views

Transferring Money Through Your Bank

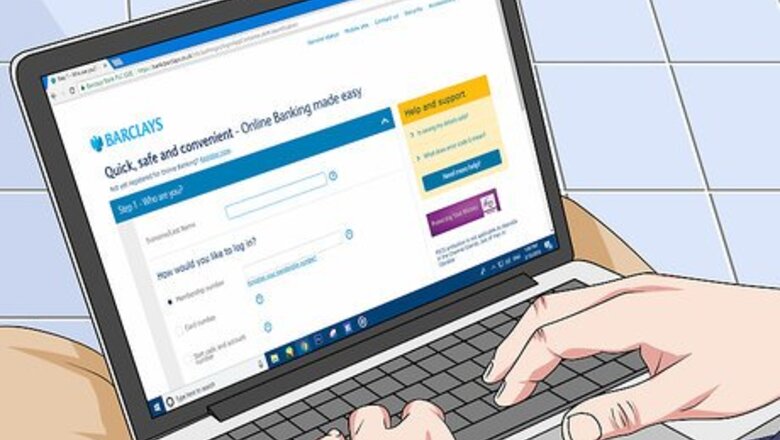

Log into your online banking profile. Sending the funds online is the easiest way to transfer funds through a bank, but you’ll need to have an online banking profile to do it. If you don’t already have one, you could set up this feature on your account by visiting a branch of your bank. As an alternative, you can make the transfer in person at a bank branch. You can also try depositing the funds using a check written on the account your Euros are in, but many U.S. banks will refuse to process foreign checks. If they do process it, they usually charge hefty fees.

Provide the address and bank account number of the recipient. Your bank will need this information in order to make the transfer. If you visit the branch in person, you may also need to provide the address of the bank where you are sending the money.

Give the recipient’s SWIFTBIC code. The SWIFTBIC code is assigned by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) in Belgium. Each bank is assigned its own number, and your recipient will need to get the code for their bank so that the funds can go through. You may need to use an ABA routing code for the bank instead of the SWIFTBIC code. This nine digit number will be on the bottom left side of the recipient’s checks. It’s best to get both of these numbers from the recipient before you begin the transfer.

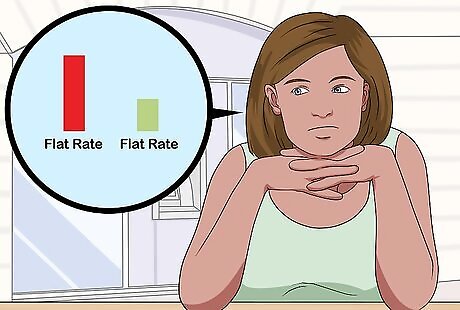

Pay the fee to send the funds. Both you and the recipient will pay a flat fee when the funds are transferred. These fees vary by bank, so check your bank’s fee schedule. The average cost for transferring funds through a bank is $45.50 for the sender and $17.50 for the recipient. If you have a premier account with your bank, you may be able to get lower fees than the average.

Wait 3 to 5 business days for the transfer to occur. Most transactions will be completed within 5 business days, but sometimes it may take longer. However, you shouldn’t become concerned until then. Plan ahead if you’re sending the funds to cover an expense. If you don't see the transfer after 5 days, follow up with your bank to check the status of the transaction.

Using Alternative Transfer Options

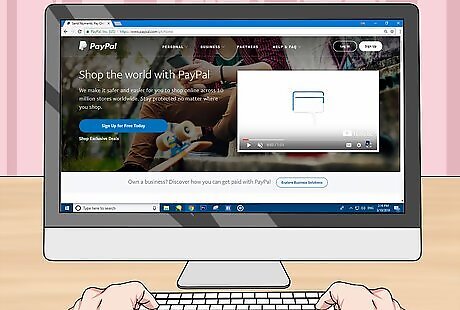

Use PayPal if both parties have accounts. If you both have registered PayPal accounts with a verified bank account, then you can send money by clicking on “Send and Request.” Select the option to “Send Money to Friends and Family,” then enter the name, email address, and phone number of the recipient. Enter the amount you want to send in Euros, and PayPal will convert the funds to U.S. dollars when they are deposited into the bank. PayPal charges a fee for this service, and it can be higher than other transfer options. They will charge both a flat fee and a percentage of the amount sent.

Try Xoom if you don’t already have a PayPal account. PayPal also offers a service called Xoom that gives you more options for transferring the funds. You can use a bank account, debit card, or credit card in addition to a PayPal account. You can transfer up to $2,999 through Xoom for a fee. Fees for transferring funds to a U.S. bank account start at $2.99.

Choose an online peer-to-peer service to transfer the funds. Peer-to-peer services let you send money to the U.S. online without going through your bank, which can result in lower fees. Providers like TransferWise and CurrencyFair send the funds through a currency exchange firm for a small fee. They also let you see how much the recipient will receive before you send the money. You will need to create an account and provide the recipient’s account details. In many cases, you can even have the funds directly deposited into the recipient’s bank account.

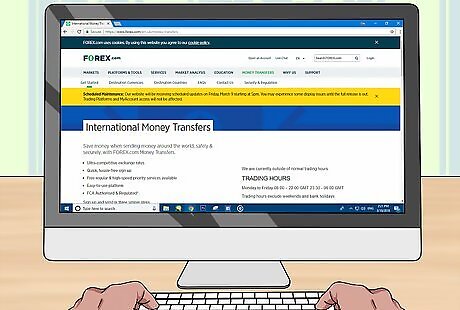

Use a foreign exchange company if you’re sending more than $3,000. These companies are usually the cheapest and safest ways to send large sums, but they’re harder to access. Most foreign exchange (forex) companies are in the United Kingdom, though they do have offices in North America and in Asia. However, you should be able to use a wire transfer to send the funds from your bank to the forex, who will then convert the funds and send them to the U.S. bank. You can find a forex company by searching online. You will need to open an account with the forex broker you plan to use, which takes a couple of days. Forex companies don’t charge a fee to send the funds. Instead, they take a cut when the funds are converted from Euros to dollars.

Sending Money Through a Wire Transfer

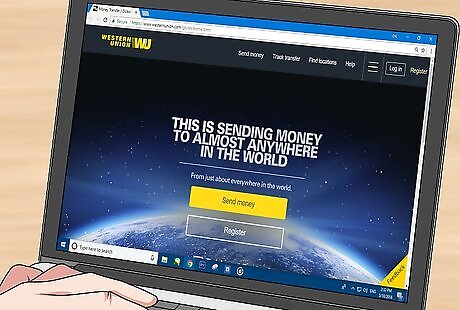

Use a wire transfer for small amounts that are needed quickly. These services can be convenient for occasionally transferring small amounts of cash, especially since the funds will automatically be converted from Euros to dollars. However, fees can add up if you transfer larger amounts. This includes companies like Western Union and MoneyGram. These companies still take about 3 business days to transfer your funds.

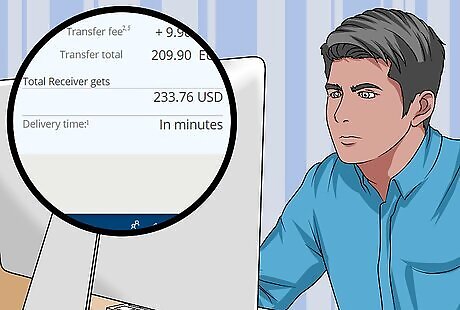

Visit the wire transfer website or storefront location. You can use the website from anywhere, and it’s actually cheaper than going to a storefront. Using an agent at a storefront location costs a higher fee. If you use the company’s website, it will show you exactly how much money in dollars the recipient will receive in their bank account.

Input the sending location and amount. Set up the transfer to go to the U.S. and tell it how much you want to send. It will then convert the Euros to dollars, which allows you to adjust the amount you’re sending if you need to. The service will also project the fees for sending the amount to the U.S.

Indicate that you want the funds sent to a bank account. These services let you send the money in cash or to a bank account. Since you already know you want to send the funds to a bank account, select that option. The transfer service will then adjust your fees accordingly. You will need to provide the recipient’s account information before the transfer can be processed. Make sure you have their bank’s address, their account number, their routing number, and their SWIFTBIC before you get started.

Complete the transaction. You can transfer the funds either online or in person at a storefront location. Once you’ve provided all of the information, you just need to complete the transaction for the funds to get transferred.

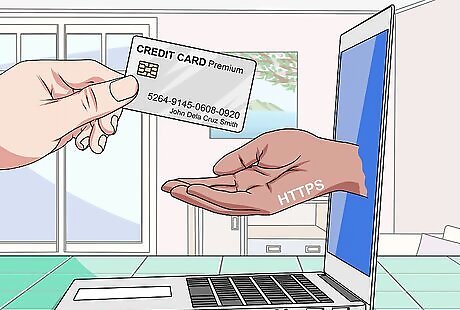

Pay your total, which includes the funds and the fees. You can pay with your bank account or a credit or debit card. If you go in person, you can also use cash. Currently, fees start out between 1.00 EUR and 1.90 EUR for Western Union online transfers. Fees increase as the amount sent increases. Fees are usually higher when you transfer funds in person.

Choosing the Best Transfer Option

Compare the flat fees for sending the funds. Most services charge a flat fee for transferring Euros to a U.S. bank. If a company does not charge a flat fee, then they likely charge more for converting the funds from Euros to dollars. You can check fees by looking at the company’s website or by asking. If a company will not share their fee, it’s a good idea to choose another company.

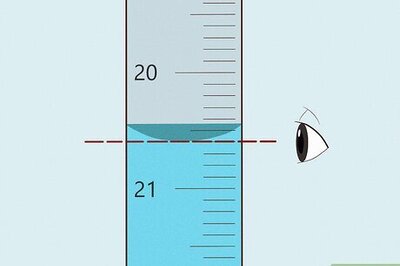

Check the exchange rates before you send the Euros. Most people don’t know that exchange rates can vary based on who is converting the cash. The exchange rate will be how many dollars you get per Euro, which can vary by a few cents. For example, one bank may exchange your Euros for $0.80 per US dollar, while another bank may exchange it for $0.77 cents per U.S. dollar. When sending large amounts, this difference can cost you big bucks. Rates change often, so check rates at the time you plan to transfer the funds. Then send the funds as soon as possible. Not all companies will advertise their exchange rate, so ask if you don’t see it.

Check the arrival date. How long the transfer will take can vary, so it’s a good idea to check this when choosing how you’ll transfer the money. If you need the funds in the U.S. quickly, you might want to pay more to get the funds there on time.

Comments

0 comment