views

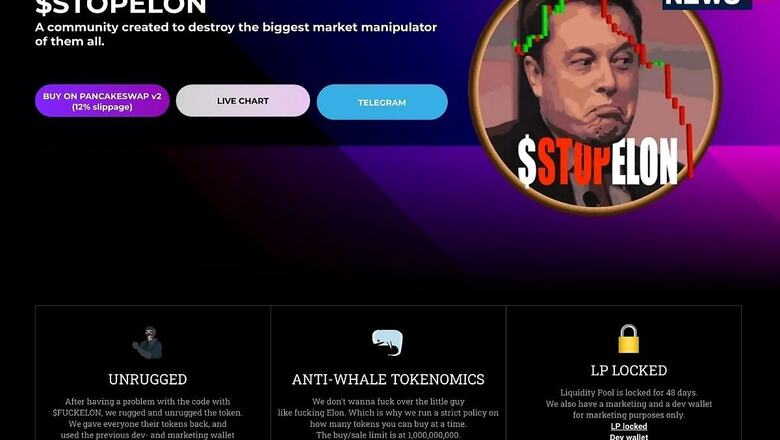

We’ve said it before, and we’ll say it again. There are very few things that are certain in life. Day after night. And Elon Musk tweeting about cryptocurrency. Usually with pretty damaging effects for crypto investors, something we have seen over the past few weeks with the tumbling values of Dogecoin and Bitcoin. The former being the result of a SNL appearance which didn’t really result in the Dogefather helping Doge value spike as expected. Now, the cryptocurrency wants to fight back, and a new coin has been minted as a result—STOPELON. The intention is to make crypto investors, particularly those who are starting out, aware of the crypto market fluctuations that are caused by Elon Musk’s tweets, which the community calls “irresponsibly manipulating”. Final target—take full control of Tesla stock, after the four-phase $STOPELON launch plan.

“Elon Musk is infamous for irresponsibly manipulating the cryptocurrency market with his Twitter account. Just recently, he did it again, causing a massive crash across all frontiers when he tweeted that Tesla will cease to accept Bitcoin as payment. Anyone with even a shred of critical thinking sees through his lies. He has been trying to pump crypto for ages, tweeting about it to no end, and even going to Saturday Night Live as a final resort to get Dogecoin up! It’s ridiculous!” says the Stop Elon team, on their website. They mince no words in saying that Musk’s tweets toy with investor portfolios like candy and calls him a “narcissistic billionaire”. The $STOPELON phased rollout now sees the launch of the website and listing the crypto on BSCSCAN, which tracks cryptocurrency transfers and holders. The next steps in this phase include the ongoing code audit by techrate.org as well as listing on Coinhunt, CoinGecko, Delta, Coinstats and BlackFolio, and also target 5000 BSC addresses. The second phase steps include staking liquidity, large scale token drop across exchanges, NFT shop STOPELON and small cap exchange listings.

The third phase would see mind-cap exchange listings which sees STOPELON targeting KuCoin while the fourth phase looks to get the crypto coin large cap listings on Binance, Coinbase and Kraken. The final target which the community wishes to achieve is to take full control of the Tesla stock and “fly to f*****g Pluto”, as they say. At the time of writing this, StopElon is trading at $0.0000188133 and the market cap is pegged at $9,774,130 with the total supply pegged at 1,000,000,000,000. You can buy $STOPELON right now using the Trust Wallet, this is available for Apple iPhone and the Android phones. For step 2, the community says, “Transfer BNB to your wallet. This can be done from Binance via the BNB network, or you can also top up your Trust Wallet by going into your Smart Chain wallet and press buy in the right corner.” The next step would involve you enter PancakeSwap via DApps and Exchange BNB for $STOPELON using the contract address: 0xd83cec69ed9d8044597a793445c86a5e763b0e3d.

Cryptocurrency, including Bitcoin, Ethereum, Litecoin, Dogecoin and others have been under the spotlight for the energy that is required to mine these digital coins, and the impact on the environment. A few days ago, in the midst of all the cryptocurrency tweets that Musk had been posting, he took time out to write that Tesla would no longer accept Bitcoin as a mode of payment for buying their electric cars, because of the increased power consumption that define mining and transactions with Bitcoin and other crypto coins, and the environmental impact because of that. It was in March that Tesla had said they’d accept Bitcoin as a mode of payment for buying their electric cars. Later, Financial services and investment management firm Galaxy Digital released some Bitcoin energy consumption numbers and these indicate that the traditional banking systems as well as Gold mining consume as much as twice the energy that Bitcoin requires. The numbers by Galaxy Digital peg the annual electricity consumption of the Bitcoin network at 113.89 terawatts per hour per year (TWh/year). In comparison, the banking systems consume 263.72 TWh/yr of power while gold mining consumes around 240.61 TWh/yr. They also point out that of the 26,730.07 TWh/yr electricity that is produced, there are transmission losses as high as 2,205.23 TWh/yr—and that’s according to the data confirmed by International Energy Agency (IEA). This loss is 19.36 times of what Bitcoin’s energy consumption is, over the year.

Read all the Latest News, Breaking News and Coronavirus News here. Follow us on Facebook, Twitter and Telegram.

Comments

0 comment