views

Exercising Reasonable Care

Employ a customs broker. Clearing imported products through CBP is an incredibly complicated tax. To avoid this complexity, most importers will hire customs brokers, who are experts in the importation process. These brokers will help you through the process and ensure all the rules are followed. All customs brokers must be licensed and must and must obtain a power of attorney from you. While customs brokers can help you through the process, you will ultimately be responsible for mistakes in the process.

Provide CBP with accurate information. In order to get your product into the United States properly, you must work within the CBP compliance framework. Part of doing this involves exercising reasonable care when you make all your filings and determinations. One of the most important things you can do throughout the importation process is to provide CBP with truthful, complete, and accurate information. The information you provide throughout the process will help CBP determine the admissibility of your product, classify your product, and value it. Failure to provide accurate information may lead to your product being denied at the border and the possibility of criminal or civil charges being filed against you.

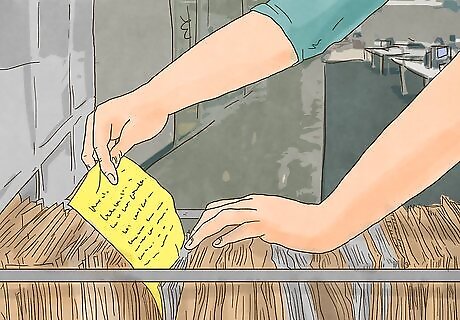

Maintain good records. CBP requires, throughout the entire importation process and for a period of five years after, that you keep all records relating to the importation of your product and make them available to CBP if requested. Make copies of every piece of paper you file with CBP or other agencies and keep them in a safe place.

Analyze "Informed Compliance" publications. Part of the importation process involves doing your due diligence before shipping your goods. CBP makes this process straightforward by giving you access to information about how to comply with importation laws. CBP's website posts every Informed Compliance publication, which are there to help you evaluate requirements in various factual scenarios. These publications include informative brochures as well as specific advisory opinions. These publications can tell you everything from how to classify a product to how to value it. You can find these materials on the CBP website.

Contact a CBP officer at your port of entry. Before shipping a product to the United States, contact a CBP officer at the port of entry where you want your product shipped. You can find a list of ports, as well as their contact information, on the CBP website. When you contact the port of entry, ask to speak with an import specialist that deals with the type of product you are shipping. These employees can help you make classification determinations, estimate the duty rate you will pay, and even answer questions abut specific filing requirements.

Ask CBP for clarification. If you really want to make sure you are following the rules, you can ask CBP to issue a ruling, specific to your case, that will give you your classification information and duty rate. You may request a ruling by sending CBP a letter through the mail or electronically.

Contact other federal agencies. Some products must be cleared with other federal agencies, in addition to CBP, before they can enter the United States. For example, if you are importing food for commercial use, you will have to file certain paperwork with the Food and Drug Administration (FDA). It will then be the FDA's responsibility to review your application and determine the importation eligibility of your product.

Marking Your Product

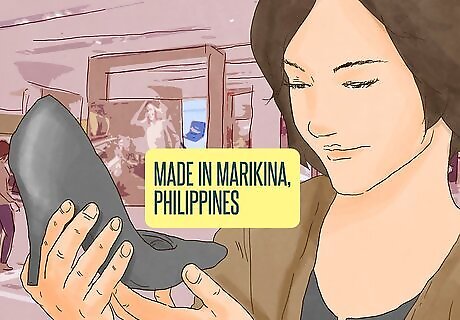

Determine the country of origin of your product. If you want your product accepted into the United States, you must accurately declare the product's country of origin. In some cases, where a product is wholly manufactured in one country, this process can be straightforward. However, when your product is a raw material or something that has been manufactured in multiple countries, this determination can prove much more difficult. In general, your product's country of origin is the country where the product was manufactured, produced, or grown. This country of origin determination will be used by CBP to confirm whether your product can be accepted in the United States, whether the product is subject to additional tariffs and taxes, and whether your product is subject to certain benefits.

Mark your product correctly. Once you know your product's country of origin the product must be marked with that information. The marking on the product must be legible, permanent, and in English. This law helps the ultimate purchaser of your product make an informed decision and avoid being misled or deceived. Examples of acceptable markings include, "Product of X", "Made in X", or "Contents Made in X".

Re-mark your product each time it is repackaged. If your product is repackaged or manipulated after it is imported, the product's new containers must be marked with the country of origin. If you fail to properly mark your product, you can receive a penalty or an additional duty of 10% of the value of your product.

Assigning a Tariff Classification

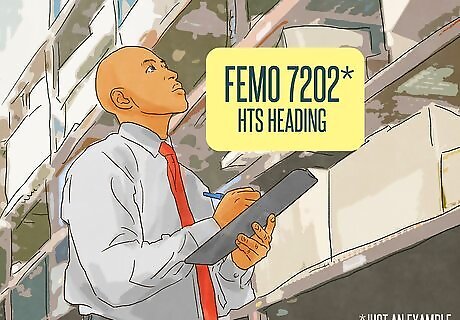

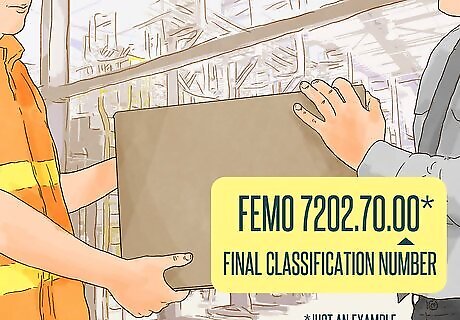

Classify your goods using the appropriate four-digit Harmonized Tariff Schedule (HTS) heading. Every product that is imported into the United States must have a specific tariff classification. Classifications are determined by using the HTS. The classification of your product will determine the duty rate that applies. To start the classification process, look through the HTS to find a heading that matches the description of your product. For example, Ferro Molybdenum has a heading of 7202.

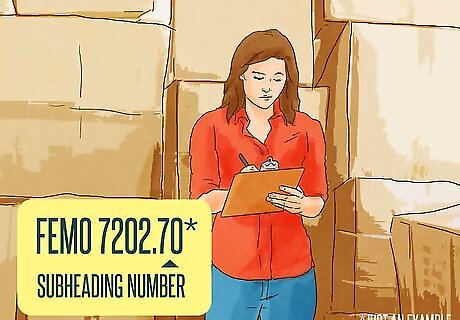

Identify your product at the six-digit subheading level. Once you have found your heading, identifying the next two digits of your classification is straightforward. The HTS will have, next to the heading numbers, subheading numbers. Match the subheading numbers to your product description. For example, if the product you are importing is Ferro Molybdenum, the subheading numbers are 70. Therefore, at this point, your classification number will read 7202.70.

Determine the correct eight-digit classification. The HTS will also provide you with a two digit sub-subheading, which will be used to create your complete eight-digit classification. Your final classification number will have to be provided on entry paperwork later in the process. For example, if you are importing Ferro Molybdenum, your sub-subheading is 00. Therefore, your final classification number for Ferro Molybdenum will be 7202.70.00.

Valuing Imported Goods

Use the "transaction value" method whenever possible. All goods imported into the United States must be valued using a particular method. The value of your product will be used to calculate the duty you owe. In most cases, the duty rate, which is determined based on your tariff classification, is represented as a percentage. Your duty payment is calculated by multiplying the duty rate by the product's value. The preferred method of valuing a product is the transaction value method. To use this method, you simply determine what the price paid was for the imported product when it was sold for export to the United States. In addition to the price paid, you must also add packing costs, commissions, royalties, and any proceeds of a subsequent sale. For example, assume you paid $75,000 for a shipment of Ferro Molybdenum and you plan on reselling that product for a total of $100,000. Additionally, assume it cost you $10,000 to pack your product. In this scenario, the value of your product would be $110,000 ($75,000 + $25,000 + $10,000).

Determine the value of identical merchandise. If the transaction value cannot be determined, you will need to use one or more alternative methods to determine your product's value. If possible, determine your product's value by comparing it to an "identical product". To do this, take the transaction value of an identical product that has been previously imported. For example, if an identical product has a transaction value of $110,000, you can value your product at $110,000.

Calculate the transaction value of similar merchandise. If there is no identical merchandise available to value, you can value your product using the similar merchandise method. Similar merchandise is merchandise that has similar components and materials, and that is commercially interchangeable with your product.

Select the deductive or computed value method. Using the deductive method, the value of your product is determined by the resale price of your product after it has been imported. Deductions are then taken for duties and taxes among other things. To use the computed method you will add up all costs and expenses incurred in producing the good.

Employ the fallback method. If none of the specific methods can give you a value for your product, CBP will work with you to use any combination of methods that will give you a reasonable value.

Filing an Entry Package

Name an importer of record. When your shipment reaches a port of entry in the United States, a specific party (known as the "importer of record") must file an "entry package", which will be used by CBP to evaluate your use of reasonable care. The importer of record must have a meaningful legal interest in the transaction that brought your product to the United States. For example, the owner or purchaser of the product will almost always be able to be the importer of record. Additionally, in some cases, a person who is receiving the goods but who is not the owner or purchaser will be allowed as an importer of record. However, if a person has no involvement in the importation transaction, other than processing entry paperwork, that person will usually not be allowed to be an importer of record.

File an import bond. When your product gets to a port of entry and you have to fill out entry documents, one of the things you will have to provide is a bond reference number. This number will correspond to a specific import bond, which is filed in order to cover potential duties, taxes, and fees. The bond itself is a contract between you and CBP. CBP promises to clear your product (so long as you comply with the law) and you promise to provide all required information and fees. The bond itself is filed on CBP Form 301. The bond amount you have to pay is an estimate of the actual amount you will owe to have your product liquidated. The estimate is based on certain guidelines the CBP has established.

File an Importer Security Filing (ISF) when necessary. If the product you are importing is being shipped via ocean vessel, you will be required to submit an ISF prior to your merchandise arriving in the United States. The ISF must be submitted electronically. Visit the CBP website for the most up-to-date information. To comply with ISF requirements, the following information must be filed at least 24 hours before your product is loaded onto a vessel meant to go to the United States: Supplier's name and address Seller's name and address Buyer's name and address Ship-to name and address Importer of record number Consignee numbers Country of origin Commodity HTSUS number Container stuffing location Stuffer

Ship your product to the United States. At this point you have done everything you are required to do prior to shipping your product to the United States. Once you ship your product and it arrives at a port of entry, you will have to work with CBP to get your product cleared (a.k.a., liquidated).

Submit entry documents in order to secure release. In order to get items entered into the United States, you need to provide CBP with enough information to admit your product, release your product, and charge you the correct amount in duties, taxes, and fees. To get your product released by CBP, you must file the following documents, online through the Automated Commercial Environment (ACE), within 15 days after your product arrives in the United States: An Entry Manifest (CBP Form 7533) or other proper application (e.g., CBP Form 3461) Evidence of the right to make entry (e.g., a bill of lading) Evidence of a bond A commercial invoice A packing list Other documents that might be required in special circumstances (e.g., the importation of food for resale)

File an Entry Summary. Once you file your initial entry documents, CBP will decide whether they want to examine your product. While CBP has the right to do this, they often waive it. If your goods are released, you will need to file your "Entry Summary". Your Entry Summary is a package of information that includes all of your initial entry documents in addition to Customs Form 7501. This form will ask for, among other things, your product classification, origin, and value. This Entry Summary, as well as your duty deposit payment(i.e., an estimated duty payment), must be filed within 10 days after entry.

Finalize the entry. After you file your Entry Summary and duty deposit, the entry will remain open (i.e., unliquidated) for about 314 days. During this time, you or CBP can review and/or change entry information as necessary. After the 314 day mark, your product's entry will be finalized (i.e., liquidated). If changes were made that affect the duty you owe, you will either receive a bill or refund. After your final payments are made or refunds given, the importation process will be complete (unless you want to challenge a CBP decision).

Keeping Records and Challenging CBP Decisions

Maintain required documentation. The law in the United States requires you to keep all documentation associated with the import for a period of five years. During this five year period CBP can request any information and you will be required to produce it within a reasonable amount of time. The documents you should keep include, but are not limited to: The Entry Summary Bond information Correspondence Binding rulings Certificates of origin Commercial invoice Packing list Manifests

File a formal protest. If, during the liquidation process, you disagree with a decision made by CBP, you can file a formal protest and challenge that decision. Your protest must be filed within 180 days of the date of liquidation. You will file your protest at your local port of entry. You can use CBP Form 19 to draft your protest. If you fail to protest in a timely manner, the protest will be denied on its face. Your formal protest must challenge a specific CBP decision. For example, you could challenge the value, classification, duty rate, duty amount, markings, and country of origin issues. CBP will not review protests submitted regarding CBP decisions about damages, customs penalties, and duty demands.

Challenge a denied protest. If CBP denies your protest, you can challenge the CBP by filing a summons in the United States Court of International Trade (CIT). The CIT has the power to review denied protests as well as other matters that cannot be protested. In order to file a case with the CIT, you must first pay all outstanding duties and fees. In most circumstances, when the CIT hears your case, they will review the evidence and make factual and legal conclusion on their own (i.e., they will not look at how CBP ruled).

Comments

0 comment