views

Written by Badri Narayanan Gopalakrishnan

Recently, the Biden administration in the US announced an increase in tariffs on certain commodities imported from China. A press release issued by the White House said that the tariff rate on certain steel and aluminum products will increase from 0-7.5% to 25% in 2024, while the rate on electric vehicles will increase from 25% to 100% and the same on semiconductors will increase from 25% to 50% by 2025, among others.

Steel is a vital sector for the American economy, and American companies are leading the future of clean steel. This move echoes a similar strategy implemented during the Trump Administration, which imposed tariffs that have largely remained unchanged. The rationale behind these tariffs includes a range of stated objectives, from addressing human rights concerns to economic policy adjustments. However, the primary underlying objective is to make Chinese exports expensive enough to incentivise domestic production in the US.

According to White House statements, the tariffs aim to reduce dependency on Chinese imports and counter China’s unfair trade practices, encouraging local manufacturing. Over the past few years, this strategy has had some impact. The US has slightly reduced its reliance on China, with Mexico overtaking China as the top exporter to the US.

Similarly, the European Union has been contemplating restrictions on imports of electric vehicles (EVs) and other commodities from China, citing concerns over excessive subsidies provided by the Chinese government. These discussions are part of broader efforts to ensure fair competition and protect local industries from subsidised imports. The EU’s stance aligns with the objective of tariff hikes, reducing dependency on Chinese goods and promoting domestic production.

Despite these efforts, Chinese investment continues to flow into various regions, including Mexico. Recent data indicates that a significant portion of foreign direct investment (FDI) in Mexico originates from China. This investment is part of a broader strategy by Chinese companies to circumvent tariffs and continue accessing key markets like the US by relocating production.

Chinese exporters and suppliers have also been moving operations to other East and Southeast Asian countries such as Vietnam, Malaysia, and Indonesia. These countries benefit from lower tariffs and preferential trade agreements, allowing Chinese products to enter markets like the USA with reduced costs.

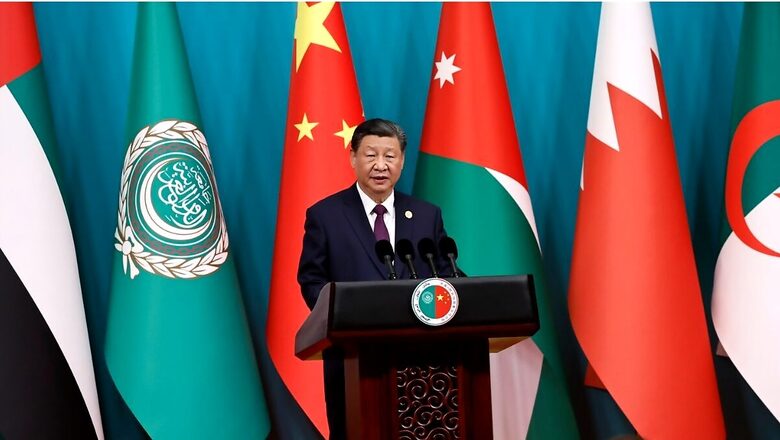

The Belt and Road Initiative (BRI) further exemplifies China’s strategic efforts to integrate into global supply chains. By investing in infrastructure and development projects across Asia, Africa, and Europe, China strengthens its trade networks and mitigates the impact of direct tariffs and trade restrictions.

During the early days of Trump’s tariffs, China leveraged special economic zones (SEZs) in Mongolia to gain a ‘Made in Mongolia’ stamp, thereby qualifying for lower tariffs under the Generalized System of Preferences (GSP) for landlocked developing countries (LLDCs). Such maneuvers highlight China’s adaptability and strategic planning in maintaining its export markets.

India has taken a multifaceted approach to regulate Chinese imports and investments. During the COVID-19 pandemic, India banned numerous Chinese apps and restricted direct FDI from China. These measures aim to insulate the domestic market from Chinese influence and signal a commitment to protecting local industries.

India emphasises strict ‘Rules of Origin’ in its free trade agreements (FTAs) to prevent indirect Chinese imports through partner countries. Despite these efforts, India’s trade deficit with China continues to grow, driven largely by imports of intermediate inputs essential for the production of final goods.

In many consumer and intermediate goods, the Indian government has introduced quality standards that must be met for imports to be allowed. These standards ensure that India doesn’t become a dump yard for cheap substandard goods. Additionally, India has restricted e-commerce exporters from China, such as Temu and Wish, from dumping goods into the Indian market as they do in the US and the EU. These measures complement the government’s production-linked incentive (PLI) scheme, which aims to boost domestic manufacturing sectors like the toy industry.

Unlike the US, which maintains an extensive list under Section 301 of their Tariff Act to scrutinise Chinese imports, India does not use a blanket approach against any country. Instead, anti-dumping duties are imposed after thorough investigations as outlined by the World Trade Organization (WTO) rules. This approach ensures that India addresses surging imports that are transient in nature while adhering to international trade laws.

Chinese exports continue to pose challenges for many countries, prompting varied responses. The US has imposed new tariffs on Section 301 goods, and the EU has initiated anti-dumping investigations against Chinese electric vehicles. The EU is fast-tracking these investigations and may impose duties as early as July, which could be around 25%. In response, China has launched its own investigations, indicating an escalating trade conflict.

Chinese oversupply, driven by efforts to prop up its economy through manufacturing support while the real estate sector struggles, is a significant issue. As the domestic economy has limits on how much excess production it can absorb, exporting and dumping surplus goods abroad becomes essential for Chinese manufacturers. However, this strategy might not be as effective now, as the global market is less willing to absorb supply shocks that threaten domestic manufacturing.

In an interconnected world, unilateral tariff measures can have ripple effects. For instance, if Biden’s tariffs lead to oversupply in other markets, countries like India may need to take preemptive measures to mitigate the impact.

In FY23-24, imports from China constituted 15% of India’s total imports, amounting to $675.44 billion. The composition of these imports reveals important trends:

- Intermediate and capital goods form the major share of imports from China.

- Consumer goods imports are declining, both in absolute terms and as a proportion of total imports.

- Capital goods imports are falling as a share of the total but are rising slightly in absolute terms.

- Imports of intermediate goods are increasing, both in absolute terms and as a proportion of total imports.

China’s position as a manufacturing powerhouse, especially for consumer goods, poses a significant challenge for countries like India. The scale and cost-effectiveness of Chinese manufacturing are difficult to match, despite efforts to reduce dependency. Many consumer goods imported from China eventually end up in landfills within a few years, highlighting the need for sustainable and competitive alternatives.

Regulating imports from China involves a complex interplay of tariffs, investment restrictions, and stringent trade rules. While these measures can mitigate dependency to some extent, they cannot entirely eliminate the reliance on Chinese imports, especially for intermediate inputs crucial for domestic industries. Achieving self-sufficiency and competitiveness in producing these inputs is a long-term goal that requires sustained effort and strategic planning.

(The author is a fellow at NITI Aayog. All views are personal and do not represent those of NITI Aayog)

Comments

0 comment