views

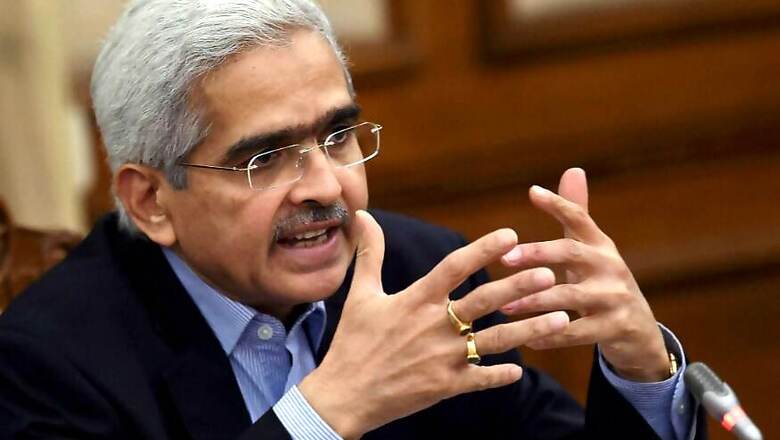

Mumbai: Governor Shaktikanta Das on Thursday called for more cooperation between the government and the Reserve Bank to help boost the sagging growth engine and to ensure systemic stability.

A dip in consumption and private investment has exerted pressure on the fiscal math, the governor said in his foreword to the bi-annual Financial Stability Report released on Thursday evening.

Concerted efforts are required to revive private investment and the government needs to continue with economic reforms, Das said.

On the positive side, Das, who has delivered three consecutive rate cuts of 0.75% this year bringing down the key repo rate to a nine-year low of 5.75%, said the lower inflation and the moderate outlook on the same can help alleviate the constraints to the fiscal numbers.

"Overall, the situation warrants greater cooperation internationally as well as monetary and fiscal coordination domestically to ensure systemic stability," Das said.

He said companies in the crisis-hit non-banking finance companies need to develop on "prudent lines" and focus on asset liability management.

The shadow banks also need to focus on their strengths, by harnessing their expertise that has helped them grow, he said.

"The Reserve Bank is reinforcing the regulatory and supervisory framework to help them better adapt to the evolving scenario," he said.

It can be noted that the asset liability mismatches, wherein the NBFCs borrowed short term to create long-term assets, was blamed as the primary reason for the pains in the segment that started with the crisis at infra lender IL&FS last September.

Das said there has been an improvement in the performance of the state-run lenders due to recapitalisation with both provision coverage ratios and capital buffers showing an uptick.

But he underlined the need for PSBs to be "specially focusing" on governance reforms and strengthening their balance sheets.

"The proof of the pudding lies in the public sector banks' ability to attract private capital through market discipline rather than being overly dependent on the government for capital," he said.

Comments

0 comment