views

X

Research source

Receiving Profit Distribution

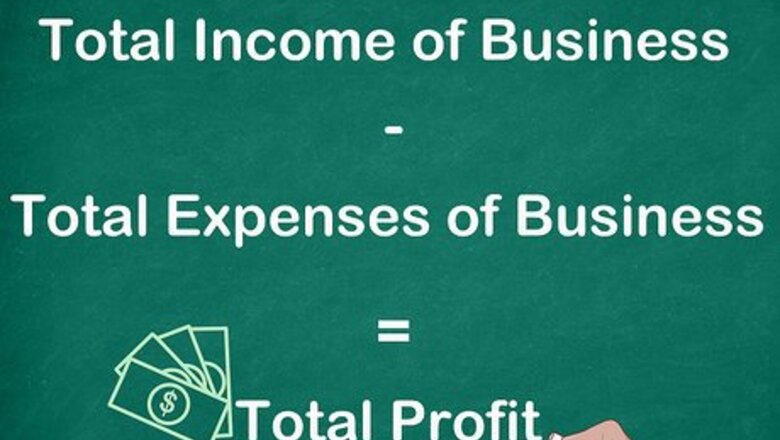

Calculate your profits. Total your business income and subtract all business expenses from that total to find your business's profit. If you're simply keeping all your profits for yourself, that is the amount of money that you've made over the course of the year. Keep running calculations to ensure that you're not taking too much money out of your business. You need to be able to pay all of your bills and cover business expenses on a daily basis.

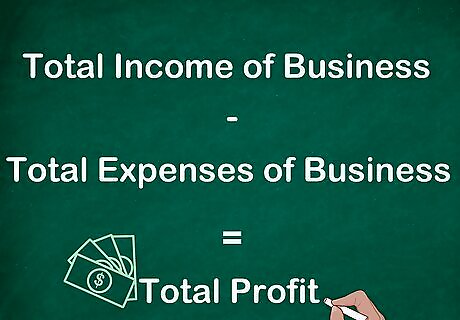

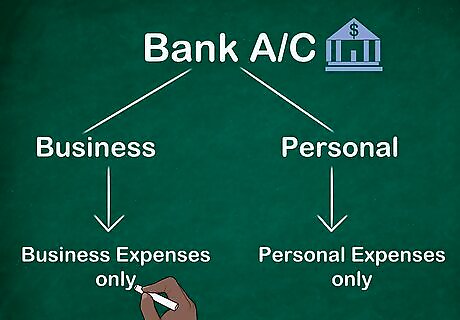

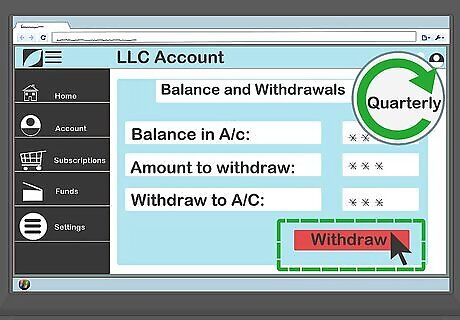

Withdraw net profits to your personal account. When you simply keep all the profits of your business after business expenses are paid, you are treated as self-employed. You will be responsible for self-employment taxes on all the money you earn through your business. Set up separate bank accounts for your business and personal finances. Only use your business account to pay for things you can deduct on your taxes as legitimate business expenses. For example, if you never use your car for business purposes, make your car payment out of your personal bank account, not your business bank account.

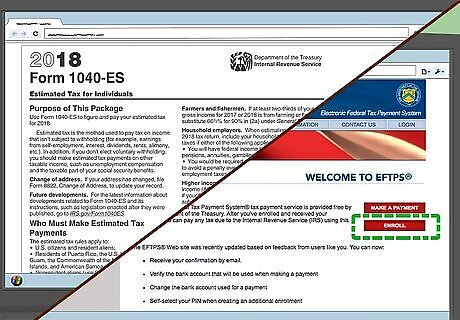

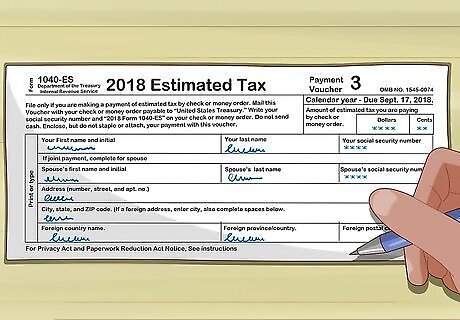

Pay estimated taxes each quarter. If you expect to owe at least $1,000 in taxes, or if you paid any taxes at all on self-employment income last year, you must pay quarterly estimated taxes in your expected earnings. Use the IRS worksheet at https://www.irs.gov/pub/irs-pdf/f1040es.pdf to estimate your taxes. If you use an online bookkeeping service, such as QuickBooks, it may do this calculation for you. To pay estimated taxes, set up an account with the Electronic Federal Tax Payment Service (EFTPS), available at https://www.eftps.gov/eftps/.

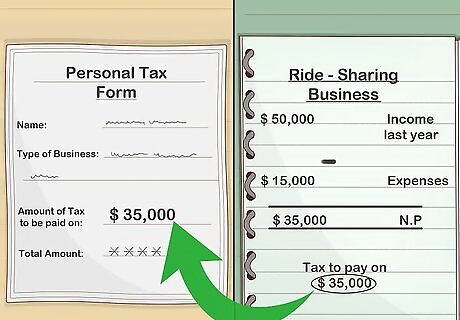

File your personal taxes. When you distribute profits directly to yourself, you simply list them as self-employment income when you file your personal taxes each year. Your total business income is reduced by any business expenses you have. You'll pay self-employment income tax on the net profits for your business. The profit you distributed to yourself can't be deducted as a business expense. For example, you operate a ride-sharing business that generated $50,000 in income last year. You had $15,000 in deductible expenses, including fuel and car maintenance. Your business's net profits are $35,000. You will pay self-employment income tax on the full $35,000.

Consult an accountant as your business grows. When your business is in the start-up stage, keeping all the profits for yourself makes the most sense. However, when your business starts turning consistent profits, you may find that other options for paying yourself would greatly reduce the amount of money you're paying in taxes. An accountant can help you structure your payments so that you're making a comfortable living while also investing profits to help your business grow.

Taking a Draw

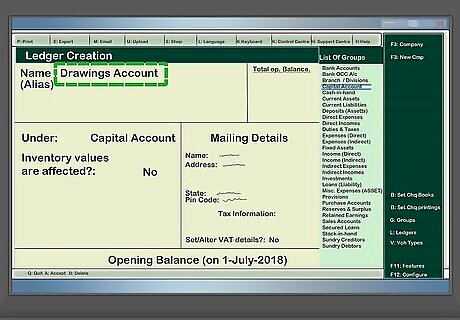

Set up a drawing account. A specific drawing account creates a record of the amount of money you're taking from the LLC for yourself. If you have a multi-member LLC, each member should have their own drawing account on the business's books. Typically your drawing account isn't a separate physical bank account, it's simply an accounting tool. On your LLC's books, you would note a debit from the cash account to the drawing account. The drawing account would indicate a credit in the same amount. Most accounting software, such as QuickBooks, has options for you to create a drawing account. Talk to an accountant if you're unsure how to set up a drawing account or want to make sure your books are in order.

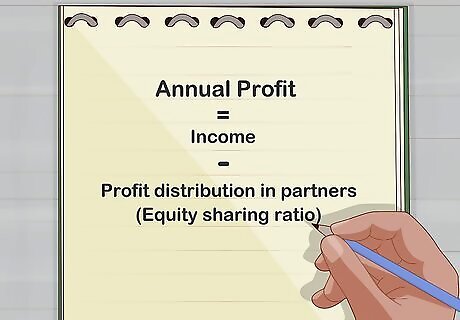

Estimate annual profits. Your regular draws typically represent a percentage of your business's profits. If you have a single-member LLC, you can set this percentage at whatever you want. For multi-member LLCs, percentages are usually based on each member's equity contribution. For example, if your LLC has 4 members, each of whom has equal equity, and you want to split 100 percent of the profits, each member would draw 25 percent. As another example, suppose your LLC has 2 members with equal equity, but you want to keep 50 percent of the profits in the LLC. You and the other member would each draw 25 percent of the total profits, or half of the half you want to distribute.

Schedule regular draws. Taking a draw is similar to getting a paycheck, except that the amount you're paid is tied directly to the amount of money your business makes. Regular payments look more legitimate than random distributions. They also make your accounting easier. Since you're not on the payroll, you have the freedom to schedule draws when it's convenient for you. For example, you may want to take a draw once a quarter, after you've calculated and paid your quarterly estimated taxes.

Calculate estimated taxes. A draw isn't subject to withholding, which means you're responsible for paying self-employment income taxes each year. Typically, you'll make estimated quarterly payments, then reconcile on your tax return at the end of the year. Generally, the IRS requires quarterly estimated tax payments if you paid taxes last year, or if you expect to owe more than $1,000 in taxes. The IRS provides a worksheet you can use to estimate your taxes. You can download the worksheet at https://www.irs.gov/pub/irs-pdf/f1040es.pdf. Many accounting software packages, such as QuickBooks, will estimate your taxes for you based on the profit generated by your business.

Paying Yourself a Salary

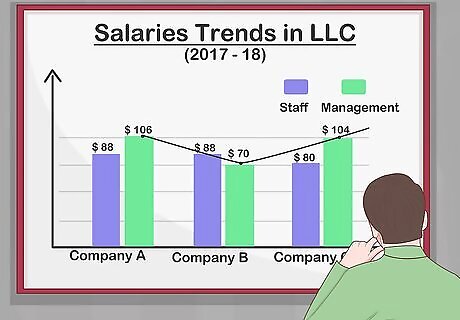

Compute reasonable compensation. If you want to pay yourself a salary, the IRS requires that your compensation be reasonable given your skills and education, and the amount of time you spend working for your business. Review salaries of people who perform similar job duties and have a similar background, education, and experience in the field. Take your location into account as well. A professional in a large city, such as Los Angeles or Chicago, would likely command a higher salary than a similar professional in a small town or rural area.

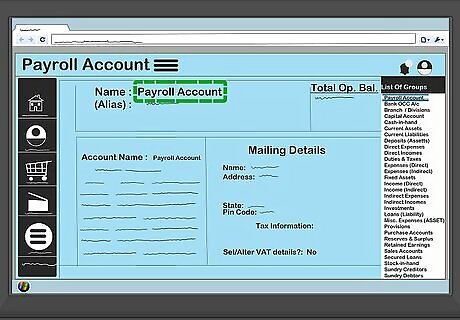

Set up your payroll system and accounts. You can do your payroll yourself, or hire an accountant or bookkeeping professional to do it for you. Even if you are your LLC's only employee, it's still a good idea to open a separate payroll account to write your paychecks. A separate payroll account ensures that you're not basing your pay on profits. This avoids the risk that the IRS decides your pay is a dividend or draw, assessing additional taxes and penalties as a result.

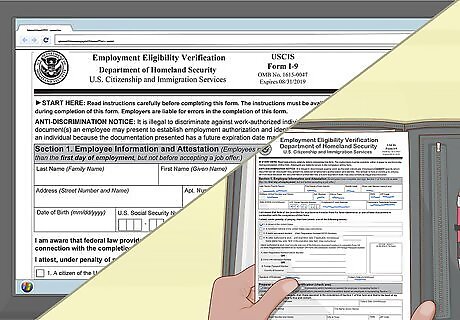

Verify your employment eligibility. Before you can put yourself on the payroll, you must complete Form I-9 to verify that you are eligible to work in the United States. The completed form must be kept on file with your other business or personnel records. You can download the form you need from the U.S. Citizenship and Immigration Services website at https://www.uscis.gov/i-9. You still need to complete this form and have it on file, even if you're the only employee in your business.

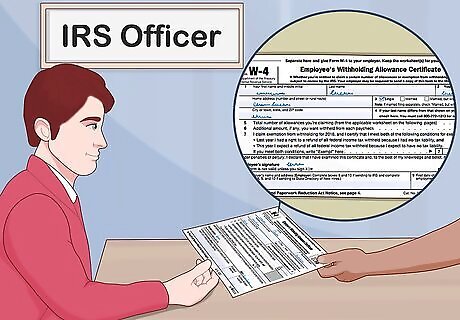

Compute your tax withholding. When you put yourself on the payroll, you'll have taxes withheld. Form W-4 is used to determine the amount of money that must be withheld from each paycheck. Keep your Form W-4 with your other business and personnel files. While you don't have to submit the form to the IRS, you must make it available if asked.

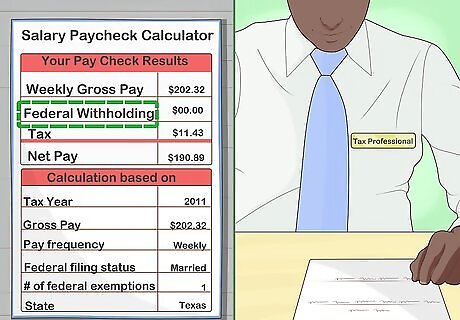

Report wages and deposit taxes. If you pay yourself a salary, you must withhold state and federal taxes from your paychecks. Deposit federal taxes either semi-weekly or monthly, depending on the deposit schedule you've chosen. Check your state's rules on withholding and depositing state income taxes. You may not be able to deduct your own paycheck from your LLC's profits as a business expense. Talk to a tax professional to make sure you're accounting for your paycheck correctly on your LLC's taxes.

Collect your paycheck. Even though it's your LLC, when you put yourself on the payroll you are considered an employee. Your LLC must follow all applicable state and federal regulations regarding paychecks and pay periods. You can write yourself a check from your LLC's payroll account, or you can set up direct deposit from the payroll account to your personal bank account.

Comments

0 comment