views

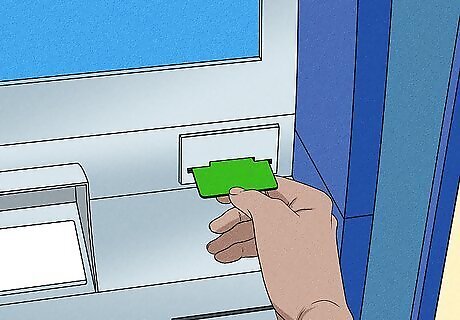

- Take your debit card to an ATM owned by your bank, insert it, and enter your PIN. Follow the instructions on the screen to activate your card.

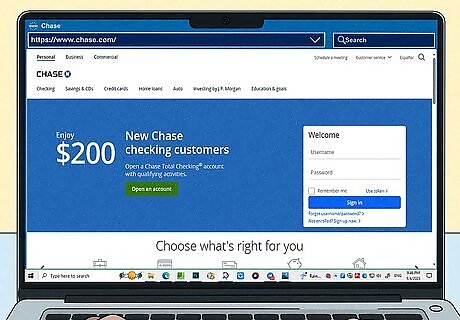

- Go to your bank’s website or app and find the “Activation” option. Give them the necessary information for activating your card.

- Call your bank or go in person to have an operator/representative activate the card for you.

Activating Your ATM card

Put your debit card and PIN number into an ATM owned by your bank. Choose an ATM that is well-lit, situated in a visible location, and owned by your banking establishment. Insert your card, use your PIN or your temporary PIN, and follow the instructions on screen. To be sure it worked, perform a balance inquiry or make a transaction. Some cards won’t activate unless you do. You can conduct transactions at second- or third-party ATMs once your card is set up, but you have to go to one owned by your specific bank for the actual activation. If you’re receiving a new card (and not a replacement card on an existing account) your bank should send you a temporary PIN number in a separate envelope. If it’s a replacement, you can use the same PIN. If you weren’t sent a PIN, either activate the card and then choose a PIN, or use the 3-digit security code on the back of the card to activate the card before choosing a PIN.

Alternatively, activate your card through your online account. Many banks provide an activation service via the Internet, through their website or an app. Log in to your bank’s website or app and select the option to activate your card. Most online activation services require you to enter the security code on the back of your card. The activation option may be in “New Account Information” or “FAQs.” You may have to have a preexisting online banking ID to use this option.

Call your bank to have an operator help you with activation. Most banks provide a toll-free number you can use to activate your card. This number may be located on a sticker on your ATM card, in the letter mailed with your card, or on their website. Call the toll-free number and follow the prompts. The requested information usually includes the last four digits of your social security number, your zip code, and the security code on your card. The Bank of America activation number is 1-888-624-2323. For Chase, call 1-800-290-3935, for Wells Fargo, call 1-877-294-6933, and for Capital One, call 1-844-242-2388. Bank of America has an international number, as well—call collect to 1-925-675-6195. You can also go to a branch of your bank in person to speak with someone—the process is the same as the over-the-phone one.

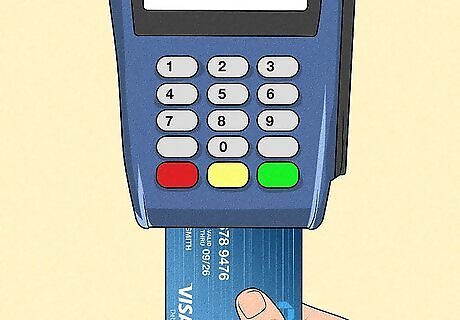

Make an in-person purchase with your new debit card to activate it. Some banks (like Bank of America, for example) allow you to make a purchase to activate the card. To activate it, use the card in the store, then just enter your PIN (or temporary PIN).

ATM Card Best Practices

Verify that the card you received is one you applied for or requested. If you get an ATM card you’re not expecting, contact your bank immediately to find out if the card is legitimate. Some banks will issue a new debit card if there was a problem, like potential fraud, associated with your existing debit card. If you didn’t request a new debit card, decide if you need one. Read the fine print or contact the bank to make sure the debit card doesn't have hidden fees or that switching to a new card is required. Examine the card's expiration date. If the expiration date is approaching soon, contact your bank. This is often a sign of a fraudulent card.

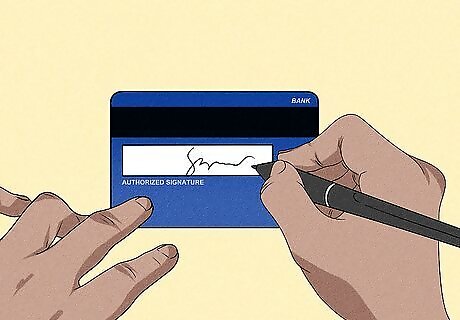

Sign the back of the card. As soon as you receive a new, legitimate debit card, sign the back of it. This is a mostly defunct fraud protection practice, but merchants can still decide to refuse you service if the back of your card is unsigned. If this is a replacement debit card, or you received a temporary card, destroy your old cards now. Cut the card up so that the name and number cannot be identified. This helps protect your identity and information.

Change the preset PIN to a personal one. If your bank sends you a temporary PIN and allows you to create your own, change your PIN. Creating your own PIN for your ATM card creates an additional level of security for your account. Memorize your new PIN, and don’t carry that number with you in your wallet.

Comments

0 comment