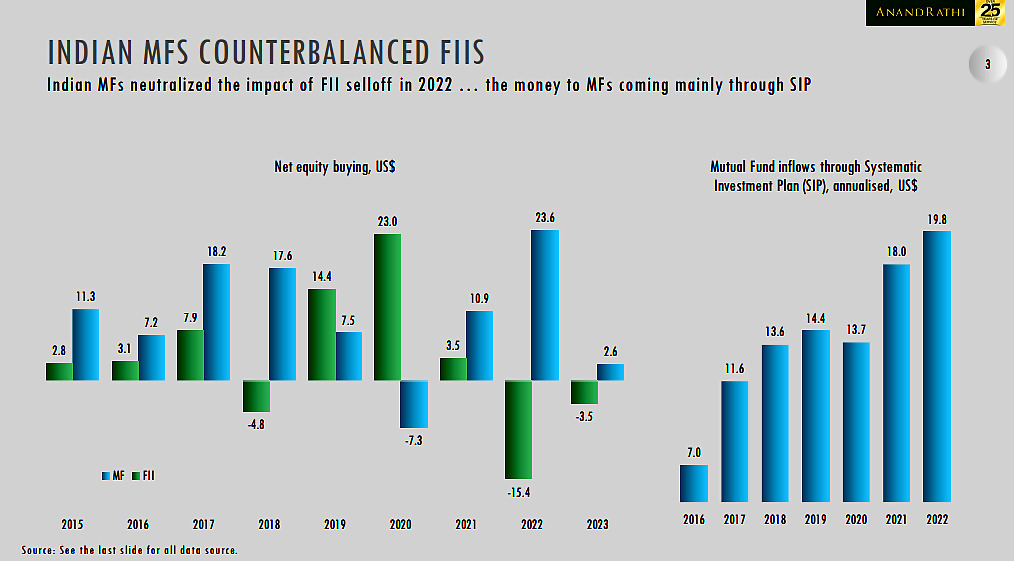

The report said that Indian mutual funds counter-balanced FIIs.

Indian mutual funds neutralised the impact of FII selloff in 2022. It noted that the money to MFs is coming mainly through SIP.

Notably, investors are betting big on SIPs to generate long-term wealth, with monthly flows in the mutual fund industry through the route rising to an all-time high of Rs 13,040 crore in October, 2022.

Annualised equity return in US dollars: 2000-22 – longer term over 5 years;

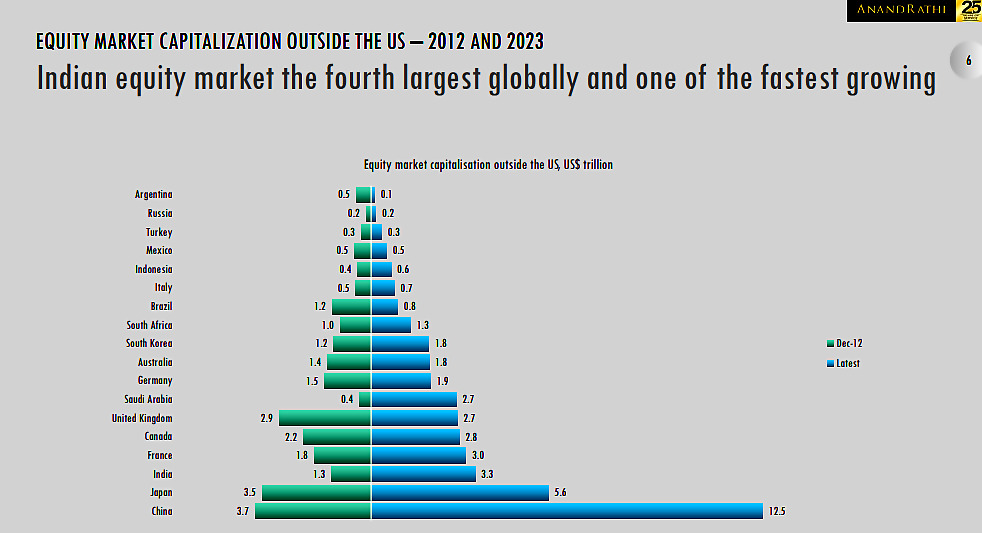

Indian equity market the fourth largest globally and one of the fastest growing.

Why Indian equities the best among all major countries?

Savings and spending

Read all the Latest Business News here

Comments

0 comment