views

Deciding to Incorporate

Select the legal structure that works best for your company. A corporation is not always the best business form for every company. Before you make this decision, you should consult with an attorney to review the options and the positive and negative aspects of each one. You have several options to consider: Corporation. The primary purpose for creating a corporation is to limit your personal liability that may come through operating a business. A corporation separates your personal property from the property and obligations of the corporation. A corporation may either be for profit or non-profit. Under certain circumstances, you may file a professional corporation (PC) as well. Limited Liability Company (LLC). A limited liability company (LLC) is a kind of compromise. It provides some of the protection from personal liability that comes with a corporation, but you still will report the income as part of your personal tax return. Sole proprietorship. This form of business operation is the most convenient because you operate the business on your own. No particular filing or business creation is required. All profits and losses become part of your own personal tax returns. However, you maintain personal responsibility for all of the business’s obligations and liabilities. Partnership. A partnership is legally similar to a sole proprietorship with more than a single individual running the business. The partners need to draft a partnership agreement to divide income and share costs and losses of the company. Each individual partner is responsible for reporting his or her share of income in personal tax returns.

Choose a name for your new corporation. If you decide that a corporation is the best form of business operation for you, then you need to select a name. Under New York state law, your corporate name must be unique, to avoid confusion with any existing New York corporations. You can search the New York Corporation and Business Entity Database online to see if the name you select is available. However, this online search is only a preliminary indication that the name is available at the time of your search, but it does not reserve the name. The only method to get formal approval of your corporate name is to submit a request in writing to Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231. In a letter, include the name or names that you would like to have approved with a written request to have the names approved. You need to enclose payment of $5 for each name you submit. You may not request a name search by telephone. After conducting the search, the Division of Corporations will reply to you in writing. You should save the response, assuming it is positive, and submit it along with your corporate filing.

Reserve your corporate name. You may file an optional Application for Reservation of Name, which has a fee of $20. The form is available here online, http://www.dos.ny.gov/forms/corporations/0234-f.pdf. Once your corporate name is reserved, you must file your corporate papers within 60 days or lose the reservation. If you wish, you may extend the reservation twice, but each extension costs an additional $20.

Preparing the Certificate of Incorporation

Review the prepared Certificate of Incorporation form. The New York Division of Corporations has prepared a template that you may use as the form for your Certificate of Incorporation. However, this form is not required. It satisfies the minimum requirements for a filing. You may choose to consult with an attorney to review the form and consider adding more information. The template Certificate of Incorporation is available at http://www.dos.ny.gov/forms/corporations/1239-f.pdf.

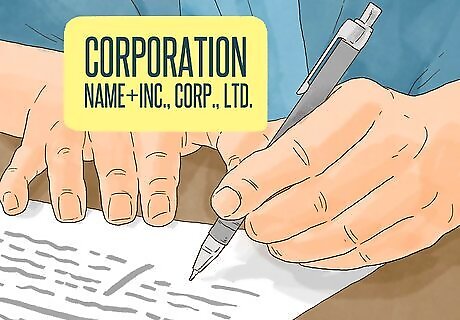

Present the name of the corporation. The first item on the Certificate of Incorporation is the corporate name. You need to include the name exactly as you verified it with the Division of Corporations. The name must include one of the words “Incorporated,” “Corporation,” or “Limited,” or one of the abbreviations “Inc.,” “Corp.,” or “Ltd.”

State the purpose of the corporation. The stated purpose does not need to be specifically limiting. In fact, it is better if you make a statement that is general enough to allow your company to grow over time, without having to file an amendment to the Certificate of Corporation. The template Certificate of Corporation contains the following stated purpose, which is acceptable for nearly any corporation: “The purpose of the corporation is to engage in any lawful act or activity for which a corporation may be organized under the Business Corporation Law. The corporation is not formed to engage in any act or activity requiring the consent or approval of any state official, department, board, agency or other body without such consent or approval first being obtained.”

Report the county where the corporate office will be. You do not need to report a street address. Only the name of the county is required. If you expect to be doing business around the state, list the county where the primary offices of the corporation will be housed.

Designate the number of the shares that are authorized. Every corporation must report the number of shares that the corporation will be authorized to issue. The designation must state whether the shares are authorized “with par value” or “without par value.” Shares “without par value” may be sold at any price. Share “with par value” must have a set price value, and cannot be sold or traded for anything less than that stated value. The New York template Certificate of Incorporation suggests reporting 200 shares, without par value. This is how most new corporations begin. You should meet with an attorney to discuss your planning and strategies related to issuing corporate shares.

Name the Secretary of State for service of process. In New York, all corporations must authorize the Secretary of State as its agent for service of process. This means that any legal proceedings against the corporation may be presented to the Secretary of State’s office. The Secretary of State will then relay the paperwork to the corporation. Together with naming the Secretary of State, you must provide an address for the corporation, to which the Secretary of State can forward any legal notices.

Provide the name, address and signature of each incorporator. The incorporators are the people who draft the Certificate of Incorporation. They may or may not serve as officers of the corporation. The personal addresses for each incorporator must be included.

Include the name and mailing address of the filer. This is the person who is officially filing the Certificate of Incorporation. You may designate one of the incorporators or one of the officers to be the filer. This is the person who will receive the receipt of filing when the Division of Corporations returns it. The filer must be a person. You may not designate the corporation itself as the filer of its own Articles of Incorporation.

Filing the Articles of Incorporation Electronically

Use the New York State Department of Corporations online filing system. You can access the online corporate filing system at https://appext20.dos.ny.gov/ecorp_public/f?p=201:17. When you begin, you should have a completed draft of the Certificate of Corporation with you, so that you will have all the information at hand to complete the online filing. The online filing system is available Monday through Friday, from 6:00 a.m. until 7:30 p.m.

Select “Domestic Business Corporation.” Under the heading of “Online Filings,” you will select “Domestic Business Corporation” to begin creating your online Certificate of Incorporation.

Choose the filing that you intend to submit. For most filings, you will select the first option, “Certificate of Incorporation for a Domestic Business Corporation.” The other two options are for a Limited Liability Company (LLC) or a Domestic Benefit Corporation.

Proceed with your online filing. Each successive screen will prompt you to provide certain pieces of information for creating your new corporation. Answer each question carefully and completely. If necessary, you can select the “Save for Later" button at the bottom of the screen. This will save the information that you have entered and allow you to leave the screen and come back later to finish. Be aware that your filing is not effective until you complete and submit the entire document.

Review all information and select “Continue.” After you have entered all the information for the Certificate of Incorporation, review everything carefully. Make sure that you have entered responses in all required fields, and that you have spelled the name of the corporation correctly. After you are satisfied with all the information, select the “Continue” button at the bottom of the screen. Type the legal name of the incorporator in the box for the signature.

Review the completed Certificate of Incorporation. After you have entered all the information, the next screen will show you the completed form of the Certificate of Incorporation. Review it carefully for accuracy and completeness. The filing is still not complete, and you may return to the previous screen to make any corrections by selecting the “Go Back” button at the bottom of the screen. You may select the “Print Preview” button to view the Certificate of Incorporation as it will appear on paper. When you are satisfied, select “Continue” at the bottom of the screen.

Provide your payment information. After you move on to the next screen, you will be prompted to enter certain required information to pay the filing fee. The fee for filing a Certificate of Incorporation is $125. There is also a minimum tax of $10 for 200 no par value shares. If you identify more shares, the tax will increase. The amount is calculated for you as part of the online filing when you enter the number of shares. If you already have a Federal Employer Identification Number (FEIN), you are asked to provide it. This is not required to file the Certificate of Incorporation, but if the corporation is going to have employees, you will need one eventually. Provide your credit card information and email address for confirmation. Click the box to authorize payment.

Finalize your corporate filing. After all the information about payment is completed and you have authorized the payment from your credit card, select the “File Document” button at the bottom of the screen. This will finalize your filing and charge your credit card for the filing fee. A receipt for the filing will be sent to your email address.

Filing the Certificate of Incorporation by Mail, by Fax, or in Person

Prepare the Certificate of Incorporation in the proper format. The Certificate of Incorporation must be typed on standard, white, 8 1/2 x 11 inch paper. The document should be titled, “Certificate of Incorporation of (Name) Corp.” Each separate piece of information should be listed as a separate “Article,” as demonstrated on the template form.

Sign the Certificate of Incorporation. The final Certificate of Incorporation must bear the signature of one or more of the incorporators or the corporation’s attorney, if one is identified. Without a signature, the filing is incomplete and will be delayed or returned to you.

Prepare the filing fee and tax payment. The filing fee for a Certificate of Incorporation is $125. There is a minimum $10 tax for 200 no par value shares. If you authorize more shares, or a different type, you will need to review the Secretary of State’s website for the tax calculation. Without the proper filing fee, your paperwork will be returned to you. If you are mailing your submission, include payment by check or by including a credit card payment authorization statement, along with your credit card number. If you are faxing, you need to include the credit card authorization statement. If you are filing in person, you need to be prepared to pay by cash, check or credit card.

File your paperwork. Once your filing package is complete, and you have the payment ready, you need to submit your filing. To file by mail, send the completed package to the Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, New York 12231. Be sure to include the completed Certificate of Incorporation and the information about payment of the filing fee and the shares tax. To file by fax, send the package to the Department of Corporations at (518) 474-1418. Be sure to include all pages of your filing submission, together with the payment information. To deliver your filing in person, take it to the Division of Corporations office. Take the completed paperwork to the Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, 6th Floor, Albany, NY 12231. The Division of Corporations is open from 9:00 a.m. to 4:30 p.m., Monday through Friday.

Receive your filing receipt. This is your formal notice from the New York Department of Corporations that your Certificate of Incorporation has been accepted and filed, and that your corporation is eligible to operate. The filing receipt will be sent to you within two business days after your submission is received.

Comments

0 comment